I was going through some old papers recently and, lo and behold, stumbled across my first grade report card. Since I’ve often struggled with authority figures, I opened it with some trepidation and discovered a few tidbits about the past.

- Much like many employers today, achieving a rating of “outstanding” was impossible by Mrs. Northem’s standards, and is likely the genesis of my overachievement urges.

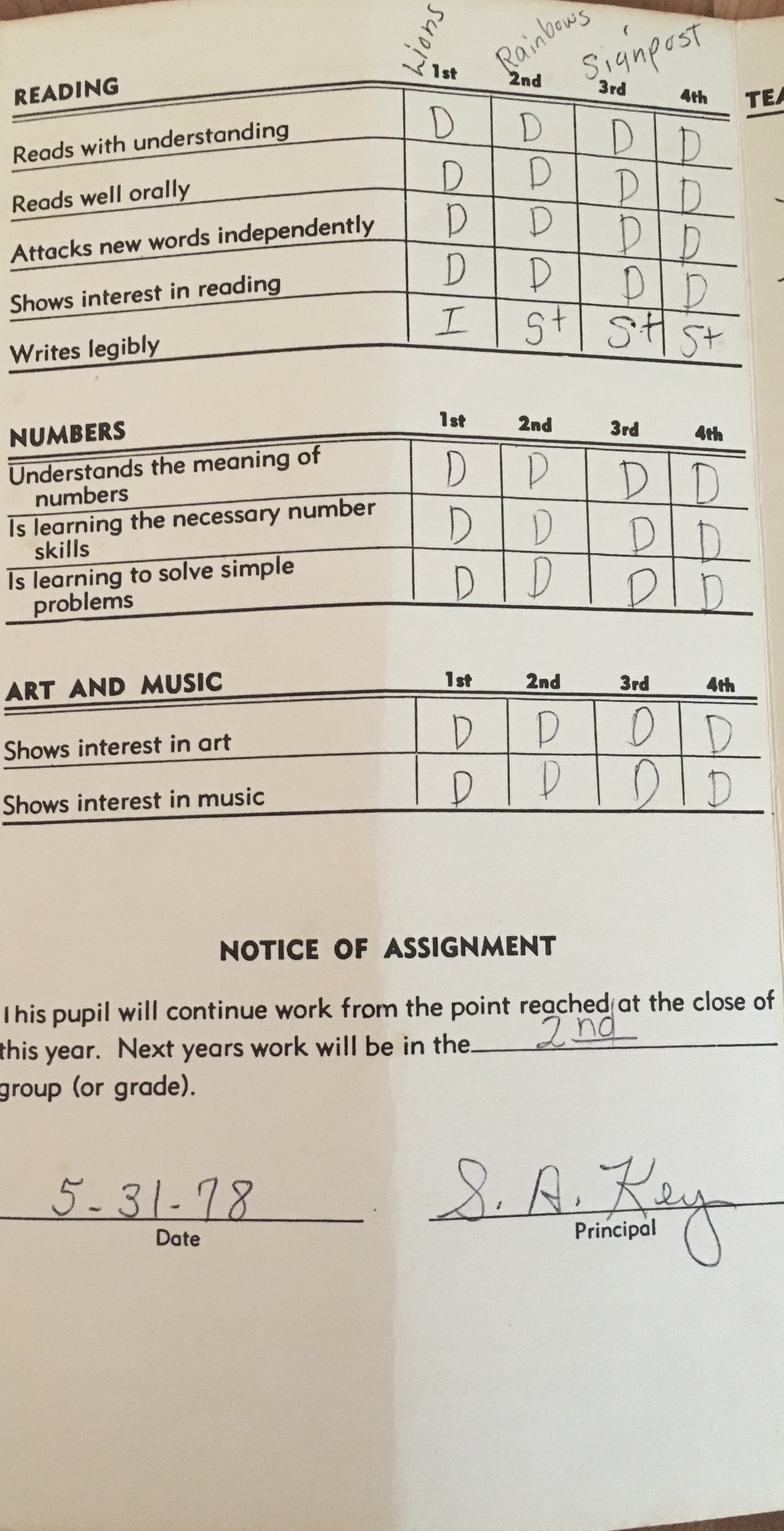

- Grades were not merely the results of tests and homework, as they became as I got older, but a more nuanced measure of success.

