It's time for another animated installment of The Hedge Fund Truth! Turn up your speakers, close your door and watch this week's video blog. This video looks at some of the truths and fictions around the hedge fund industry, focusing around recent bad press about returns, fees and a shortage of talent. It asks if the entire industry should be tarred with the same big brush or if there is nuance that investors and industry watchers may not have considered. Are hedge funds inherently BAD for investors, or do we need to gather more data and adjust our thinking? Enjoy!

(c) MJ Alts

Please note the MJ Alts blog is now posted on the 1st and 3rd Tuesday of each month.

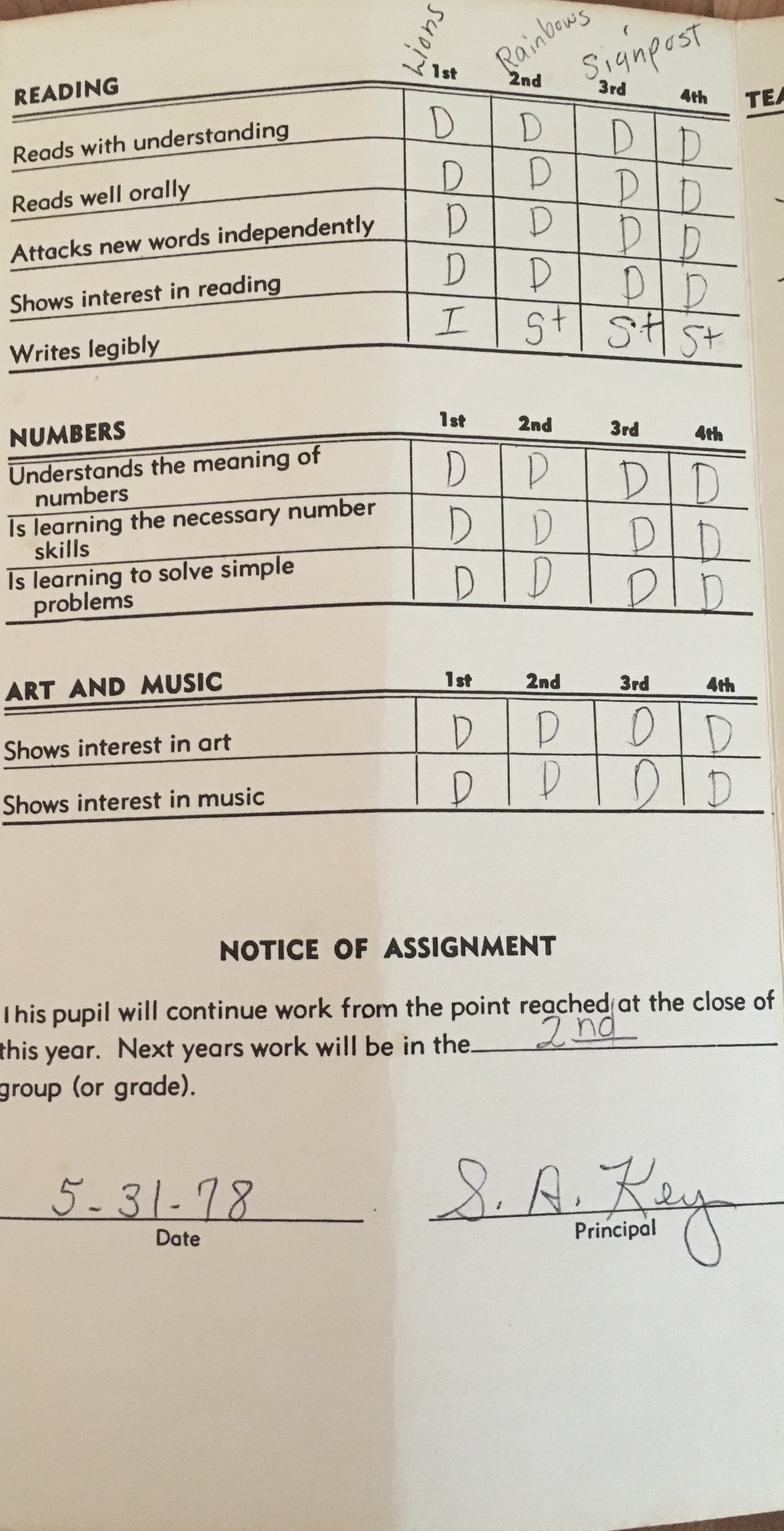

I was going through some old papers recently and, lo and behold, stumbled across my first grade report card. Since I’ve often struggled with authority figures, I opened it with some trepidation and discovered a few tidbits about the past.

- Much like many employers today, achieving a rating of “outstanding” was impossible by Mrs. Northem’s standards, and is likely the genesis of my overachievement urges.

- Grades were not merely the results of tests and homework, as they became as I got older, but a more nuanced measure of success.

