(c) 2016 MJ Alternative Investment Research. All Rights Reserved.

One of my favorite comedic routines of all time comes from fellow Alabama native Roy Wood Jr. Now a regular on The Daily Show, Wood originally did stand-up at various and sundry venues, and made his television debut on Letterman in 2008.

Known for prank calls and “you ain’t going to Mars”, Wood’s best work (in my humble opinion) was a bit he did about career day.

Unlike many of us invited to talk at Career Day, Wood eschewed the normal “if you work hard and study, dream big and believe in yourself, you can achieve anything” mantra. No, Mr. Wood instead chose the path of honesty.

“Remember career day, when a bunch of people would come lie to you?” said Wood. “I went to career day and told them the truth. Look, two or three of y’all aren’t going to make it. That’s the truth. Everybody’s not going to be rich and famous. Somebody has to make the Whoppers, and that’s what people need to understand at an early age. We need failures – they provide chicken nuggets and lap dances, and I like both of them. They are important services...But apparently that’s the wrong thing to thing to say to a room full of first graders.”

As I received news of yet another rash of hedge fund closures, Mr. Wood’s words came to mind. Not because I expect these former fund managers to start making “parts is parts” processed chicken or working in a Magic Mike tribute show, but because, at least the way the industry is evolving right now, “two or three of y’all aren’t going to make it.”

I’ve seen managers that have struggled for years with low AUMs or extended (or even endless) pre-launch woes and many of the folks I talk to are wondering, “When is enough, enough?”

It’s hard to know when to throw in the towel in this industry. We’re always one trade, one IPO, one deal away from fame and fortune. One Thai Baht, one housing crisis, or one Facebook could make or break a professional investor. It’s a giddy proposition, and one that anyone with a Google machine knows can and does happen.

But unfortunately, waiting for the lightning to strike, and figuring out how to capitalize on it if you’re not already a household name, can be excruciating.

I’ve said it before, but I’ll say it again. If you’re a hedge fund manager with $100 million under management and a 1-and-20 fee structure who made 10% for investors last year, your firm generated a whopping $560,000 after expenses last year. If you gave any of your investors a fee break for founders’ shares, or if a fair amount of that capital is personal or friends and family, and fees dip closer to 1-and-15, you made 60 grand.

That’s right, I said 60-freakin’-grand.

And that’s for making roughly 10 times what the S&P 500 generated.

And since 50% of the industry manages less than $100 million, those firms did even worse, even if they, too, outperformed, which may make those chicken nuggets look a bit more attractive.

So what’s an intrepid, alternative investment professional to do in a world where 90% of capital is directed to the billion-dollar club and expenses are at an all-time high? Maybe it’s time for a little soul searching.

What’s your overall financial situation? Assume perhaps 10%-20% in AUM growth going forward, along with realistic return expectations. What does the overall firm income look like? Many fund managers launch funds with healthy war chests created at other firms or from other roles, but that is seldom an endless pool of capital. What is the realistic proposition for wealth creation and preservation assuming costs continue to increase and asset growth is sluggish at best? It can be difficult to part with one’s magnum opus, and as humans we do tend to ascribe more value to things in which we have sunk costs. But take a step back and attempt to look rationally and unemotionally at your current situation and the likely scenarios for the next three years. Enlist an impartial third party to validate your assumptions and try to determine if you’re still on the right path.

Can you reinvent your business in any way to improve your AUM base or reduce expenses? There are a growing number of private equity firms dedicated to purchasing strategic stakes in asset managers, have you considered selling a part of the business? Have you investigated all of your service provider relationships to ensure you have all your bases covered, and covered most effectively? Are you being penny-wise and pound-foolish when it comes to bringing on additional resources, like marketing or operational assistance? Can you team up with a group of other managers to create a cost-sharing consortium for certain functions? Have you shopped your strategy to larger shops that may be looking to diversify their offerings? It is always critical to remember that it running an investment firm ain’t all about (managing) the money, money, money – running an investment shop requires business acumen, strategic planning and smart investments in the firm. Maybe you don’t end up being stud duck of your own Blackstone-esque entity, but you do get to keep doing what you love.

Can you see yourself doing anything else? I know several investors who say that if you don’t want to manage money at $100 million, you don’t deserve to manage money at $1 billion, and there’s something to be said for that - at least in a perfect world. If you can think of other career avenues you might enjoy, however, it may be time to explore those options. Money managers have done that throughout the last several years, leaving to spend time with family, get involved in charity, and at least three even leaving to start food trucks (The Dark Side of the Moo, and the PIMCO croque-monsieur truck) and The Real Good Juice Company. Hell, even I contemplate buying a farm and raising organic eggs at least once a month. But at the end of the day, I still love what I do. Most days. If you get up every day excited to face the markets, win or lose. If you think your strategy still has the “it” factor. If you think doing any other job would be like enduring the “long dark tea time of the soul”, stick with it. You may never be Dan Loeb, but you’ll always be engaged and happy.

Here’s to better luck in 2016 for everyone. Let’s hope that the industry changes in ways that make it easier for emerging managers to keep their heads above water and that my little soul searching exercise turns out to be a worst case scenario and not the status quo. If not, you can always think of a break from the investment industry like a stop loss. It's a fail safe to give you time to re-evaluate, re-adjust and come back stronger. Just look at the PIMCO food truck guy - after three years of sandwiches, he's back in the game. And he brought snacks.

Links to sources:

Roy Wood Jr. Career Day - https://www.youtube.com/watch?v=_mApfABF-c8

Hedge Fund Fees - The Truth and Math - http://www.aboutmjones.com/mjblog/2015/6/29/hedge-fund-truth-series-hedge-fund-fees

Hedge Fund Food Truck - http://www.cnbc.com/2015/06/10/from-finance-to-food-trucks-lessons-learned.html

PIMCO Food Truck - http://blogs.wsj.com/moneybeat/2014/10/29/the-pimco-food-truck-lives-on/

Hedge Fund Juicer - http://money.cnn.com/2014/10/06/investing/quit-wall-street-open-food-business/

“long dark tea time of the soul” is from The Hitchhikers Guide to the Galaxy

As y’all recover from the excesses of fried turkeys, stuffed stockings, too much ‘nog and an overdose of family time, it seems like a good time to catch up on some light reading. So, in case you missed them, here are my 2015 blogs arranged by topic so you can sneak in some snark before you ring in the New Year.

