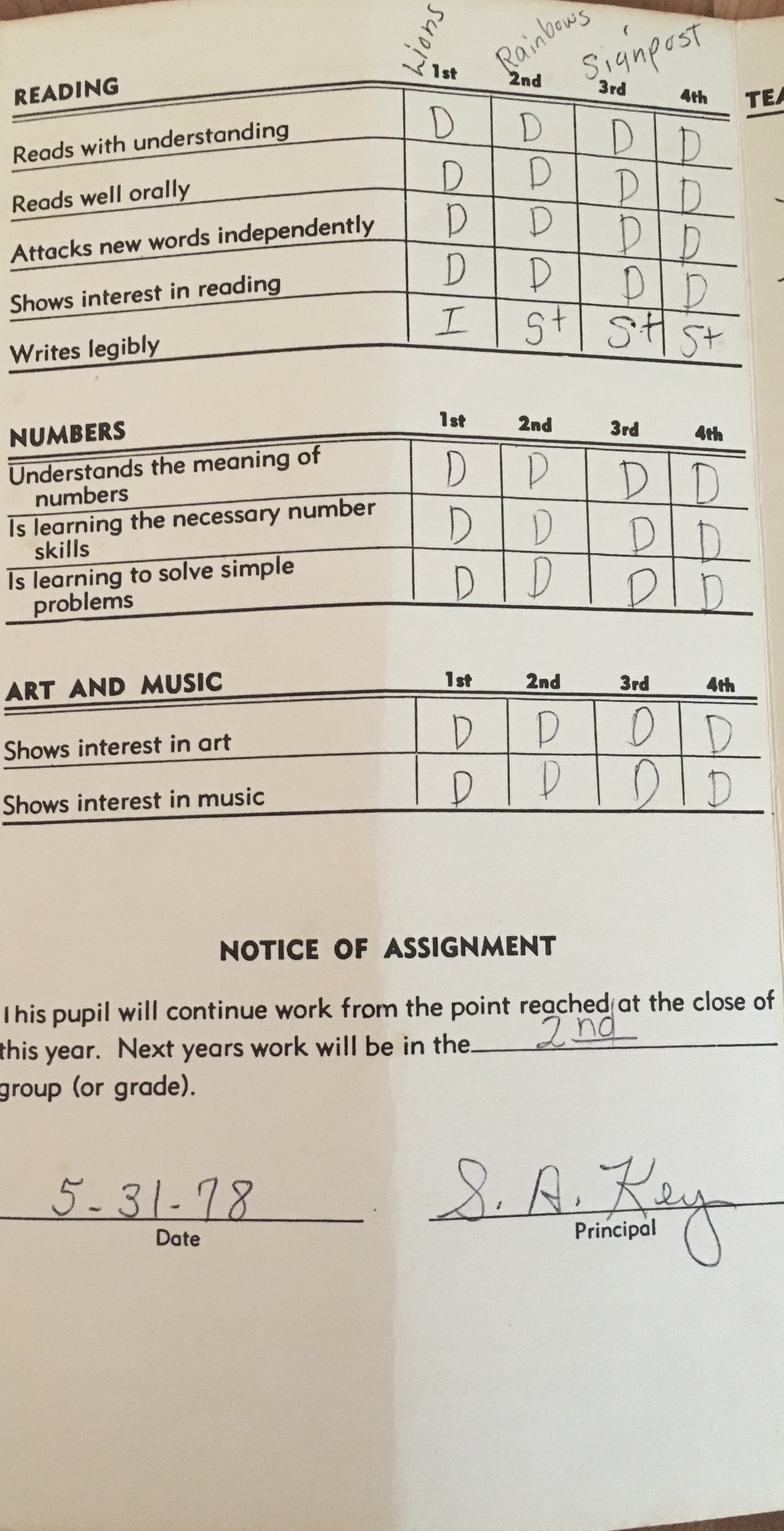

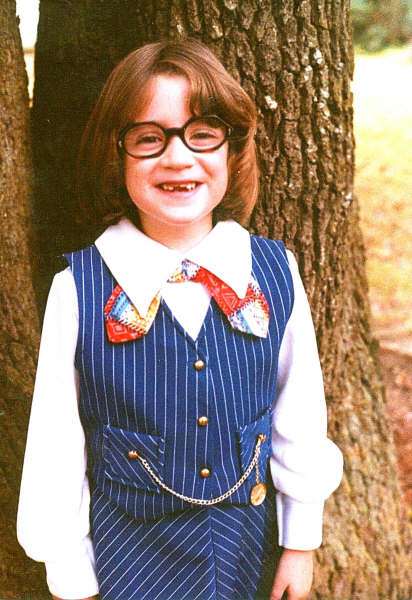

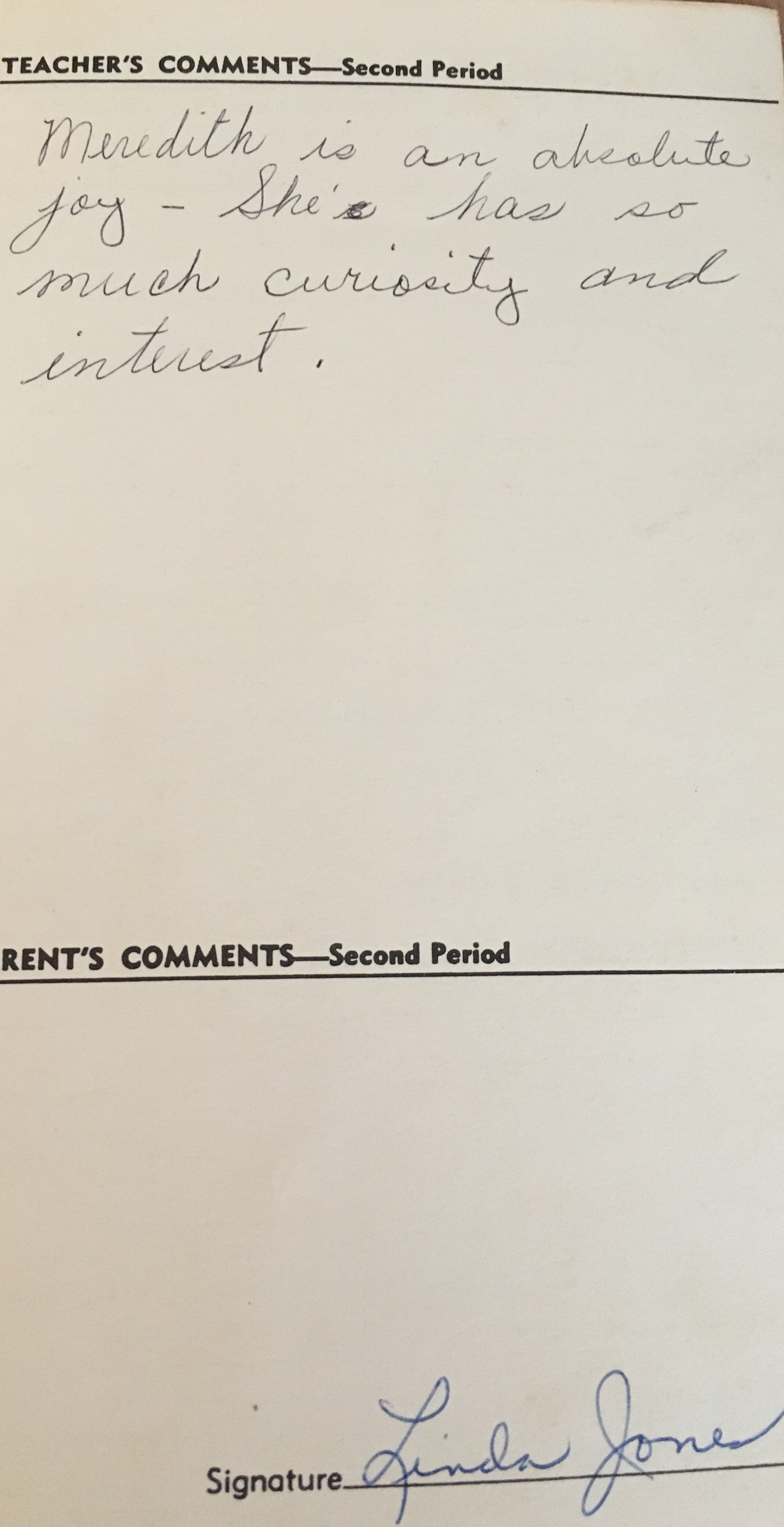

My ex and I parted ways about a year ago. After taking some time to eat some ice cream, clean out my closets and get my personal feng shui back in order, I decided recently it was time to re-enter the dating scene.

Unfortunately, as someone who A) works from home and B) travels extensively, I realized that meeting men who weren’t delivering FedEx packages or patting me down in the airport was going to be a bit challenging. So I bit the bullet and did the online dating thing.

Color me PTSD’ed.

My first day at the online ‘all-you-can-date’ buffet saw me literally innundated with emails. “Hey!” I thought. “I must still have it!.”

But then I started to actually open those emails and realized that nearly all of the men who had emailed me could be categorized into one of three buckets:

- Men holding things they had killed;