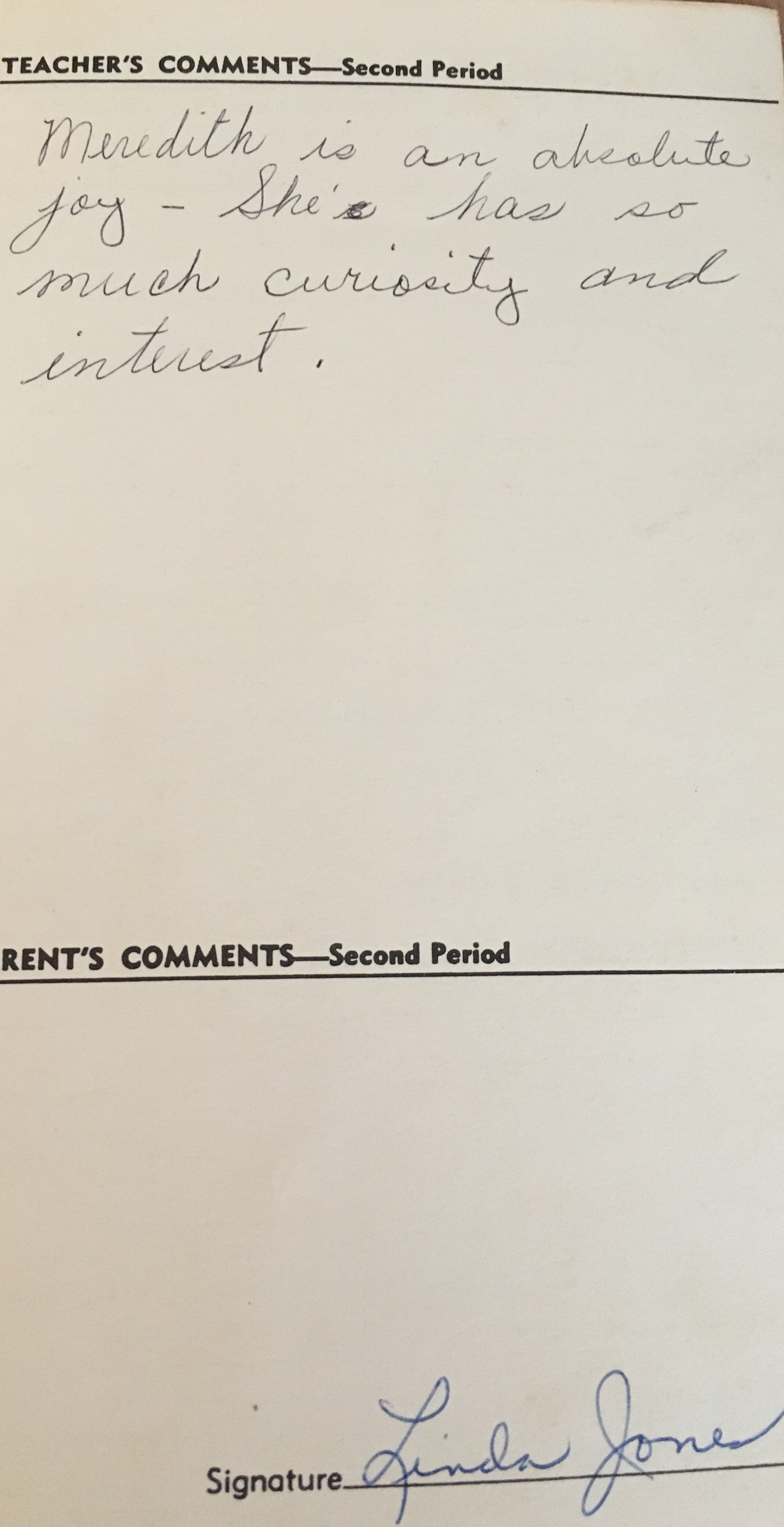

- My teacher (and the ones that followed) seemed to actually like me, with Mrs. Northem writing “Meredith is an absolute joy. She has so much curiosity and interest.”

Now, as one of my friends of course pointed out, the end of that sentence could have been left off. He contends that my teacher merely stopped writing before she added: “She has so much curiosity and interest…that I want to slap her.”

But still.

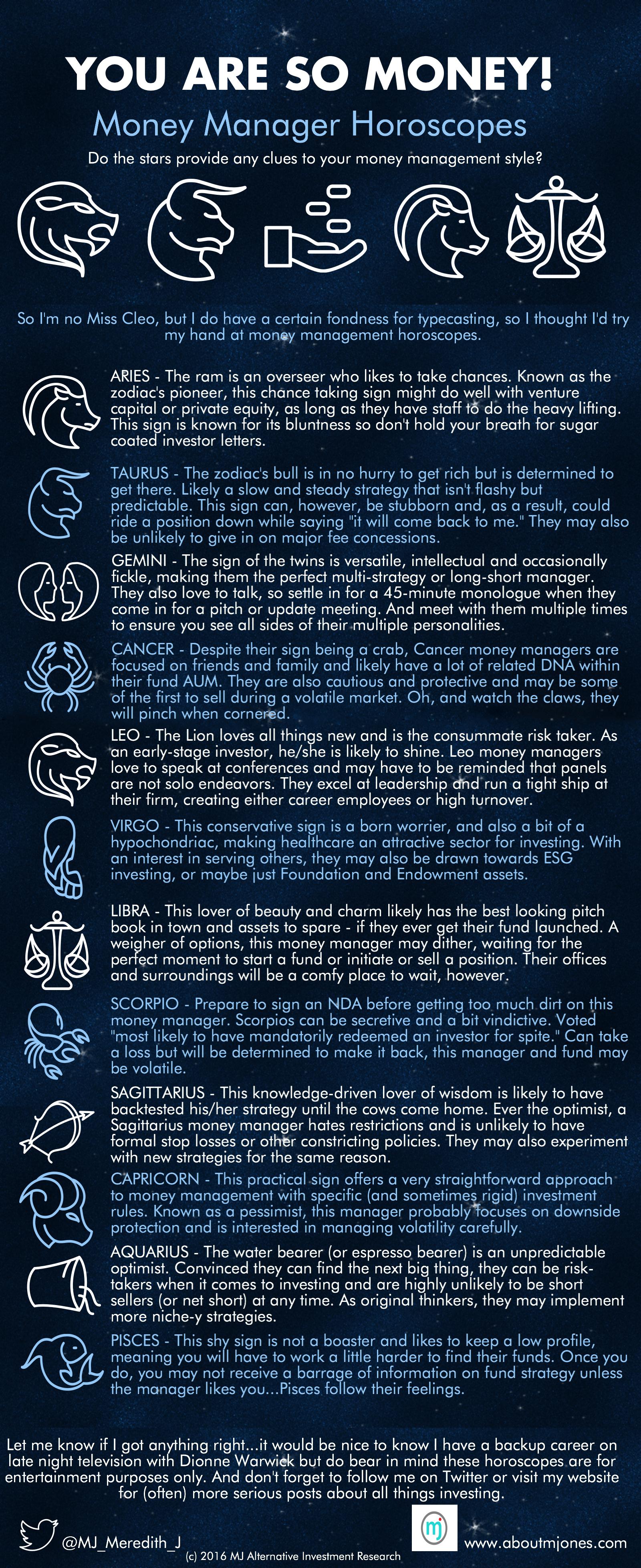

This little archeological gem made me start thinking about how we grade money managers. We all talk about their collective Grade Point Average (performance) but we tend to get stalled after that.

For example, consider the headlines that of late argue hedge fund managers have generated poor performance, particularly relative to their fees.

What does that mean, exactly?

Let’s assume that means that the average hedge fund has essentially a “C” GPA. If there are five funds (because the math is easy), what grades did each fund make?

- 3 A’s and 2 F’s

- 3 A’s and 2 D’s

- 4 B’s and 1 F

- 5 C’s

- 4 C’s and 1 D

For some reason, financial pundits seem to think the answer has to be either 4 or 5, when, in fact, every combination of the grades above would generate that C average.

While certainly Garrison Keillor can’t be right when he quips “all our children are above average,” it is important to remember that when we talk about average performance some funds, potentially a great many funds, will have performed above that average, while others will have performed below the average. It’s math, y’all.

But before we even get too tied up in our numeric underpants, let’s also consider that the “grades” we give our managers are not as simple as a single performance number.

Just like my reading “grade” was comprised of understanding, reading aloud, attacking new words, interest and writing, in which I earned “D”oes good work across the board (with the exception of writing…I’ve always had the handwriting of a serial killer), how we measure managers is, or should be, comprised of a number of different factors.