Happy reading and best wishes for a joyous, profitable, and humorous 2016.

Happy Holidays from MJ Alts!

HEDGE FUND TRUTH ANIMATED SERIES

http://www.aboutmjones.com/mjblog/2015/6/29/hedge-fund-truth-series-hedge-fund-fees

http://www.aboutmjones.com/mjblog/2015/6/1/the-most-hated-profession-on-earth

http://www.aboutmjones.com/mjblog/2015/3/2/the-hedge-fund-truth-launching-and-running-a-small-fund

http://www.aboutmjones.com/mjblog/2015/1/19/savetheemergingmanager

WOMEN AND INVESTING

http://www.aboutmjones.com/mjblog/2015/12/13/dear-santa

http://www.aboutmjones.com/mjblog/2015/11/16/not-so-fast-times-at-hedge-fund-high

http://www.aboutmjones.com/mjblog/2015/9/25/doing-well-doing-good-improving-investment-diversity

http://www.aboutmjones.com/mjblog/2015/7/26/the-evolution-of-a-female-fund-manager

http://www.aboutmjones.com/mjblog/2015/6/10/advice-to-the-future-women-of-finance

http://www.aboutmjones.com/mjblog/2015/4/27/diversification-and-alpha-by-the-book

http://www.aboutmjones.com/mjblog/2015/1/26/dont-listen-to-greg-weinstein

EVERYONE HATES ALTERNATIVE INVESTMENTS (ESPECIALLY HEDGE FUNDS)

http://www.aboutmjones.com/mjblog/2015/12/7/keen-delight-in-the-misfortune-of-hedge-fundsand-me

http://www.aboutmjones.com/mjblog/2015/2/2/mfp1glk0exk0vlnqtpx6lby2ba9z8n

http://www.aboutmjones.com/mjblog/2015/11/23/babelfish-for-hedge-funds-1

http://www.aboutmjones.com/mjblog/2015/11/8/hedge-funds-bad-reputation

http://www.aboutmjones.com/mjblog/2015/10/5/dear-hedgie

http://www.aboutmjones.com/mjblog/2015/9/9/investment-professional-fact-fiction-the-business-trip

http://www.aboutmjones.com/mjblog/2015/5/17/hedge-funding-kindergarten-teachers

http://www.aboutmjones.com/mjblog/2015/4/14/are-hedge-clippers-trimming-up-the-wrong-tree

http://www.aboutmjones.com/mjblog/2015/2/16/rampallions-scullions-hedge-funds-oh-my

FUND RAISING & INVESTOR RELATIONS

http://www.aboutmjones.com/mjblog/2015/6/22/swingers-and-the-art-of-investor-communication

http://www.aboutmjones.com/mjblog/2015/4/5/7-secrets-to-a-successful-fund-elevator-pitch

http://www.aboutmjones.com/mjblog/2015/10/26/founding-funders

http://www.aboutmjones.com/mjblog/2015/8/28/crisis-communication-for-investment-managers

http://www.aboutmjones.com/mjblog/2015/7/20/trust-me-im-a-portfolio-manager

http://www.aboutmjones.com/mjblog/2015/5/4/the-declaration-of-fin-dependence

EMERGING MANAGERS

http://www.aboutmjones.com/mjblog/2015/8/17/people-call-me-a-skeptic-but-i-dont-believe-them

http://www.aboutmjones.com/mjblog/2015/10/19/are-you-the-next-blackstone-dont-count-on-it

DUE DILIGENCE

http://www.aboutmjones.com/mjblog/2015/11/1/the-evolution-of-due-diligence

http://www.aboutmjones.com/mjblog/2015/8/6/a-little-perspective-on-the-due-diligence-process

GENERAL INVESTING INSIGHTS

http://www.aboutmjones.com/mjblog/2015/10/11/investment-wisdom-increases-with-age-dance-skills-dont

http://www.aboutmjones.com/mjblog/2015/8/24/the-love-of-the-returns-chase

http://www.aboutmjones.com/mjblog/2015/8/2/slamming-the-wrong-barn-door

http://www.aboutmjones.com/mjblog/2015/6/8/the-confidence-hubris-conundrum

http://www.aboutmjones.com/mjblog/2015/5/10/the-crystal-ball-in-the-rearview-mirror

http://www.aboutmjones.com/mjblog/2015/2/23/pattern-recognition-may-make-you-poorer

http://www.aboutmjones.com/mjblog/2015/1/5/new-years-resolutions-for-investors-managers-part-one

What do you want to read about in 2016? List topics you enjoy or would like to see more of in the comments section below.

In the meantime, gird your loins for the blog that always parties like it’s 1999, even when it’s 2016.

And please follow me on Twitter (@MJ_Meredith_J) for daily doses of research, salt and snark.

Less than one score and seven years ago, it was relatively easy for hedge funds and other private fund vehicles to gain early stage capital. They went to their networks of high net worth individuals, let a little word of mouth work its magic, and then waited for early investments to roll in. Due diligence was minimal, who you knew was paramount and a rising tide (the Bull Market) lifted all ships. If it hadn’t been for the shoulder pads, it might have been the golden age of hedge funds.

Now, of course, raising early stage capital is a whole different ballgame. From seeders to bootstrapping to joint ventures to Founders’ Share classes, there are a host of options available to emerging managers who want assets, although frankly most work better in theory than they do in practice.

Lately, most of the buzz has surrounded Founders’ Share capital. And for managers that are unable to secure bulk early stage financing from a seeder, founders’ shares may hold some appeal.

Founders’ shares generally reduce management fees by up to 50 basis points, while incentive fees may be reduced by up to 5 percent. Founders’ shares are generally offered for a limited time for only early mover investors and are discontinued when a specific asset level or time threshold is passed. Founders’ Shares, and their reduced fees, remain in effect as long as the investor maintains an allocation to the fund.

Founders’ Shares have a lot of perceived benefits, including:

- Founders’ Shares sound cool. Seriously. Investors feel more like they’ve build something, and that can be appealing to some.

- They create urgency. Because Founders’ Shares are only offered until a certain AUM threshold is reached, or for a certain period of time, theoretically this “limited time offer” should encourage investors to pull the allocation trigger. Hey, it works for Ronco...