- Men my dad’s age and older; and

- Curiously, Civil War re-enactors (As an aside, do folks not realize the South actually lost the Civil War? I mean, isn’t that kind of like re-enacting the Titanic sinking over and over again? Big fanfare. Long denouement. Everyone dies. But I digress…)

Ho-lee-shit.

My mind started racing.

“Well, if this is the best that’s out there for me these days, I’m going to be single forever,” I thought.

“Do you suppose they have nunneries for spiritual, not religious, former Presbyterians-quarter Jews whose favorite form of cardio is shopping and who want to endow the cloister not only with their worldly ‘dowry’ but with vast amounts of high quality hair gel???” I wondered.

Seriously. My dating life was over. Kaput. I was hopeless. Driven to salted caramel ice cream, red velvet cake, NeimanMarcus.com and re-runs of the BBC's Pride and Predjudice in an instant.

And then I realized something.

I had fallen for literally one of the oldest tricks in the mind’s playbook. Instead of considering the known unknowns (i.e. – the thousands of men online and in the physical world from whom I hadn’t received disturbing, Santa Clause-esque pictures), I had taken the known knowns and concluded that I would eventually die alone and be eaten by my cats. And don’t even get me started on the unknown unkowns in this scenario. I mean, Bridget Jones-type endings don’t just happen in the movies, right?

Daniel Kahenman explained this information processing phenomenon in his book Thinking Fast And Slow as “what you see is all there is (WYSIATI),” and I was a classic victim.

But it was somewhat comforting to me to remember that I’m not the only one that falls for this little mind game. The investment industry does it all the darn time. In fact, it’s one of the things that makes me the kinda tired about the work I do.

Don’t believe me? Think about the following areas:

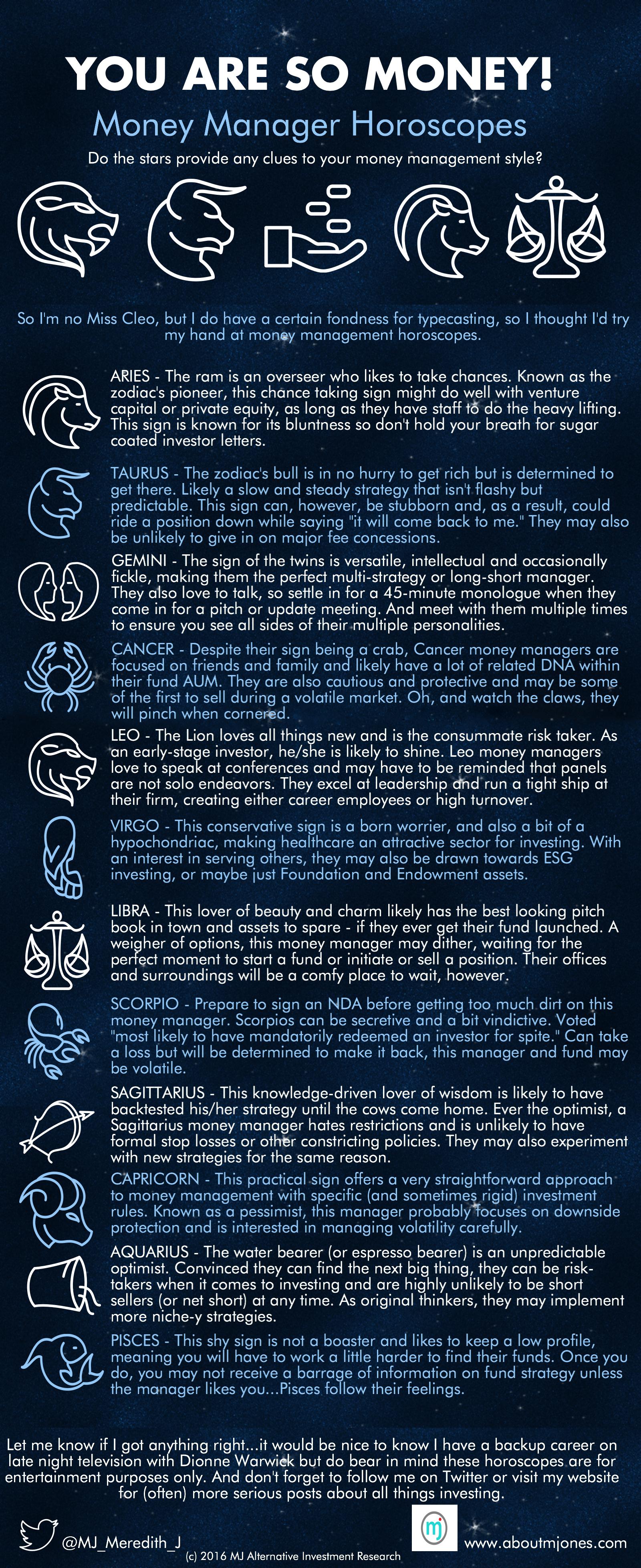

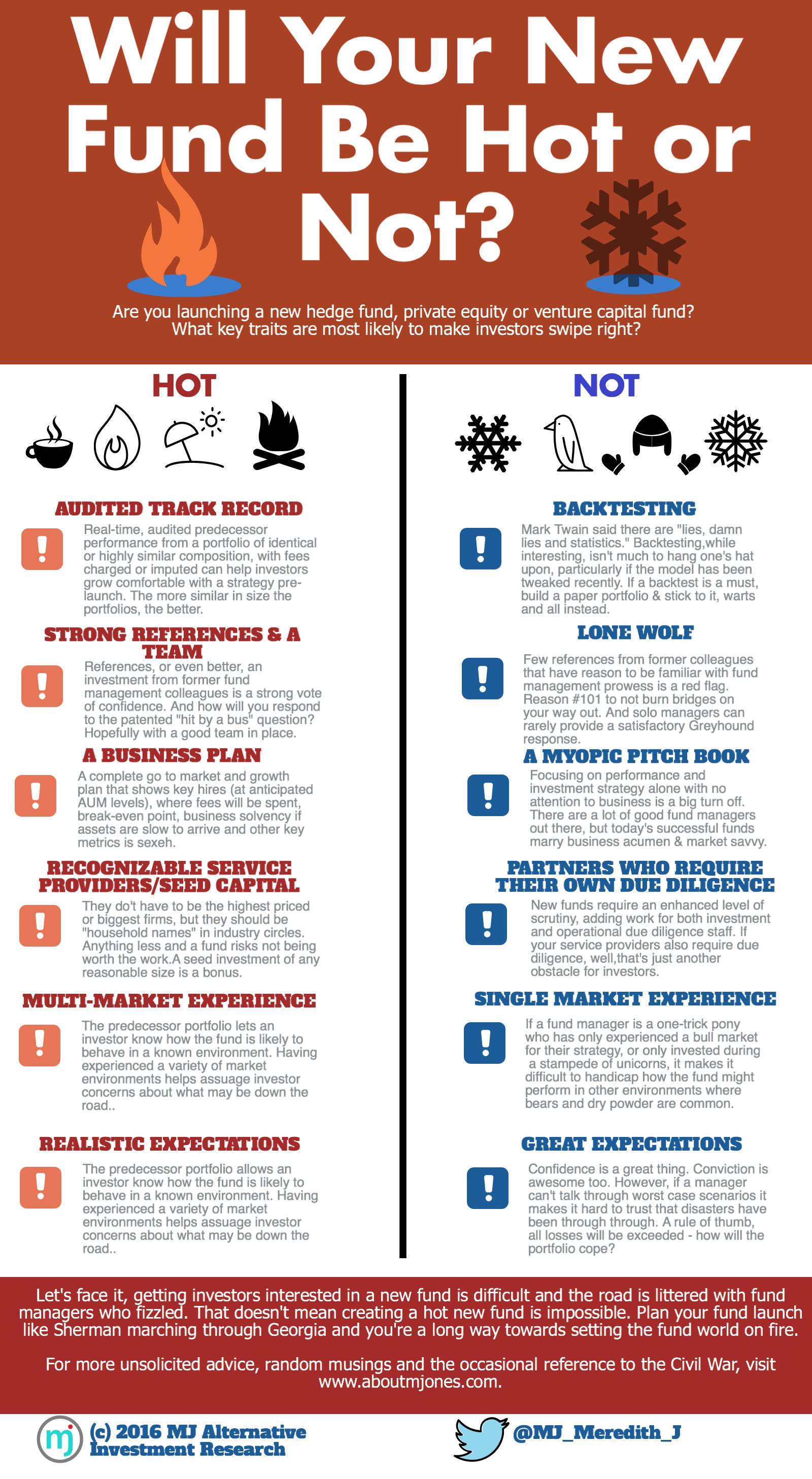

Hedge Fund Returns: A classic example of WYSIATI, we all know that hedge fund returns have been positively tragic for years, right? I mean, we see the HFRI Asset Weighted Index is down -0.21% through July and that obviously means that all funds have struggled to post any kind of decent returns. Well, hold on there a minute, Sparky. What if I told you that looking at that one number was giving you a bad case of the known knowns? What about all of the other funds in the HFR database? I guess they’re underperforming, too? Nope. Even if you look at other index categories you can see instances of strong outperformance: Credit Arb – up 5.17%, Distressed – up 6.20%, Equity Hedge Energy – up 10.73%, and those are all averages. Or what about the small funds I'm always pushing on y'all? They are up 4.1% for the year to date, according to industry watcher Preqin, compared with a somewhat anemic gain of 0.54% for the "billion dollar club." In fact, these numbers are the known unknowns – the numbers we could consider, but we don’t because there’s a nice, neat single little index number for us to rely on. And then you’ve got the unknown unknowns – the funds that DON’T report to HFR and aren’t accounted for in their index. I know of funds that are up 10%, 15% even 20%+ for the year. In a universe of 10,000 funds, drawing conclusions from one bit of known known data just doesn’t cut it.