- Did the manager perform as expected? Not every manager or strategy will perform well in every market. If, however, the fund performed as we expected given the prevailing market and strategic considerations, that should be taken into consideration. For example, marking down a short seller for not generating eye-popping positive returns during a raging bull market is insanity and a push towards style drift.

- Is the manager taking the risk I expect him to take? If a fund manager starts taking increasing risk with your capital as they chase some illusive performance benchmark, that’s more cause for concern in my book than underperformance.

- Does the manager communicate effectively? Do you have sufficient transparency and frequent updates so you can evaluate how you feel about items 1 and 2?

- How does the manager’s performance fit into my overall portfolio? No fund is an island, but is instead part of an overall asset allocation plan. Managers and strategies should contribute when you expect them to (see above), but again, constant outperformance is more of a myth.

Perhaps because much of the media doesn’t get the full picture, or perhaps because, like me, they’re a bit removed from their old report cards, too many folks become entirely too fixated on manager GPA. Unfortunately, that leads those less familiar with investing to potentially make decisions based on this all-too-linear thinking as well, perhaps even ignoring investments that could have a positive impact on their overall portfolio because they are “bad.”

And that’s really the shame, here. Because if we look behind the manager “grades” we would see that many investors, two-thirds in fact, believe their hedge fund investments actually met or exceeded their expectations in 2015, according to Preqin data.

Which means that either more than half of our industry suffers from the “Lake Woebegone Effect” (all my managers are above average) or there is more to the story than simple average performance.

As someone who “D”id good work with numbers, even back in 1978, I’m betting it’s the latter.

Please note: My blog is now published on the first and third Tuesday of each month.

In the fantastic, utterly un-politically correct movie Blazing Saddles, Madeline Kahn plays a lisping, Teutonic, burlesque dancer (and at least part time lady of the evening) by the name of Lily von Shtupp. Enlisted to help rid Rockridge of its new sherrif, we get to see Lily in action as she performs one of the movie’s highly underated muscial numbers “I’m Tired.” Kahn croons:

“I’m Tired…

Tired of playing the game…

Ain’t it a cwying shame….

I’m SO tired.”

I felt a bit the same this week as I contemplated the latest hedge fund headlines and had a head-on rendezvous with some déjà vus. A quick Googling let me know I wasn’t imagining things…we actually are stuck in a sort of hedge fund Groundhog’s Day. Minus the cheeky rodent.

Yes, it seems we get to start the year in January, where we lament that the average hedge fund performed averagely. Then in April and May we get the Hedge Fund 100 that showcases most successful (from an AUM perspective) funds, followed closely by the Hedge Fund “Rich List”, which tells us all how much we didn’t make the year before.

Around mid-summer we get treated to a rare showcase of female hedge fund talent, before switching gears to talk about mid-year performance, closures and anticipated end of the year launches. Short articles follow that focus on the Hedge Funds Care and 100 Women in Hedge Fund Galas, before we end the year discussing, again, how the average fund fared.

And in between bursts of schadenfreude, finger pointing and headshots of hedge fund bigwigs, we get a (time-lagged) look into hedge fund portfolios. Not that we care, because the average hedge fund is still average, but let’s just take a little peek.

So to thoroughly prepare us all for the year ahead, I thought I’d create a little cartoon calendar to keep the continuous coverage in perspective.

(C) MJ Alts

And if you need something a bit more granular to mark the days just remember this happy mantra – negative hedge fund coverage? Must be a day that ends in “Y.”

Image Credits: BrainCheese and 123RF: <a href='http://www.123rf.com/profile_photoman'>photoman / 123RF Stock Photo</a>

I’m a crazy cat lady. Those that know me well in the industry are already clued into that fact. Those that don’t know me well probably at least suspected it. After all, no one can be this sarcastic and inappropriate without spending an inordinate amount of time by herself.

What folks may not know is I am, in fact, a total bleeding heart when it comes to any animal. I have stopped my car to rescue skunks, turtles, dogs, and cats. I have nursed injured geese and mice. In fact, just before Christmas I found homes and no-kill shelter placements for 48 cats that a even crazier cat lady was hoarding in her BFE, Tennessee trailer.

So imagine my outrage when the story broke about a baby dolphin that died after a bunch of total effing morons passed it around on the beach for selfies.

Come. On.

I was so pissed I stomped around the house blathering on (to myself and to my three cats) about how stupid the entire human race has become and how this is all a sign of the total end of civilization, which I am sure some idiot will capture on a freaking GoPro.

And then I started to calm down. I did what those of us who work with causes have to do so often when confronted by things too horrible to imagine. I breathed and I began to think about all of the people that I know who do good things for the world. How private equity veteran Jeremy Coller is a vegetarian and a champion for farm animal welfare. How 100 Women in Hedge Funds raised more than GBP550k for children’s art therapy. How one of my favorite seeders and one of my favorite family office guys both do volunteer work with wildlife and schools in Africa every year.

As a level of sanity returned, I remembered a quote from the existential masterpiece Men In Black: “A person is smart. People are dumb, panicky dangerous animals and you know it.”

http://memeguy.com/photo/42477/men-in-black-quote-seems-more-relevant-by-the-day

I needed to re-focus on persons. Not people.

All too often, however, we tar a person with our people brush. Sometimes it’s well deserved (not to mention a time saver), but most of the time we find that there are exceptions to every rule. And while it’s hard for most of the public to imagine them as individuals, this is also the case in the world of alternative investments.

Let’s consider some of my fave hedge fund “you people” themes:

Hedge Funds Keep Getting Crushed – Sure, most index providers show hedge funds started the year down more than 2% on average, but that means some funds did worse and…gasp….some funds did significantly better. Hopefully you saw some of the latter in your own portfolio, but if not, Business Insider proves this point with this handy article.

Hedge Funds Charge 2 & 20 – In their study “All That Glitters” Elizabeth Parisian and Saqib Bhatti conclude that pensions pay roughly $81 million in hedge fund years per year, amounting to roughly 57 cents on every dollar of profit. In December 2015, Eurekahedge reported that average hedge fund performance fees last touched 20% in 2007, while Citibank reported that management fees were, on average 1.59%, with an operating margin of 67 basis points. I’ve seen several funds launch of late with either no management fee or zero performance allocation. And what we’re talking about? They are just the headline fees. Most managers, roughly 97% the last time I polled them in 2013, were willing to drop fees for large investments. That’s a whole lot of persons charging less than “those people.”

Hedge Fund Billionaires – Google “hedge fund billionaire” and, if you’re like me, you’ll get 131,000 results in about 0.57 seconds. Of course, what’s interesting about that fact is it is probably roughly 130,500 hits higher than the actual number of hedge fund billionaires. If one assumes that all hedge fund managers with AUM over $1 billion are, in fact, billionaires (a stretch if I’ve ever heard one), then that leaves roughly 9,500 hedge fund managers who are not billionaires, unless they secretly won the family inheritance or actual lotteries. That’s a pretty unbalanced barbell on which to base any kind of income assumption. And of course, that doesn’t take into account that a hedge fund manager, even a Big Billionaire Hedge Fund Manager, can lose money for the year if they don’t achieve profitability for their clients.