- They entice fee-wary investors without sacrificing the entire fee structure of the fund.

However, just because they sound good in theory doesn’t mean they are a panacea for every fund.

- Managers should consider the capacity of the fund. If the capacity is low, the amount allowed in founders’ share classes must be balanced to prevent a general loss of profitability for the fund.

- Institutional investors who insist on a “most favored nation” clause may be eligible to receive the reduced fee structure. As a result, it is important to discuss any legal ramifications of founders’ shares with counsel.

- Marketing materials must be created that clearly outline the opportunity for early investors. These materials (as well as any databases to which you’ve reported fees) must be updated when the initial “founding period” is over.

Perhaps most importantly, it’s important to remember that sacrificing fee revenue is most dangerous when assets under management are low. Once a firm or fund has attracted $1 billion in AUM, even a 1% management fee will generate $10 million in fee revenues in a flat year. For a $100 million fund, that fee revenue falls to $2 million in a 2% and 20% scenario, and $1 million in a 1% and 20% scenario (assuming flat performance).

And of course, those numbers are BEFORE expenses. Citibank estimates that a typical $100 million hedge fund must spend $2,440,000 each year to keep the fund running. Factoring that into the equation, it’s easy to see how quickly a fund can go from hero to zero, particularly if performance doesn’t pan out.

(c) 2015 MJ Alts

So I said all that to say this. Founders’ Shares can be a great thing if used judiciously, but please do the math to determine how much of a great thing you can stand to offer.

During an unbelievable number of meetings with investors and managers, I hear the same two refrains:

“We’re looking for the next Blackstone.”

Or

“We think we’re the next Blackstone.”

It’s enough to make you wonder if such success is commonplace or if we’re all overreaching just a teeny bit.

Well, I’ve shaken my Magic Eight Ball and the answer is this, at least for newer funds: “Outlook Not So Good.”

Recently, on a boring Sunday afternoon, I decided to go through Institutional Investor’s list of the 100 largest hedge funds and figure out when each fund company launched.

Yes, clearly I need more hobbies.

But the results (as well as my lack of social life) were pretty shocking. There are no funds within the top 100 that launched during the last 5 years. There are only 4 funds in the top 100 that launched within the last 10 years. In fact, nearly 70% of the top 100 hedge fund firms launched before the first iPod.

Obviously, this begs a question: Where are all the new Blackstones?

(c) 2015 MJ Alts

Whatever complaints can be lobbed at hedge funds, I do find it hard to believe that the talent pool has deteriorated to such a degree that there just isn’t a supply of skilled fund managers available. On the other hand, I do have a few theories on what forces may be at work.

- Change In Investor Dynamics: For a long time, hedge funds were the investment hunting ground of high net worth individuals and family offices. In fact, pre-1998 saw little to no meaningful investment of institutional capital into hedge funds, and investment activity into hedge funds didn’t accelerate markedly until after the Tech Wreck. But by 2011, 61% of all capital in hedge funds was institutional capital. But why should this matter? Imagine you’re an institutional investor with $1 billion or more to invest into hedge funds. Imagine you have a board. Imagine you have headline risk. Imagine you are hit on by every fund marketer known to man if you go to a conference. Imagine you have policies that dictate the percent of assets under management that your allocation can represent. Now, try to put that capital to work in a reasonable number of high-performing hedge funds. It seems reasonable to assume that the investing constraints of being a large institutional investor would drive allocations towards larger funds with longer track records. Just like you never get fired for buying IBM, it’s unlikely you’ll be canned for investing with Blackstone, AQR, Credit Suisse or other big name fund complexes.

- Market Timing: According to HFR, assets in hedge funds grew from $490.6billion in 2000 to nearly $1.9 trillion in 2007, or more than 287%. One of the reasons for this surge in assets is, I believe, prevailing market conditions. Having just exited one of the greatest bull markets in history and entered two of only four 10-year losing streaks in the history of the S&P 500, hedge funds had an opportunity to well, hedge, and as a result, outperform the markets. Unlike the last 6-ish years (recent months notwithstanding), where hedge funds have been heavily criticized for “underperforming” during an almost unchecked market run-up, market conditions were more favorable to hedged strategies between 2000 and 2008. This allowed managers with already established track records and AUM to capitalize on market and investor demographic trends and secure their dominant status going forward.

- Evolving Fund Management Landscape: Let’s face it – the financial world was a kinder and gentler place before 2008. Ok, that’s total BS, but it was less regulated. Hedge funds were not required to register with the SEC, file Form PF, hire compliance officers, have compliance manuals, comply with AIFMD, FATCA and a host of other regulatory burdens. As a result, firms formed prior to 2005 did perhaps have an overhead advantage over their newer brethren. Funds today don’t break even until they raise between $250 and $350 million in AUM, and barriers to entry have certainly grown. Add to this that more than 90% of capital has gone to funds with $1billion+ under management post-2008 and a manager would practically have to have perfectly aligned stars, impeccable performance and perhaps have made some sort of live sacrifice to achieve basic hedge fund dominance, let alone titan status.

This is not to say that newer funds haven’t made it into the “Billion Dollar Club” or that rarified air of 500 or so hedge funds that manage the bulk of investor assets. It is, however, a stark look at how we define expectations and success on both the investor and manager side of the equation. If 40 is the new 30 and orange is the new black, is $500 million or $1 billion in AUM the new yardstick for hedge funds? Time will tell, but I’m wondering if the Magic 8-Ball isn’t on to something.

It’s funny, but I have a lot of conversations about all the travel I, and my fellow investment professionals, do in the course of our daily lives. For some reason, telling people that you “have” to go to New York, Los Angeles, Hong Kong, London, Paris, Monaco or some other “sexeh” locale puts all sorts of weird ideas into people’s heads. It’s like they think business travel turns you into P-Diddy or something. You’re big pimpin’ and you spend the cheese because you go to New York and stay at the W Hotel in Times Square for a night (Starwood whore!).

So, for those of you who wonder what all us lonely travelers do when we’re out on the road, I thought I’d sum it up for you. If either scenario sounds familiar to you, sound off in the comments section.

How Folks Picture My Business Trips

My (first class) flight leaves at a completely reasonable daylight hour. I was able to pack during work hours and therefore had no encroachment upon my “personal life.”