Diversity: In April 2015, Marc Andreessen famously said in an interview that “he has tried to hire an unnamed woman general partner to Andreessen Horowitz five times. Each time, she’s turned him down.” See? Even a luminary in the venture capital world can get sucked into WYSIATI. Because the “unnamed woman” was likely one of the few females Andreessen associates with in the industry, she constitutes his entire universe. She is his known known. And if you think there aren’t great women and minority candidates, funds or investment opportunities out there, the problem is likely with you. Cultivating different networks, rewriting job descriptions to attract different applicants, working with recruiters who specialize in diversity, hell, even just being more intentional about hiring and investing can reveal a wealth of candidates that can help bring cognitive and behavioral alpha to your firm.

Fund Fees: Hedge fund fees are 2 and 20. 2 and 20. 2 and 20. I hear (and read) this so much I want to vomit. Do some funds charge 2 and 20? Sure. Do some funds (read: most funds) charge less, if not in headline fees, in actual fees? Hell yes! The average fees for a hedge fund these days is about 1.55% and 18% and declining. For new fund launches, fees were remarkably stable for years, never approaching the 2 and 20 milestone on average. And what’s more, roughly 68% of funds in a Seward & Kissel study offered reduced fees for longer lock ups, while 82% of equity funds and 29% of non-equity funds offered reduced-fee founders share classes. And what about hurdle rates? An investor recently swore to me that “no hedge funds have hurdle rates.” Well, that’s just bupkis. A show of other investor hands in the room immediately dispelled that myth, proving that, while not the majority of funds, some funds do have benchmarks to beat before they take their incentive allocation. What that one investor saw was not all there was.

Indices: Can’t Beat ‘Em, Join ‘Em: Obviously, the entire investment industry is trending towards passive investments. You can’t swing a dead pouty fish without hitting an article touting the death or underperformance of active investment management. And for people who have only been investing over the last 10 years or so, it probably looks like the S&P 500 is a sure bet. Always goes up, right? Well, wrong. While it’s certainly true that the S&P does tend to go up over time, you can never be sure what the time frame will be, and whether you’ll have time to recover from any unexpected downturn. But the bull market we’ve seen since March 9, 2009 isn’t all there is. Actually, if you recall, at that point in time, the S&P 500 had just experienced a 10-year losing streak. Ouch. Don't believe me? Ask any Gen X'er like me how much Reality Bites when the first 10 years of your 401k saving is wiped out by a tech wreck. Sorry, Millennials, but you haven't cornered the market on false financial starts quite yet.

Investment Opportunities/Herding: Private equity and venture capital dry powder with nowhere to go. Hedge funds all own the same stocks. Crowded trades. High valuations. What investor could possibly make money in this environment? Once again, 13-Fs, Uber and Apple aren’t all there is. Even though we tend to fixate on the visible data, there are a number of niche-y, networked, regional, club-deal and other funds out there getting it done. Even big firms with the right resouces can pound the pavement, do the research or build the quantitative system that generates returns. Don’t believe me? Read the article (link below) on Apollo, who did more deals in the first part of this year than their three largest competitiors put to work in the same period. Just because the managers you’ve seen thus far haven’t done it, doesn’t mean it isn’t being done.

So before you freak out about one of the topics above and eat an entire red velvet cake while standing at your kitchen counter (no judgement).

Before you decide that you should do away wholesale with your hedge funds, private equity funds, venture capital allocation, financial planner, mutual funds or your dating life.

Take a step back.

Breathe.

Sign off of Match.com because, honestly, any site that thinks the best reason for going on a date with someone is that neither of you smokes needs help with their dating algorithm.

And understand that you’re likely looking only at what you know, which may not help you as much as you’d like.

Sources: HFR, http://www.huffingtonpost.com/2015/04/11/andreesen-women_n_7046740.html, Seward and Kissel, http://fortune.com/2016/08/04/hpe-private-equity-apollo-global-management/