At the end of the day, as my former boss, George Van, used to say, “hedge funds are as varied as animals in the jungle,” and boy, is he right. And whether we want to believe it or not, hedge fund managers are individuals first, and “those people” second.

The moral of the story? Generalizations are generally not your friend. They make you mad. They make you sad. They may make you ignore investment options based on public opinion rather than facts. Instead, take a moment to slow down and individualize. Unless I find out you took a selfie with that dophin, in which case, I suggest you speed up and use your head start.

A few years ago, I went to Vienna to give a pre-conference workshop at a hedge fund conference. Because I had more than one connection, I checked my luggage, which I almost never do. When I arrived at the Vienna airport and retrieved my luggage, I discovered that it was soaked with a mysterious pink liquid. Everything in my bag was moist, a little fragrant and a lovely shade of rose.

I rushed out into the Vienna evening to purchase something to wear to the event the next day and was at least able to score some skivvies and something to sleep in before the shops closed. I sent those and a suit out to the hotel cleaning service immediately upon my return to the Vienna Hilton.

After two hours, there was a knock on the door.

“Fraulein Jones! We have your laundry!”

I opened the door and was greeted by a white-gloved hotel staffer holding a few coat hangers in one hand, and a silver tray above his head in the other. As I stood slack-jawed and jet-lagged in the doorway, the tray was lowered to my eye level.

On it were my neatly folded and laundered undies. Which had been paraded in all of their unmentionable glory through the entire conference hotel.

The next morning, the “room service undies” story was the talk of the event. I, or at least my underclothes, was the highlight of the conference.

Now, don’t get me wrong, I appreciated the professional Austrian laundry service. The prompt delivery to my door before I collapsed into bed was lovely, too. But much like Goldilocks, there was a desired level of service that was too much, one that was too little, and one that was just right. I’m not sure I quite needed the white gloves. And the silver panty platter? Well, let’s just say that was straight-up overkill.

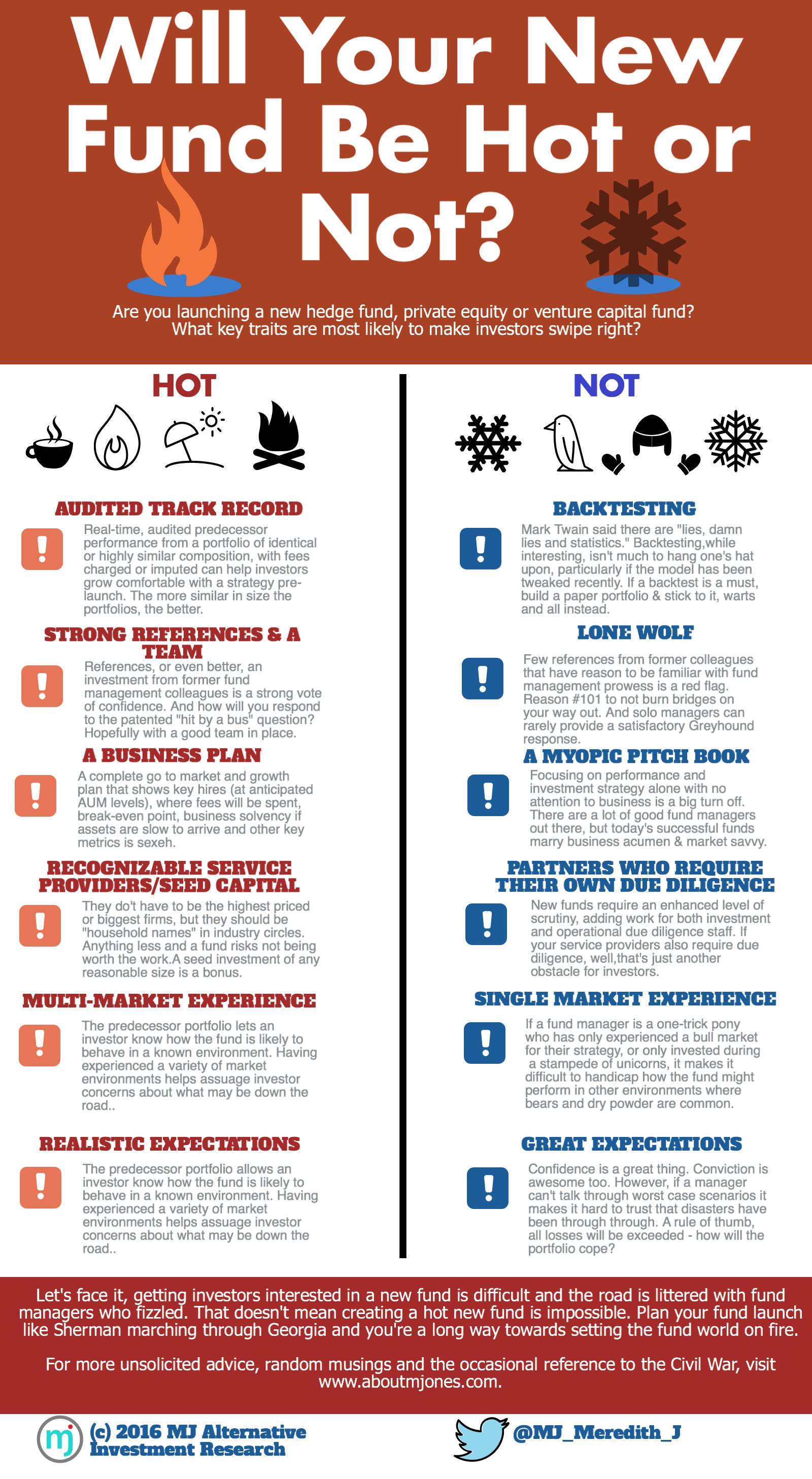

It’s not much different in hedge fund land either. At another conference last week, I had the pleasure of sitting next to two gentlemen who were running a small hedge fund. They gave me their elevator pitch (interesting) and then peppered me with some questions about how to take their fund to the next level. It wasn’t long before the question of service providers came up.

“Just how important are our service providers anyway?” they wanted to know. “We’re a small fund and we really need to be cost conscious, so can we get by with what we have?” they asked.

Unfortunately for them, the answer was a fairly unequivocal “no.” They were using individuals, not firms, for the most part. And while inexpensive, these individuals were almost certain to cause problems in one of three areas eventually.