I arrive at the airport and whisk through security ‘cos, you know, frequent flyer street cred.

I board the plane and drink champagne or my alcoholic beverage of choice all the way to my destination, where I am picked up by a helicopter or limousine and deposited at my uber-chic hotel.

My first meeting is always a lunch meeting, which is somewhere swanky and leather and where martinis are swilled until it’s time for my next meeting, which, curiously, is also over drinks.

After that meeting I return to the hotel to return a few calls. Or nap. Or get a massage. You know…”work.” Maybe I even take time to sightsee or catch a show.

My dinner meeting is always somewhere fabulous that the average mortal can’t get into and where my meal costs more than a mortgage payment.

Everyone then adjourns somewhere similarly hip/swanky (depending on the friend) and then finally return to the hotel around midnight.

The next morning starts no earlier than a brunch meeting before I head to the world’s largest board room to make a presentation about how everyone secretly makes money but doesn’t tell “the little people” about it.

I then go to another lunch meeting, knock back a couple of drinks before collecting checks totaling eleventy-million dollars and boarding my (first class) flight home, having skipped security entirely because, let’s face it, I’m me.

How My Business Trips Actually Go

I almost never get a flight that leaves when it’s daylight. Whether that means I get up at the absolute crack of dawn or whether that means I schlep my bags to the office and work all day before racing to the airport to catch a flight that night, I rarely see the outside of an airport while the sun shines.

The whole time I’m en route to the airport, I am checking to see where I am on the upgrade list. However many first class seats are left, there is at least a 50% chance that I am that number plus one.

I do have TSA Pre-Check, but I seem to have a high “hit rate” for random extra screening. So I get often get felt up before boarding the plane. And it’s Nashville, so there’s often someone with a gun in the pre-check line. After security I rush to take my seat and put my earphones in (and/or feign sleep) before my seatmate can strike up a conversation about insurance, actuarial work, healthcare or some other topic I could care less about.

I arrive at my destination city and get in a cab. It usually smells like Fritos. Unless it’s been raining in which case it smells like O that didn’t stay with the B. And Fritos. (C’mon y’all, that helicopter thing was like TWO TIMES and it only happens for GAIM Monaco).

I drop by the hotel (which is either corporate or points-grabbing approved), but my room isn’t ready because it’s still WAY early to check in. I store my bags and run to my first meeting.

(Full disclosure: Sometimes I check in so late that the only rooms left are “accessible”, so I get to hang my clothes 3 feet off the floor…almost equally fun).

I generally have meeting scheduled back to back. A full day will have no fewer than 5 meetings, which is just doable if you don't have more than 30 minutes travel time in between each. My last meeting of the day may include a glass of wine, but otherwise, weirdly, there is no adult refreshment during the course of my day. 50% of the time I have a dinner to go to, and 50% I have a date with room service while I work on all the stuff that didn’t get done while I was flying around like a buzz saw all day.

At some point, either really late at night or super early the next morning, someone calls who has forgotten I’m in another time zone. I tell them it’s fine while wiping sleep out of my eyes and firing up my computer. Hint: I sound unusually perky when you wake me up.

The next day starts with breakfast at 8:00 where one or both people don’t really get to eat because they are trying to do work during the meal. I generally check out of the hotel before this meeting so I’m essentially homeless from now on, and schedule meetings back to back until I get back into a Frito-esque cab to return to the airport.

Flights home seem to have some sort of karma attached that makes them more likely to be delayed. I hang out in the Admiral’s Club doing work that I didn’t get done during the day and listening to other business people talk too loudly into their phones. I eat too many pieces of square cheese and brownie bites.

I finally get home (after dark) and go to bed. The next workday happens 8 hours or less later.

The moral of the story: Business travel? Super sexy. Sorry to spoil your fantasy.