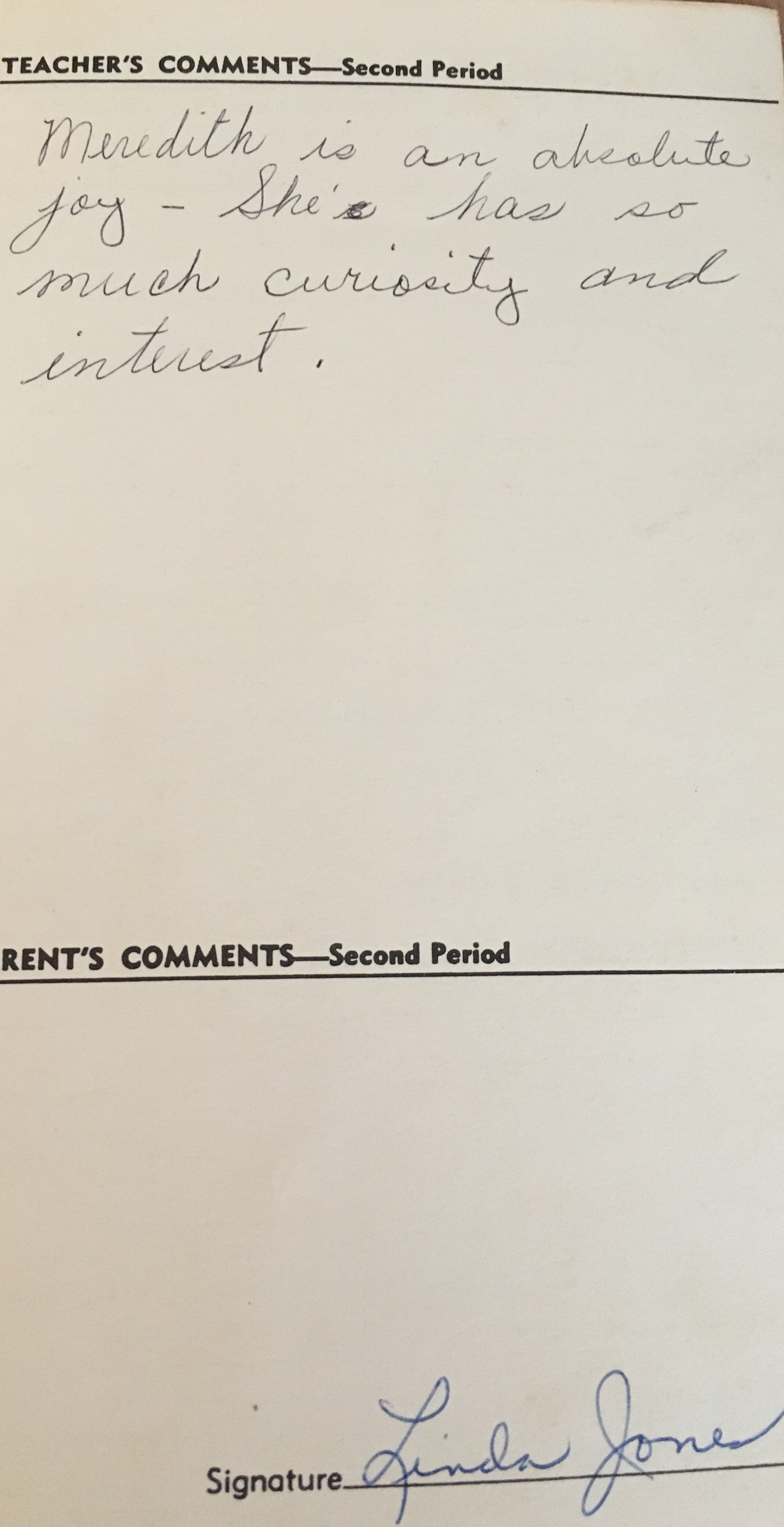

- My teacher (and the ones that followed) seemed to actually like me, with Mrs. Northem writing “Meredith is an absolute joy. She has so much curiosity and interest.”

Now, as one of my friends of course pointed out, the end of that sentence could have been left off. He contends that my teacher merely stopped writing before she added: “She has so much curiosity and interest…that I want to slap her.”

But still.

This little archeological gem made me start thinking about how we grade money managers. We all talk about their collective Grade Point Average (performance) but we tend to get stalled after that.

For example, consider the headlines that of late argue hedge fund managers have generated poor performance, particularly relative to their fees.

What does that mean, exactly?

Let’s assume that means that the average hedge fund has essentially a “C” GPA. If there are five funds (because the math is easy), what grades did each fund make?

- 3 A’s and 2 F’s

- 3 A’s and 2 D’s

- 4 B’s and 1 F

- 5 C’s

- 4 C’s and 1 D

For some reason, financial pundits seem to think the answer has to be either 4 or 5, when, in fact, every combination of the grades above would generate that C average.

While certainly Garrison Keillor can’t be right when he quips “all our children are above average,” it is important to remember that when we talk about average performance some funds, potentially a great many funds, will have performed above that average, while others will have performed below the average. It’s math, y’all.

But before we even get too tied up in our numeric underpants, let’s also consider that the “grades” we give our managers are not as simple as a single performance number.

Just like my reading “grade” was comprised of understanding, reading aloud, attacking new words, interest and writing, in which I earned “D”oes good work across the board (with the exception of writing…I’ve always had the handwriting of a serial killer), how we measure managers is, or should be, comprised of a number of different factors.

- Did the manager perform as expected? Not every manager or strategy will perform well in every market. If, however, the fund performed as we expected given the prevailing market and strategic considerations, that should be taken into consideration. For example, marking down a short seller for not generating eye-popping positive returns during a raging bull market is insanity and a push towards style drift.

- Is the manager taking the risk I expect him to take? If a fund manager starts taking increasing risk with your capital as they chase some illusive performance benchmark, that’s more cause for concern in my book than underperformance.

- Does the manager communicate effectively? Do you have sufficient transparency and frequent updates so you can evaluate how you feel about items 1 and 2?

- How does the manager’s performance fit into my overall portfolio? No fund is an island, but is instead part of an overall asset allocation plan. Managers and strategies should contribute when you expect them to (see above), but again, constant outperformance is more of a myth.

Perhaps because much of the media doesn’t get the full picture, or perhaps because, like me, they’re a bit removed from their old report cards, too many folks become entirely too fixated on manager GPA. Unfortunately, that leads those less familiar with investing to potentially make decisions based on this all-too-linear thinking as well, perhaps even ignoring investments that could have a positive impact on their overall portfolio because they are “bad.”

And that’s really the shame, here. Because if we look behind the manager “grades” we would see that many investors, two-thirds in fact, believe their hedge fund investments actually met or exceeded their expectations in 2015, according to Preqin data.

Which means that either more than half of our industry suffers from the “Lake Woebegone Effect” (all my managers are above average) or there is more to the story than simple average performance.

As someone who “D”id good work with numbers, even back in 1978, I’m betting it’s the latter.

Please note: My blog is now published on the first and third Tuesday of each month.