- Scalability – When a fund is small, the number of LPs may also be quite low. This means fewer K-1s, usually no tax-exempt or offshore investors, few requirements to register with a regulatory body or file ongoing forms, no separate accounts, etc. If you are dealing primarily with your own money and that of your friends and family, then your uncle’s friend’s cousin’s accountant son-in-law may be sufficient for your needs. But as a fund grows, the demands on fund infrastructure and service providers evolve. An administrator who can handle money-laundering regulations becomes mandatory as you accept offshore dollars. Audited financials, not just a performance review, are essential. Late or incorrect K-1s become a kiss of death. It is essential to pick service providers that can grow with your fund.

- Due diligence – And speaking of growth, it is also vital that your service providers aid the expansion of assets under management, rather than impede capital raising. The last thing a fund manager should want in an already extensive and extended due diligence process is to force an investor to have to investigate a service provider, too. If you don’t select service providers with at least a basic level of “street cred,” then investors must evaluate not just your skills and organization, but the skill and organization of the groups that support you. And this flies in the face of one of the best pieces of advice a fund manager can hear: “Make it EASY for investors to allocate. The more impediments you put on the road to an investment, the less likely someone will actually send you a wire.“

- Level of service – Finally, while I’m sure Aunt Sally’s friend’s neighbor’s daughter is great at creating account statements each month, she probably isn’t going to invite you to industry events, hold webinars on topics that are pertinent to your business or have value-add service like cap intro or strategic consulting. Just like it’s important to make it easy on investors to invest, it is equally important to make it easy on yourself to grow. The straight money-for-service trade is only part of the equation – you have to evaluate whether there is additional “bang for your buck” that you may miss by being penny wise and pound foolish.

Having said all this, I do believe there is a Goldilocks principle at work with fund service providers too. To use my Vienna analogy, you do want to make sure you can get dressed in the morning, but many managers probably don’t need their drawers delivered on a silver tray.

For those looking to play exclusively in institutional investor markets, the biggest names may be essential, but for many hedge funds, there are a range of players (and price points) available. Several publications, like Hedge Fund Alert for example, provide rankings of service providers based on their total number of SEC filings. This can be great starting point for managers looking for firms with experience (and name recognition) in the industry. Ask around and see who other fund managers use as well. At the end of the day, pick a competent, reputable, scalable provider with value-added services at a price point that seems like a good trade for those services.

Now clearly, I don’t have a dog in this hunt, so all y’all fund managers should ultimately do what you want. But since so many of you might have already seen my undies, I felt we were close enough for me to offer this unsolicited advice.

One of my favorite comedic routines of all time comes from fellow Alabama native Roy Wood Jr. Now a regular on The Daily Show, Wood originally did stand-up at various and sundry venues, and made his television debut on Letterman in 2008.

Known for prank calls and “you ain’t going to Mars”, Wood’s best work (in my humble opinion) was a bit he did about career day.

Unlike many of us invited to talk at Career Day, Wood eschewed the normal “if you work hard and study, dream big and believe in yourself, you can achieve anything” mantra. No, Mr. Wood instead chose the path of honesty.

“Remember career day, when a bunch of people would come lie to you?” said Wood. “I went to career day and told them the truth. Look, two or three of y’all aren’t going to make it. That’s the truth. Everybody’s not going to be rich and famous. Somebody has to make the Whoppers, and that’s what people need to understand at an early age. We need failures – they provide chicken nuggets and lap dances, and I like both of them. They are important services...But apparently that’s the wrong thing to thing to say to a room full of first graders.”

As I received news of yet another rash of hedge fund closures, Mr. Wood’s words came to mind. Not because I expect these former fund managers to start making “parts is parts” processed chicken or working in a Magic Mike tribute show, but because, at least the way the industry is evolving right now, “two or three of y’all aren’t going to make it.”

I’ve seen managers that have struggled for years with low AUMs or extended (or even endless) pre-launch woes and many of the folks I talk to are wondering, “When is enough, enough?”

It’s hard to know when to throw in the towel in this industry. We’re always one trade, one IPO, one deal away from fame and fortune. One Thai Baht, one housing crisis, or one Facebook could make or break a professional investor. It’s a giddy proposition, and one that anyone with a Google machine knows can and does happen.

But unfortunately, waiting for the lightning to strike, and figuring out how to capitalize on it if you’re not already a household name, can be excruciating.

I’ve said it before, but I’ll say it again. If you’re a hedge fund manager with $100 million under management and a 1-and-20 fee structure who made 10% for investors last year, your firm generated a whopping $560,000 after expenses last year. If you gave any of your investors a fee break for founders’ shares, or if a fair amount of that capital is personal or friends and family, and fees dip closer to 1-and-15, you made 60 grand.

That’s right, I said 60-freakin’-grand.

And that’s for making roughly 10 times what the S&P 500 generated.

And since 50% of the industry manages less than $100 million, those firms did even worse, even if they, too, outperformed, which may make those chicken nuggets look a bit more attractive.

So what’s an intrepid, alternative investment professional to do in a world where 90% of capital is directed to the billion-dollar club and expenses are at an all-time high? Maybe it’s time for a little soul searching.

What’s your overall financial situation? Assume perhaps 10%-20% in AUM growth going forward, along with realistic return expectations. What does the overall firm income look like? Many fund managers launch funds with healthy war chests created at other firms or from other roles, but that is seldom an endless pool of capital. What is the realistic proposition for wealth creation and preservation assuming costs continue to increase and asset growth is sluggish at best? It can be difficult to part with one’s magnum opus, and as humans we do tend to ascribe more value to things in which we have sunk costs. But take a step back and attempt to look rationally and unemotionally at your current situation and the likely scenarios for the next three years. Enlist an impartial third party to validate your assumptions and try to determine if you’re still on the right path.

Can you reinvent your business in any way to improve your AUM base or reduce expenses? There are a growing number of private equity firms dedicated to purchasing strategic stakes in asset managers, have you considered selling a part of the business? Have you investigated all of your service provider relationships to ensure you have all your bases covered, and covered most effectively? Are you being penny-wise and pound-foolish when it comes to bringing on additional resources, like marketing or operational assistance? Can you team up with a group of other managers to create a cost-sharing consortium for certain functions? Have you shopped your strategy to larger shops that may be looking to diversify their offerings? It is always critical to remember that it running an investment firm ain’t all about (managing) the money, money, money – running an investment shop requires business acumen, strategic planning and smart investments in the firm. Maybe you don’t end up being stud duck of your own Blackstone-esque entity, but you do get to keep doing what you love.