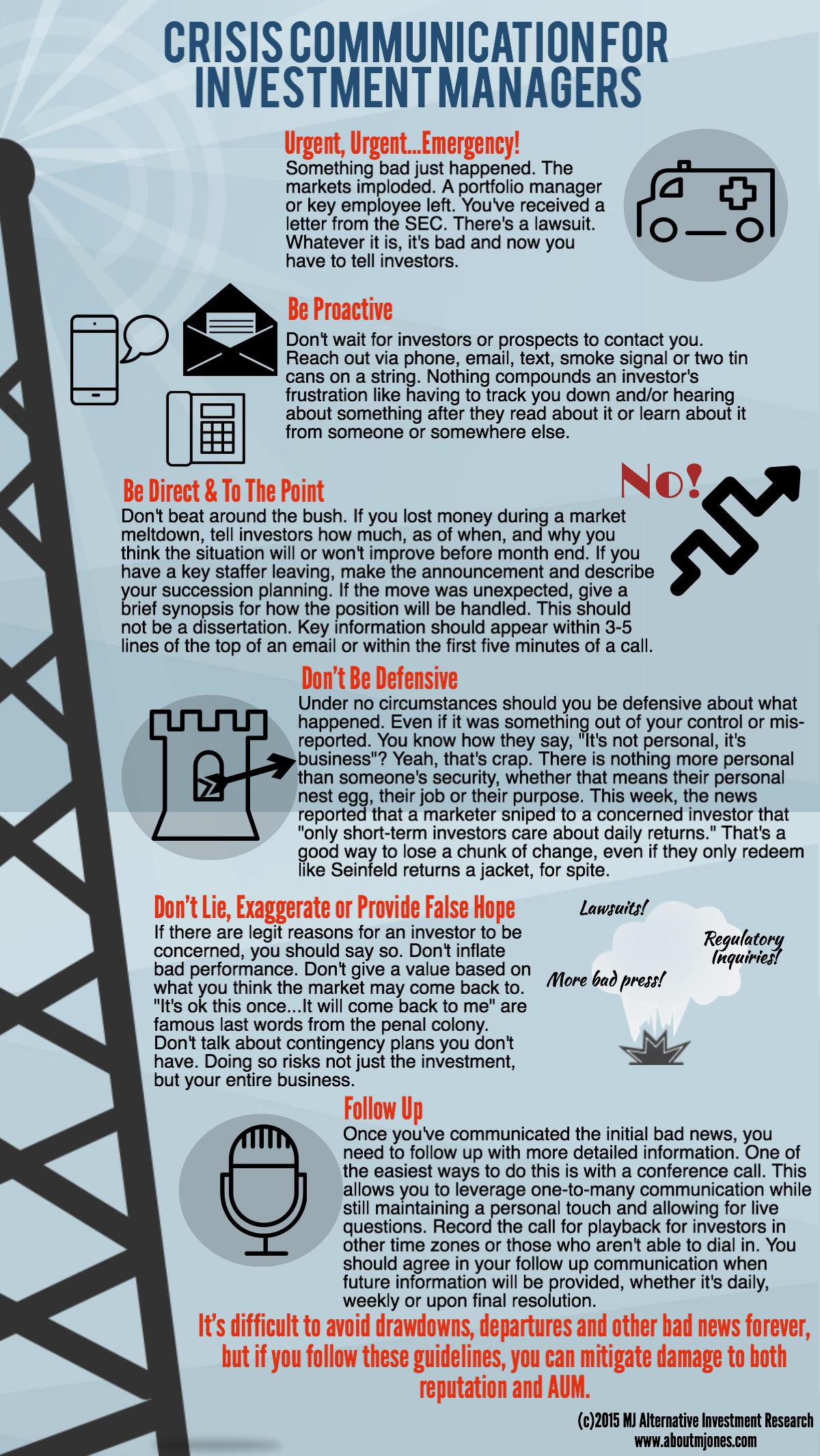

Crisis communications isn't something most money managers practice very often. Well, I guess if they did, they probably wouldn't continue to manage money very long. But last week's market volatility was a great crisis communication "pop quiz" for investment managers. In case you failed the test, or if you just want to boost your score with investors, here are some tips for effectively communicating with investors and prospects during a crisis, whether it's market-driven or created by personnel, regulatory bodies, service providers, or litigation. Communicating effectively during a crisis can make or break a business, so study up and ace the next test.

(C) MJ Alternative Investment Research

After spending some quality time with managers and investors recently, I've come to realize that, while they have a lot of respect for one another, they also have a lot of frustration with one another's due diligence processes. Here's their thoughts about each other's due diligence in a (somewhat sarcastic) nutshell.

Tongue in cheek? Perhaps. But I think there's more than a little truth in those cartoons.

Maybe we should try to agree to exercise a little more peace, love and understanding about what drives the due diligence process from both sides of the fence. For managers, efficiently (if not perfectly) responding to every investor and due diligence request is paramount, since asset flows for most managers are tight. For investors, who are also resource constrained, eliminating managers quickly that won't 'make the cut' is key, while fiduciary responsibility and headline risk contributes to a high stakes process. I think both sides agree the process is far from perfect, but perhaps there are ways to tweak the process, rather than see the other side as an adversary.

Last week’s post on the softer side of investing garnered a question from an intrepid reader:

Just how does a manager go about building trust and a personal relationship with investors and prospects?

Excellent question, and since I regularly offer unsolicited advice on how to further capital raising efforts, one on which I am more than happy to opine. So with very little ado, here are MJ’s Top Ten Ways To Build Better Relationships With Investors and Prospects. While this list isn’t quite as funny as the Top 10 Bad Names for Businesses (http://www.ultimatetop10s.com/top-10-bad-names-businesses/), it may just save you from closing your fund to become the next franchisee for this business.

Top Ten Ways To Build Better Relationships With Investors and Prospects

- Have conversations, not monologues. When you walk in to give an initial pitch or a portfolio update do you spend the majority of the time giving your spiel? Do you doggedly march through your pitch book? How much time passes before you ask your audience a question? Before you launch into your pitching soliloquy, ask your audience some questions about themselves, their portfolio and their investment goals. Pause on your table of contents and ask, “Here’s what I would like to cover today, what would you like to spend the most/least time on? Are there other topics you’d like to address?” Take notes, plan your time accordingly, and instead of taking your audience on a PowerPoint Trail of Tears, tailor the time you have for maximum & (most importantly) mutual productivity.

- Always tell the truth, even if the answer is “I don’t know.” This goes for you and your entire staff. I can’t tell you the number of times I’ve gotten one answer from a marketing/cap intro source and a different answer from a portfolio manager. Always remember: “I’ll get back to you on that.” is a perfectly acceptable reply.

- Put information about your staff and other support personnel in your pitch book and DDQ. We all remember the phrase “Two guys and a Bloomberg” from the good/bad old days of investing. Well, my friends, those day are gone (if they ever existed). No portfolio manager is an island and, whatever your stud duck fantasies may be, it takes more than one person to manage money. Not including the firm’s staff in a pitch book (including outsourced services) creates two problems for investors. A) They have to ask how tasks get done, which an investor shouldn’t have to wonder and B) it may make them think that the manager does not value their staff. Employee turnover, particularly in CFO, CCO, COO, key analyst and other functions, can be almost as devastating to a fund as manager turnover, so I worry both about hubris and employee satisfaction when I don’t see a pretty little org chart. With names.

- Talk about your background, but then, um, stop talking. I have met with managers who spent an entire meeting taking me on what seemed like a minute-by-minute tour of their professional bio. And don’t get me wrong: I care. I just don’t care that much. I can read your bio. I need to know what you see as the key inflection points and the highlights of why your background qualifies you to run the fund. I do not need an hour-long history lesson that starts off a la Steve Martin in The Jerk.

- Call before bad news arrives… A fund of funds manager friend of mine has one cardinal rule: Call me before you end up in the Wall Street Journal. I would add to that: Call me before a large, out of character loss. Call me when your entire market segment is blowing up. Call me if one of your peers is having public valuation issues and tell me why you’re not and won’t. Give your investors and prospects a heads up and they will come to trust you more.

- …but don’t only call for bad news. If you only call when things are bad, investors develop a Pavlovian response to your phone calls. Call with good news once in a while (e.g. a really good month, a terrific new hire, a great new investor, you’re going to be on CNBC…).

- Talk about what you’ve learned and how you learned it. One of the things many investors want to know about a money manager is what they’ve learned and that they are capable of continued learning. If a particular drawdown or market scare made you change your strategy or thinking about certain scenarios, that’s great to talk about. A long time ago, a prior firm had an investment with a manager that experienced significant losses during a market meltdown. When we sat with him to discuss the portfolio, he talked about that period and said that if he had it to do over again, he would sell off the book and start over. When the markets went into the pooper (technical term) in 2000, the manager did just that. He was able to avert large losses, he showed that he could learn, and he gained additional trust because he did what he said he would do, all in one fell swoop.