Can you see yourself doing anything else? I know several investors who say that if you don’t want to manage money at $100 million, you don’t deserve to manage money at $1 billion, and there’s something to be said for that - at least in a perfect world. If you can think of other career avenues you might enjoy, however, it may be time to explore those options. Money managers have done that throughout the last several years, leaving to spend time with family, get involved in charity, and at least three even leaving to start food trucks (The Dark Side of the Moo, and the PIMCO croque-monsieur truck) and The Real Good Juice Company. Hell, even I contemplate buying a farm and raising organic eggs at least once a month. But at the end of the day, I still love what I do. Most days. If you get up every day excited to face the markets, win or lose. If you think your strategy still has the “it” factor. If you think doing any other job would be like enduring the “long dark tea time of the soul”, stick with it. You may never be Dan Loeb, but you’ll always be engaged and happy.

Here’s to better luck in 2016 for everyone. Let’s hope that the industry changes in ways that make it easier for emerging managers to keep their heads above water and that my little soul searching exercise turns out to be a worst case scenario and not the status quo. If not, you can always think of a break from the investment industry like a stop loss. It's a fail safe to give you time to re-evaluate, re-adjust and come back stronger. Just look at the PIMCO food truck guy - after three years of sandwiches, he's back in the game. And he brought snacks.

Links to sources:

Roy Wood Jr. Career Day - https://www.youtube.com/watch?v=_mApfABF-c8

Hedge Fund Fees - The Truth and Math - http://www.aboutmjones.com/mjblog/2015/6/29/hedge-fund-truth-series-hedge-fund-fees

Hedge Fund Food Truck - http://www.cnbc.com/2015/06/10/from-finance-to-food-trucks-lessons-learned.html

PIMCO Food Truck - http://blogs.wsj.com/moneybeat/2014/10/29/the-pimco-food-truck-lives-on/

Hedge Fund Juicer - http://money.cnn.com/2014/10/06/investing/quit-wall-street-open-food-business/

“long dark tea time of the soul” is from The Hitchhikers Guide to the Galaxy

As y’all recover from the excesses of fried turkeys, stuffed stockings, too much ‘nog and an overdose of family time, it seems like a good time to catch up on some light reading. So, in case you missed them, here are my 2015 blogs arranged by topic so you can sneak in some snark before you ring in the New Year.

Happy reading and best wishes for a joyous, profitable, and humorous 2016.

Happy Holidays from MJ Alts!

HEDGE FUND TRUTH ANIMATED SERIES

http://www.aboutmjones.com/mjblog/2015/6/29/hedge-fund-truth-series-hedge-fund-fees

http://www.aboutmjones.com/mjblog/2015/6/1/the-most-hated-profession-on-earth

http://www.aboutmjones.com/mjblog/2015/3/2/the-hedge-fund-truth-launching-and-running-a-small-fund

http://www.aboutmjones.com/mjblog/2015/1/19/savetheemergingmanager

WOMEN AND INVESTING

http://www.aboutmjones.com/mjblog/2015/12/13/dear-santa

http://www.aboutmjones.com/mjblog/2015/11/16/not-so-fast-times-at-hedge-fund-high

http://www.aboutmjones.com/mjblog/2015/9/25/doing-well-doing-good-improving-investment-diversity

http://www.aboutmjones.com/mjblog/2015/7/26/the-evolution-of-a-female-fund-manager

http://www.aboutmjones.com/mjblog/2015/6/10/advice-to-the-future-women-of-finance

http://www.aboutmjones.com/mjblog/2015/4/27/diversification-and-alpha-by-the-book

http://www.aboutmjones.com/mjblog/2015/1/26/dont-listen-to-greg-weinstein

EVERYONE HATES ALTERNATIVE INVESTMENTS (ESPECIALLY HEDGE FUNDS)

http://www.aboutmjones.com/mjblog/2015/12/7/keen-delight-in-the-misfortune-of-hedge-fundsand-me

http://www.aboutmjones.com/mjblog/2015/2/2/mfp1glk0exk0vlnqtpx6lby2ba9z8n

http://www.aboutmjones.com/mjblog/2015/11/23/babelfish-for-hedge-funds-1

http://www.aboutmjones.com/mjblog/2015/11/8/hedge-funds-bad-reputation

http://www.aboutmjones.com/mjblog/2015/10/5/dear-hedgie

http://www.aboutmjones.com/mjblog/2015/9/9/investment-professional-fact-fiction-the-business-trip

http://www.aboutmjones.com/mjblog/2015/5/17/hedge-funding-kindergarten-teachers

http://www.aboutmjones.com/mjblog/2015/4/14/are-hedge-clippers-trimming-up-the-wrong-tree

http://www.aboutmjones.com/mjblog/2015/2/16/rampallions-scullions-hedge-funds-oh-my

FUND RAISING & INVESTOR RELATIONS

http://www.aboutmjones.com/mjblog/2015/6/22/swingers-and-the-art-of-investor-communication

http://www.aboutmjones.com/mjblog/2015/4/5/7-secrets-to-a-successful-fund-elevator-pitch

http://www.aboutmjones.com/mjblog/2015/10/26/founding-funders

http://www.aboutmjones.com/mjblog/2015/8/28/crisis-communication-for-investment-managers

http://www.aboutmjones.com/mjblog/2015/7/20/trust-me-im-a-portfolio-manager

http://www.aboutmjones.com/mjblog/2015/5/4/the-declaration-of-fin-dependence

EMERGING MANAGERS

http://www.aboutmjones.com/mjblog/2015/8/17/people-call-me-a-skeptic-but-i-dont-believe-them

http://www.aboutmjones.com/mjblog/2015/10/19/are-you-the-next-blackstone-dont-count-on-it

DUE DILIGENCE

http://www.aboutmjones.com/mjblog/2015/11/1/the-evolution-of-due-diligence

http://www.aboutmjones.com/mjblog/2015/8/6/a-little-perspective-on-the-due-diligence-process

GENERAL INVESTING INSIGHTS

http://www.aboutmjones.com/mjblog/2015/10/11/investment-wisdom-increases-with-age-dance-skills-dont

http://www.aboutmjones.com/mjblog/2015/8/24/the-love-of-the-returns-chase

http://www.aboutmjones.com/mjblog/2015/8/2/slamming-the-wrong-barn-door

http://www.aboutmjones.com/mjblog/2015/6/8/the-confidence-hubris-conundrum

http://www.aboutmjones.com/mjblog/2015/5/10/the-crystal-ball-in-the-rearview-mirror

http://www.aboutmjones.com/mjblog/2015/2/23/pattern-recognition-may-make-you-poorer

http://www.aboutmjones.com/mjblog/2015/1/5/new-years-resolutions-for-investors-managers-part-one

What do you want to read about in 2016? List topics you enjoy or would like to see more of in the comments section below.

In the meantime, gird your loins for the blog that always parties like it’s 1999, even when it’s 2016.

And please follow me on Twitter (@MJ_Meredith_J) for daily doses of research, salt and snark.