- Let people know what scares the pants off of you from a market or investment perspective. In 1999, I met with a famous money management firm to evaluate one of their funds for investment. I asked them about their worst market scenario and how they would react. They said that they couldn’t imagine a scenario where they wouldn’t see what was coming and get out of the way well in advance. Less than six months later they lost over 20% in one month. So much for that legendary foresight, eh? Every manager will lose money. Being honest about when and how a fund can lose money and how you plan to react lets your investors sleep better at night.

- Don’t hide behind jargon, buzzwords, or opaque language. At a “speed dating” capital introduction event many years ago, a frantic event organizer begged me to go into the room with a fund manager who was, um, lonely. It seems investors came to his sessions but quickly received urgent calls or emails and had to depart. I attended his session and quickly learned why. The manager didn’t want people to figure out his “secret sauce” so he talked in the most pompous, jargon-filled manner imaginable. I wanted to shank myself with my coffee stirrer within 15 minutes. Hiding behind big words, complex math and opaque terms doesn’t make a manager sound smarter. It makes them sound scarier and riskier. It means investors have to ask questions that make them feel stupid. Word to the wise: When you make people feel dumb, they seldom give you money.

- Know your client. This goes beyond the B/D definition and fun compliance videos we've all had to watch and hits on a personal level. To the extent possible, make an effort to know key facts about every client. Where do they live? Are they married? Do they have kids? What do they like to do when they aren’t asking you every question on the AIMA DDQ? Being able to have an actual personal discussion moves your relationship out of simple transactions. Don’t underestimate the power of the personal connection.

I realized I was getting a bit long in the investment industry tooth the other day when I actually started a sentence with “Back in my day…” In fact, all I needed was a cane and the ability to shoo kids out of my front yard for a full flashback to the crotchety down-the-street neighbor from my youth.

What aroused this fit of curmudgeonly angst, you may ask? Well, sad to say it was a pitch book.

Many of you know that I spend an inordinate amount of time looking at pitch books. I’ve seen long ones and short ones. Blue, black and green ones. Stapled, bound, slick, fancy or plain, I’ve seen so many pitch books my retinas have paper cuts.

Recently, while looking through a stack of pitch books I noticed a disturbing trend.

Title Page

*flip*

Tiny Print Disclaimers No One Reads

*flip*

Table of Contents

*flip*

Fund Highlights

*flip*

Performance

*flip*

Investment Process

*flip*

Portfolio Construction…

*flip*

Wait. Something is missing. *flip* *flip* *flip*

Hmmmm…*flip* *flip* *flip* *flip*

Oh wait….HERE it is…Firm and Manager Information. At the end? You betcha. Sometimes it was even in the appendix.

Look, don’t get me wrong - I recognize that investors are laser focused on returns. With all the underfunding and under-saving and underperforming, I get it. Returns matter. But they aren’t (or shouldn’t be) the only factor in the investment decision-making process.

Back in my day…

When I started investing in the late 1990s, we had a slightly different modus operandi for choosing hedge funds. Sure, we screened for alternative investment options based on returns (where available), but we didn’t get a lot of elaborate pitch books. Often all we got was a PPM, a conversation and, if we were lucky, some sort of beverage during our meeting. There wasn’t necessarily a formal “pitch” and the meetings generally entailed a lot of Q&A. My write-ups for the rest of the investment committee weren’t limited to number of positions, leverage, and service providers (although those were certainly important), but also included my general impressions of the manager and staff.

After all, we were placing money in a fund, but we were actually entrusting it to a person. And while it’s nice to think about percent returns, alpha, beta and the whole carful of Greeks, the decision of whether we were interested in a fund couldn’t be isolated from how we felt about the people to whom wrote that big freakin’ check. (Ok, it was a wire, I’m not THAT old).

Unfortunately, I think relationships and trust can get lost in DDQs, tear sheets, check boxes and stress tests, and the proof is in the pitch book pudding. Managers are eschewing bios, org charts, firm details and even grim, blank wall mug shots for pages and pages of data.

And even though my first question has always been “can this person manage money?” it has always been followed by “and can I trust them to do so?”

I mean, you can't just divorce the process & performance from the person. Even in the most quantitative strategies, with the most robust black box systems or rigorous analysis ,a person is at the helm, programming risk levels, making assumptions about the markets and investments & deciding who to trust with that information. In short, people matter & you should know & understand those people as well as you understand the strategy.

Think of it this way, if you trust your fund managers you sleep better at night. Combined with robust operational controls, you don’t worry that the manager may be running off to Key West to follow Jimmy Buffet with your money and a Coral Reefer tee-shirt. You also communicate better. Chances are the fund manager will engage with you more, and in a more open fashion. Simply put, the relationship and trust you mutually establish makes it easier to keep your mind on your money and your money on your fund managers’ mind. And of course, volatility is easier to stomach. In times of market or strategy volatility, you’re less likely to second guess or panic. If you trust the manager is executing the strategy you hired them to do, and you believe the market opportunity continues to exist, you can handle a loss.

If you think the manager is a lunatic, an a-hole, a loose cannon or in any way resembles Leonardo Dicaprio from Wolf of Wall Street in any way, none of that is possible.

Now, don’t get me wrong – I am not anti-research. Anyone who knows me (or even knows of me) understands that I let my Geek Flag fly. I also am familiar with the growing body of research that shows we have a tendency to make bad decisions when we rely only on our intuition. I’m also not anti-pitch book – I think a great pitch book helps before, during and after a meeting. But I do think we could all use a little reminder that, at the end of the day, we’re investing in people, and those people can ultimately make or break our investment experience.

So managers, put on a clean tie and go stand in front of your conference room wall, get your school picture taken and put it, and information about you and your staff, in your pitch book BEFORE you go too far down the strategy rabbit hole. And investors, look up from the checklist from time to time and think about whether you like, trust and can talk to your fund manager – you’ll both be glad you did.

Thinking about a hedge fund investment? Concerned about high fees? Before you request a fee reduction, consider that there isn't a "one size fits all" approach to fee structures. Fee reductions for smaller funds may introduce significant business risks and create counterproductive incentives. Fee reductions for larger funds may be desirable and more sustainable, but are also likely to be in shorter supply and may create negative selection bias. In short, investors AND managers should weigh the costs and benefits of slashing fees before they get themselves into an investing pickle.