I couldn’t face the same old Thanksgiving this year. Another tryptophan-laced orgy of food combined with marathon cleaning sessions before and after the big event, someone arriving with undisclosed food allergies, red wine on the carpet, cats eating the centerpiece and leftovers I have to look at with the dull eyes of the long married for weeks after the main event. No thank you!

So I did what any sane person would do: I went to Hawaii instead.

There, Thanksgiving was a Pina Colada-fueled homage to my ever present "SPF Burqa", sandy beaches and folks that unironically say “Brah.” I even tried surfing for the first time. And despite my deep-seated pleasure at a) not dying, b) not wiping out a la Greg Brady and the cursed tiki necklace, and c) standing up on at least one North Shore wave, I quickly learned after posting this picture that people did not necessarily share my enthusiasm or revel in my surfing accomplishments.

No, the most popular picture I posted was instead this gem, where a legion of people could see me wiping out like a boss.

I can’t claim to be particularly unique in this regard. In fact, it seems like the whole world likes nothing better than a deep dose of what the Germans would call schadenfreude, or “pleasure derived by someone from another person’s misfortune.” My full-on, Pacific Ocean-surfing-netti-pot photo was an exhibition of this lovely phenomenon writ small, reserved for those brave enough to call me “friend” on Facebook.

For a larger scale demonstration of schadenfreude, we had only to look as far as the hedge fund headlines in the last ten days or so. Some of my personal faves include:

“Hedge Funds Lick Wounds After Tough Year”

“Another Humbling Year For Hedge Funds”

“Hedge Funds Brace for Redemptions”

“Hedge Fund Giant Laments Profitability, Will Return $8 billion”

“Surprise! Hedge Funds Aren’t That Bad At Picking Stocks”

“The Incredible Shrinking Firms of Hedge Fund Billionaires”

Yeah, yeah, yeah…let’s all agree 2009 to present hasn’t been the easiest time to be a fan of alternative investments.

But let’s take a moment to put our keen delight in the misfortune of hedge funds into perspective.

Hedge funds aren’t exactly wiping out Greg Brady-style, either.

1) Yes, there have been closures & return of capital from some hedge funds, including a few large enough to be household names. BlueCrest opted to return outside investor capital, transitioning to a private investment partnership due to redemptions, fee pressure and its impact on recruiting. Avenue shuttered its hedge fund in favor of longer duration investments. Blackrock closed a macro fund that was down single digits for the year. Seminole returned $400 million of investor capital to better align the trading strategy with the markets and protect profitability, after returning 16% on average for the last 20 years. None of these are the spectacular, cry-during-an-MTV-performance, Justin Beiber-style meltdown, but rather strategic decisions we expect business owners to make daily.

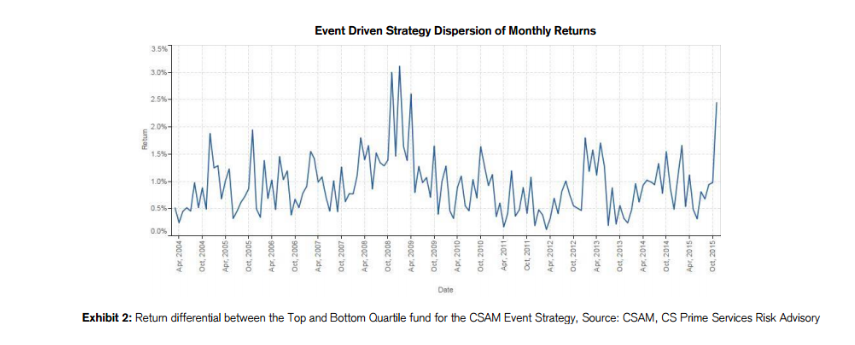

2) Yes, hedge funds haven’t exactly set the world on fire with 2015 performance. Or 2014 performance. Or 2013 performance…well, you get the picture. However, we have to remember, yet again, that the comparisons we’re making are average performance. If you look at return dispersion (here from Credit Suisse) even within single strategies of hedge funds, it is easier to remember that there are funds performing much better than the “average.”

(c) Credit Suisse Asset Management

3) Yes, hedge fund managers are losing money, but perhaps so are you. Given the explosion of institutional assets in hedge funds, celebrating the losses of a hedge fund could be tantamount to celebrating the losses of your favorite school teacher, fireman, police officer or other “main street” investor. And if that don’t take the wind out of your sails, I don’t know what will.

However, even with these clarifications, I am perhaps a little overdue in providing some hedge fund “tough love.” So here goes:

Hedge fund managers: Fee pressure is a pain. Expenses are up, regulation is increasing, the markets are more difficult to navigate and profitability is down. It’s unlikely that many of you will be able to weather a protracted double-digit or high single digit drawdown given the economic realities of managing a fund today and you’re less likely to be given the benefit of any doubt now than at perhaps any other time in hedge fund history.

But what protects fee structures and prevents increased regulation? Generating returns for your investors and doing the right things (disclosures, filings, investor relations, any and all regulatory filings) and doing it in a way that lets you sleep at night. This could be a watershed moment for hedged asset management. I wish I had a magic wand that would make it all easier but instead I can only say, for the love of all that’s holy, get ‘er done.

Writing headlines is hard.

Coming up with something appropriately attention grabbing without veering off into purple prose is a serious skill. I, myself, occasionally have moments of headline genius, but often times wind up more in the land of "huh?"

And I know it's not just me. After all, the Washington Post just gave us this headline gem last week.

Best. Headline. Ever.

But really, the world of hedge funds deserves their own set of headline awards. The headlines about the hedge fund industry are often incendiary, divisive and generally geared to just stir stuff up.

In order to help casual readers of hedge fund press wade through the copious and inflammatory rhetoric, I've created a handy-dandy hedge fund babel fish for y'all below.

May this little translation tool reduce your drama factor exponentially this Thanksgiving, even if you use it while hiding away from kids/in-laws/friends/siblings/spouses or dishwashing duties.

Hedge Fund BabelFish

(c) MJ Alts

Happy Thanksgiving to those that celebrate it, and may everyone find something this week for which to be grateful, whether there's tryptophan involved or not.

Those of you that have heard me speak on more than one occasion have probably heard me utter the phrase "Investing in emerging managers is like sex in high school. Lots of talk, very little action." In full disclosure, Jim Dunn of Verger was the first to utter those words, but they are so apropos that I have sense borrowed them for myself once or twice. (Thanks Jim!)

This week, I had the opportunity to informally poll investors and emerging managers, this time in the form of women-run funds, and that wonderful turn of phrase proved apt once again. In fact, I could almost hear Mike Damone saying "I can see it all now, this is gonna be just like last summer. You fell in love with that girl at the Fotomat, you bought forty dollars worth of [freakin'] film, and you never even talked to her. You don't even own a camera."