For those of you that were fans of the movie Swingers you may remember this infamous scene:

“[It's 2:32am, and Mike decides to call Nikki, a girl he met just a few hours ago][Nikki's machine picks up: Hi, this is Nikki. Leave a message]

MIKE: Hi, uh, Nikki, this is Mike. I met you at the, um, at the Dresden tonight. I just called to say that I had a great time... and you should call me tomorrow, or in two days, whatever. Anyway, my number is 213-555-4679 -

[the machine beeps. Mike calls back, the machine picks up]

MIKE Hi, Nikki, this is Mike again. I just called cuz it sounded like your machine might've cut me off when I, before I finished leaving my number. Anyway, uh, and, y'know, and also, sorry to call so late, but you were still at the Dresden when I left so I knew I'd get your machine. Anyhow, uh, my number's 21 -

[the machine beeps. Mike calls back; the machine picks up again]

MIKE: 213-555-4679. That's it. I just wanna leave my number. I didn't want you to think I was weird or desperate, or... we should just hang out and see where it goes cuz it's nice and, y'know, no expectations. Ok? Thanks a lot. Bye bye.

[a few more calls. Mike walks away from the phone... then walks back and calls again; once again, the machine picks up]

NIKKI: [picks up] Mike?

MIKE: [very cheerful] Nikki? Great! Did you just walk in or were you listening all along?

NIKKI: Don't ever call me again.

[hangs up]”

Yeah, communicating with potential investors can feel a bit like that.

In fact, a few years ago I was speaking with an investor friend in Switzerland about manager communication. I asked him how much he liked to hear from his current managers and potential investments and, as was his wont, he laconically answered “Enough.” When I pressed him a bit further, he provided a story to illustrate his point.

“There is a manager that I hear from every day it seems. Every time I open the mail or get an email or answer the phone, I know it must be them. Finally, I started marking ‘Deceased’ on everything they sent and sending it back. Eventually the communication stopped.”

Seriously, when you have to fake your own death to escape an aggressive fund marketer, they’ve probably gone just a HAIR too far, donchathink?

All kidding aside, communication (how much and how often) is a serious question, and one that I get a lot from fund managers, particularly those frustrated with a lack of progress from potential investors.

While some managers react to slow moving capital-raising cycles by reducing or ceasing all communication (bad idea!), others move too far in the other direction, potentially killing (hopefully just figuratively) their prospects with emails, letters, calls, etc. But there is a happy medium for investor communication if you follow these simple guidelines.

Early communication – In the earliest days, just after you’ve met a new potential investor, your goals for communication are simple:

- Provide key information about the fund (pitch book, performance history);

- Attempt to schedule a meeting (or a follow up meeting) to discuss the fund in person;

- Establish what additional materials the prospect would like to see (DDQ, ongoing monthly/quarterly letters, audits, white papers, etc.)

- Send those materials

Your only goal at this stage is to see if you can move the ball forward to get to a meeting or a follow up meeting. Think of it like dating. Just not like Swingers dating. You always want to try to move the ball down the field, with the realization that being overzealous is more likely to get you slobberknockered than a touchdown.

Ongoing communication – After you have established a dialog with a potential investor, you should have realized (read: ASKED) what that investor wishes to receive on an ongoing basis. You should continue sending that. In perpetuity. Unless they ask you to stop, or they literally or figuratively die. Think about how much communication that an investor receives from the 10,000 hedge funds, 2,209 private equity funds, and 200+ venture capital funds that are actively fundraising. If your fund falls completely off the radar, how likely is it than an investor will think about you down the line? Yeah, them ain’t good odds. Your ongoing communication should consist of a combination of the following:

- Monthly performance and commentary;

- White papers (educationally focused);

- Invitations to webinars or investor days that you are hosting or notifications about where you will be speaking;

- Email if you are going to be in the prospects’ vicinity to see if an additional meeting makes sense.

In addition, it is a good idea to establish an appropriate time to call during your meetings. For example, after the initial or follow up meeting, ask specifically when you should follow up via phone. And then do it – no ifs, ands or buts. Even if performance isn’t great at the moment. Even if you feel you’ve now got bigger fish to fry. Make the call. And during that call, make an appointment for another call. And so on and so on and so on.

The trick here is to keep the fund in front of a potential investor without being in their face. And to do that, you MUST ask questions and you must be prepared to hear that another call and/or meeting may not make sense at the moment. Take cues from potential investors. Trust me, they’ll appreciate you for it.

During Due Diligence – If you are lucky enough to make it to the due diligence stage, I would suggest preparing a basic package of materials that you can send to expedite the process and demonstrate a high level of professionalism.

- AIMA approved DDQ – And don’t leave out questions. We’ve all seen these enough to know when questions have been deleted. If a question isn’t applicable put in N/A.

- References

- Audits (all years since inception)

- Biographies of principals

- Organization chart

- Offering documents

- Articles of incorporation

- Investment management agreement

- Information about outside board members

- Service provider contacts

- Valuation policies (if applicable)

- Form ADV (I and II)

After The Investment – After an investor makes an investment in your fund you should stay focused on your communication strategies. Ideally, you should agree with the investor BEFORE THE WIRE ARRIVES what they wish to see (and what you can provide) on an ongoing basis. This will help avoid problems in the future. You can earn bonus points by including any ODD personnel on materials related to operational due diligence, since they don’t always get shared between IDD and ODD departments.

Also, make sure you pick up the phone when performance is particularly good OR particularly bad. Many managers will call when performance is bad for advance “damage control,” but only calling when performance is bad creates a negative Pavlovian response to caller ID. Don’t be the fund people dread hearing from.

Hopefully these guidelines will help as you navigate the fundraising cycle. And if not, hey, Swingers quote.

Sources: IMDB.com, CNBC, NVCA

Given that one of the hedge fund industry's largest events takes place this week (SALT), that the Sohn 2015 event featured an emerging manager session and that it's just capital raising season in general, I thought it might be appropriate to share a little unsolicited fund marketing advice in this week's blog.