Indeed, it does seem as if investors often spend a lot of time stalking the camera store, but never getting the picture. So I decided to ask the audience of managers and investors at last weeks 100 Women in Hedge Funds Senior Practitioner Workshop where we stand and what could help the situation. Here's what I learned.

1) Some women-run funds may be getting lucky, but action is still sparse.

(c) 2015 MJ Alts

2) Managers feel that a number of things impede their ability to raise capital, but investors are focused primarily on only two issues: supply and size.

(c) 2015 MJ Alts

(c) 2015 MJ Alts

3) And the answer to what would make investing in women-run funds easier? Three words: Binders of Women. Just kidding, but better data sources for women-run funds, better consultant buy-in and the mysterious answer "other" all ranked pretty high. Some of the suggestions for "other" included more seed capital to help overcome AUM objections and more networking with managers you don't already know.

(c) 2015 MJ Alts

And, while these responses were specifically geared towards women owned and women run funds, in my conversations with investors, the issues are not entirely dissimilar for minority owned and run funds, or really any other emerging manager.

So, ladies and gentlemen, let's work the problem and see if there aren't good solutions to these issues. It will be healthy for me to have to come up with a new, creative and vaguely offensive way to describe the industry.

And please take a moment to support 100 Women in Hedge Funds as they are part of the solution and the reason I could run this quirky poll in the first place!

I had yet another wedding to attend this weekend: My third in four weeks. I may never get all this rice out of my hair. Seriously.

But as I was driving to this happy event, a few questions rolled through my mind:

Was I dressed appropriately? (Not really.)

Was I going to make it before the bride actually walked down the aisle? (Just barely.)

Would there be a reprise of my “Footloose Dance” humiliation during the reception? (Thankfully, no.)

And then a strange thing happened. As I cruised onto the Ashland City Highway, a familiar tune pulsed from my speakers.

“An' I don't give a damn 'bout my reputation

The world's in trouble, there's no communication

An' everyone can say what they wanna say

It never gets better, anyway

So why should I care about a bad reputation anyway?

Oh no, not me, oh no, not me”

Yes – Saint Joan Jett had arrived to calm my nerves before I rushed into the small rural church, just in time for the wedding. To say I rocked those last five minutes of the drive would be an understatement.

When I awoke on Sunday morning, I was faced with a somewhat similar scenario. Hedge funds were skewered yet again; this time in an article by the New York Times referencing a study of eleven pension funds entitled “All That Glitters Is Not Gold.”

The study demonstrated that hedge funds had added little value to public pension funds (in many cases underperforming the fund as a whole) and cost an exorbitant amount, based on the authors’ arbitrary 1.8% and 18% fee structure.

The report concludes: “Although hedge fund managers have convinced many investors that they provide investment products so uniquely profitable that extraordinarily high fees are warranted, our research suggests that there is little evidence to back up these claims.”

Oh joy. Seems I’m not the only one that needs to be concerned with my reputation.

But, upon further study of the report, I noted a couple of interesting points that are, I think, at least worthy of consideration.

Time Periods Matter: Of the eleven pension funds reviewed for the study, nearly half included only the bull market period that started in 2009. There was no period longer than 13 fiscal years in the study (about the time the first pension funds dove into the hedge fund waters), and actually only one of those. For the pension plans that did include the 2008/09 fiscal year, in every case, based on visual interpretation of the line graphs, the hedge fund portfolios outperformed. So it would appear that, given the appropriate market environment, hedge funds can and do perform. So should we draw concrete performance conclusions on hedge funds’ performance during what has been a raging bull market? As we all know, if a fund is truly “hedged” it is nigh on impossible for that fund to outperform a market with its foot on the gas.

Manager Selection Matters: As investors, we make choices about our investments. Our choices are informed by the amount of money we have (or don’t have) to invest. They are informed by investment bylaws and state regulations. They are informed by the universe of investment options of which we are aware. They are informed by the amount of time we have to devote to our investment research. They are informed by our behavioral biases and those of other key decision makers. In other words, fund selection isn’t straightforward. Think about how hard it is to order a great entrée in a restaurant – and now picture that entrée costing thousands or millions of dollars. Get my drift?

No matter how you look at it, each investor has some responsibility for their fund selection. What’s interesting about this study is, again, based on eyeballing the line graphs, it looks like the plans reviewed generated hedge fund returns of about 8.3% in FY 2014. If you look at the NACUBO/Commonfund review of 832 endowments, in contrast, you see that they averaged a 9.9% return from “marketable alternative strategies.” Now, granted there could be a difference in terminology, or there could be something there. After all, I always say in investing, Your Mileage May Vary, and manager selection is a huge part of that. Even among the eleven managers in the "Glitters" study, there is a large variance in overall portfolio and hedge fund performance.

So maybe the problem isn’t the investment vehicle. Maybe there is something that public pensions and others that are disappointed with their hedge fund earnings could learn or adapt from public endowments' approach to hedge fund investing. After all, endowments entered the hedge fund fray a bit before their public pension brethren. And, now this is just a thought, but looking at the largest endowments in the NACUBO study, they’re kind of kicking ass when it comes to hedge funds. Their marketable alternatives strategies returned 11.4% in FY’14, well above hedge fund industry averages and well above what others may be experiencing. What’s the what here? Should we be looking to those investors to figure out what ingredient we may be missing from our own secret sauce? It's not that the pensions included didn't do an admirable job of building portfolios, as each beat the overage hedge fund average, but is there something that could be done (structurally, in manager selection or otherwise) to boost returns?

Fees, Fees, Fees: As I mentioned, the study uses an arbitrary 1.8% and 18% fee structure, even though we know that industry average is closer to 1.5% and 17%, but let’s even leave that aside for a moment. We really have no way of knowing what these pensions paid in fees unless it is publicly disclosed. If they went into a separate account, for example, they may have a totally different fee structure. If they negotiated a lower fee, that’s also difficult to know. In many cases, public pension “big dogs” are able to achieve fee concessions that us mere mortals cannot hope to get.

Does this mean I think there’s no wiggle room for hedge fund fees? Absolutely not. Those of you that are regular readers know that I generally support sliding scales for management fees in particular, based on the manager’s total AUM. But even then, it’s not a straightforward “Off with their fees!” equation. Some strategies are more labor intensive than others, which may require higher fees. Newer and smaller funds have very little room between profitability and problems in their fee structures. As in most things hedge fund related, there is not one-size-fits-all fee solution. Investors should advocate for themselves within reason, and managers should protect their ability to attract talent, execute strategy and generate returns for all their investors. It’s all about balance.

It’s perhaps wise, then, to take a step back and think about whether we have enough data to draw actionable conclusions and, perhaps more importantly, if there is a way to improve hedge funds relationship and return contribution to public pensions. Anything else would be discarding the baby with the bathwater, based on what looks like a bad reputation.