All too often, I hear about breakdowns in fund marketer/fund management relations. Fund management becomes disenchanted with how the asset raising process is going (read: slowly). Fund marketing feels pressured to raise assets for a fund that isn't performing well (read: poorly). Fund management feels that they (their three year old child, their neighbor's teenager or the guy on the street corner) could do a better job of bringing in capital. Fund marketing feels unappreciated (duped or downright angry) when bonus time rolls around.

It doesn't have to be this way.

To help avoid these common problems, I've put together a Declaration of Fin-Dependence. It's always important to remember that capital raising is not a solo sport and, even though I've seen it come to this, it ain't a contact sport either. In order to achieve capital raising success ($1 BEELION dollars, world domination, Rich List, etc.), it is critical that management and marketers both set and manage expectations carefully and execute on their common goals. The less ambiguity, the better. So, take a moment to read this historic document and then think about adding your John Hancock before you go after the Benjamins.

The Declaration of Fin-Dependence

I am no stranger to making lame excuses. Just last week, in the throes of a bad case of the flu, I managed to justify not only the eating of strawberry pop-tarts and Top Ramen but also the viewing of at least one episode of “Friday Night Lights.” It’s nice to know that when the chips are down at my house, I turn into caricature of a trailer park redneck.

But in between bouts of coughing and episodes of Judge Judy, however, I did manage to get some work done. And perhaps it was hyper-vigilance about my own excuse making that made me particularly sensitive to the contrivances of others, but it certainly seemed like a doozy of a week for rationalizations. Particularly when it came to fund diversity in nearly every sense of the term, but particularly when it came to investing in women and/or small funds.

So without further ado (and hopefully with no further flu-induced ah-choo!), here were my two favorite pretexts from last week.

Excusa-Palooza Doozie #1 – “We want to hire diverse candidates, but we can’t find them.”

In an interview with Fortune magazine, Marc Andreessen, head of Andreessen Horowitz said that he had tried to hire a female general partner five whole times, but that “she had turned him down.”

Now c’mon, Mr. Andreessen. You can’t possible be saying that there is only one qualified female venture capital GP candidate in the entire free world? I know that women only comprise about 8-10% of current venture capital executives but unless there are only 100 total VC industry participants, that still doesn’t reduce down to one. Andreessen Horowitz has within its own confines 52% female employees, and none of them are promotable? If that’s true, you need a new head of recruiting. Or a new career development program. Or both.

But it seems that Andreessen isn’t entirely alone in casting a very narrow net when it comes to adding diversity. A late-March Reuters piece also noted that they best way to get tapped to join a board as a woman was to already be on a board. One female board member interviewed had received 18 invitations to join boards over 24 months alone.

It seems the criteria used to recruit women (and, to some extent, minority) candidates into high-level positions are perhaps a bit too restrictive. In fact, maybe this isn’t a “pipeline” problem like we’ve been led to believe. Maybe it’s instead more of a tunnel vision issue.

So, as always happy to offer unsolicited advice, let me put on my peanut gallery hat. If you genuinely want to add diversity to your investment staff, here are some good places to look:

- Conferences – The National Association of Securities Professionals, RG Associates, The Women’s Private Equity Summit, Opal’s Emerging Manager events, the CFA Society, Morningstar and other organizations are all now conducing events geared towards women and minority investing. Look at the brochures and identify candidates. Better yet, actually attend the conference and see what all the hubbub is about, bub.

- Word of mouth – I have to wonder if Andreessen asked the female GP candidate on any of his recruitment attempts if she knew anyone else she could recommend. If not, shame on him. Our industry is built in large part on networking. We network for deals, investors, service providers, market intelligence, recruiting, job hunting, etc. We are masters of the network (or we should be) and so it seems reasonable that networking would be a fall back position for anyone seeking talent. And if Andreessen did ask and was not given suitable introductions to alternate candidates, shame on the “unnamed woman general partner.”

- Recruiters – Given the growing body of evidence that shows diversity is good for investors, it’s perhaps no surprise that there are now at least two recruiters who specialize in diversity candidates within the investment industry. Let them do the legwork for you for board members, investment professionals and the like.

- Service providers – Want a bead on a diverse CFO/CCO – call your fund auditor. Looking for investment staff? Call your prime broker or legal counsel. Your service providers see lots of folks come in and out of their doors. Funds that didn’t quite achieve lift off, people who are looking for a change, etc. – chances are your service providers have seen them all and know where the bodies are buried. Don’t be afraid to ask them for referrals.

Excusa-Palooza Doozie #2 – See?!? Investors are allocating to “small” hedge funds! In a second article guaranteed to get both my fever and my dander up, we were treated to an incredibly optimistic turn of asset flow events. It turns out that “small” hedge funds took in roughly half of capital inflows in 2014, up from 37% in 2013 per the WSJ.

Now before you break out the champagne, let me do a little clarification for you.

Hedge funds with $5 billion or more took in half of all asset flows.

Everything that wasn’t in the $5 billion club was termed “small” and was the recipient of the other half of the asset inflows.

It would have been interesting to see how that broke down between funds with $1 billion to $5 billion and everyone else. We already know from industry-watchers HFR (who provided the WSJ figures) that 89% of assets went to funds with more than $1 billion under management. We also already know that there are only 500 or so hedge funds with more than $1 billion under management. So really, when you put the pieces together, aren’t we really saying that hedge funds with $5 billion or more got 50% of the asset flows, hedge funds with $1 billion to $5 billion got 39% of the remaining asset flows, and that truly “small” and, well, "small-ish" hedge funds got 11% in asset flows?

I mean, for a hedge fund to be termed “small” wouldn’t it have to be below the industry’s median size? With only 500 hedge funds at $1 billion or more and 9,500 hedge funds below that size, it seems not only highly unlikely but also mathematically impossible that the median hedge fund size is $5 billion. Or $1 billion. In fact, the last time I calculated the median size of a hedge fund (back in June 2011 for Barclays Capital) it was - wait for it, wait for it - $181 million.

And I’m betting you already know how much in asset flows went to managers under that median figure…somewhere just slightly north of bupkis. And the day that hedge funds under $200 million get half of the asset flows, I will hula hoop on the floor of the New York Stock Exchange.

So let’s do us all a favor and stop making excuses and start making actual changes. Otherwise, we’re leaving money and progress on the table, y’all.

Sources: WSJ, HFR, BarclaysCapital, Reuters, Huffington Post