Do you give good monthly letter? Do investors and prospects read your periodic missives or do they end up screened into the junk mail folder? Read on for how to make your monthly commentary more effective (and more widely read)!

We've all been there.

Moving, shaking, getting stuff done at an industry event.

Hitting up investors for contact details and meetings. Meeting fund managers who can potentially add value to an investment portfolio. Looking for new business prospects among investors and managers.

And then it happens. Knowingly or not, we commit one of the Seven Deadly Sins of Conference Attendance.

Duh duh DUUUUHHHH!

There is perhaps no better way to curtail your most earnest conference efforts than to commit one of the following breaches of event etiquette:

The First Deadly Sin: Chasing Investors Like It's A Zombie Apocalypse

(c) Resident Evil

We all know the shark-to-seal ratio at most investment industry events isn't exactly even. As a result, the investors in the room tend to get a lot of attention. You can see them at cocktail parties, during coffee breaks, or just walking across a room with a trail of hungry investment managers and investor relations folks in their wake. Once, at a GAIM conference in Monaco, they gave out actual proximity detectors to participants. It was like watching the movie Aliens, with investors playing the role of Ripley.

I know every manager that spends money on a conference is hoping to get maximum time with investors, but please, slow your zombie roll. Don't mob investors, and try to keep your interactions to a bare minimum to keep the flow going. You're not going to sell anyone on your fund over a granola bar in a hotel hallway. Keep it simple. Your name. "I'd like to introduce you to my very interesting fund when you have a moment - can I get your card?" Move On. And if an investor is obviously trying to get somewhere (to the coffee, to the can, to a meeting) give them a little breathing room. They'll actually think better of you for it.

The Second Deadly Sin: Hiding From Managers

(c) Mean Girls

Probably as a result of the first deadly sin, some investors have taken to disappearing during networking opportunities (breaks, cocktails and lunches), in the hopes of grabbing a little peace and quiet and piece of mind. As tempting as this may be, it can be beneficial to resist the desire to escape the maddening crowd. I'm assuming that investors go to conferences to find great investing opportunities. Eating lunch in a bathroom stall (ok, your hotel room) probably isn't the best way to find them.

The Third Deadly Sin: Cutting In Line

(c) Family Guy

A panel of investors has just finished up. You really want to talk to one (or more) of the presenters. A line of eager fund managers and conference participants has formed as the panel exits the podium. You wait patiently while they smile, shake hands and give cards to those in front of you. Then, out of nowhere, someone comes up, jumps the line and starts chatting up the investor. Worse yet, the next session starts and everyone has to move to retake their seats, leaving dreams of making contact with those investors unfulfilled. NOOOOOOO! So you. Yes you line-jumping fund manager (or marketer). Don't. The investor knows you did it (even if they can't always stop you). The managers who were patiently waiting know you did it (and are silently fuming). And you just look kind of like a tool. Just say no to line jumping.

The Fourth Deadly Sin: The Nameless Text

(c) Tropic Thunder

You managed to score an investor's card at a cocktail party, lunch or during a break. "What the hell," you think. "I'll send them a text to see if they have time to meet for breakfast or coffee in the morning." So you send a text: "Great meeting you last night. Grab a bite tomorrow am?" The only problem? The investor has NO FREAKING IDEA who you are. For all they know, this message could be a misdial from someone else's beer-goggled evening.

It's never a great idea to text investors anyway, unless you have an imminent meeting or they've given you express permission, but texting without identifying yourself and assuming that the investor will remember you out of throngs of fund managers is just silly. Include your name and the fund name. Or better yet, send an email.

The Fifth Deadly Sin: The Drive By

(c) The Dukes of Hazzard

Similar to the hiding from managers, the drive by occurs when investors, usually those scheduled to speak, attend an event only for their session. Fund managers, lured to pay event fees in part by the hugely cool and monied speaking faculty, get gypped out of their hard-earned dollars and investors get cheated out of finding good investment ideas for their portfolio. A true lose-lose.

The Sixth Deadly Sin: The Close Talker/Cornering Folks

(c) Seinfeld

Conferences are crowded. Conferences are loud. Investors are scarce. One-on-one time is at a premium. That's still no excuse from getting all up in someone's personal space. I have literally been backed into a corner at an event before and, let me tell you, I was not amused. I also once attended a conference after just getting Invisalign. I wasn't entirely used to the Invisalign trays yet, and had just hurriedly scarfed a mint when I was corralled by a fund marketer. Before I knew it, the mint flew out of my mouth and landed on the marketer's arm. I tried to be cool - I picked the mint off of him, said "um, I think this may be mine," and slunk off. But seriously, if you're so close that an Arthur Bell promotional mini-mint with lisp velocity and zero aerodynamics can hit you with enough force to stick to your skin, you are too damn close. An arm's length for distance is a good rule of thumb here.

The Seventh Deadly Sin: No Business Cards

(c) American Psycho

This one can be a bit tricky as both investors and fund managers are at times guilty. Generally speaking, investors eschew business cards to avoid a post-conference email zombie apocalypse, while fund managers and marketers either don't bring them to (Machiavellian interpretation) force investors into giving their cards up, or because (poor planning interpretation) they underestimate how many cards they will need.

Dear All: Conferences are networking events at heart. Bring cards and enough of them. That is all.

So there you have it.

Before you hit up your next Hedge Fund, Private Equity, Venture Capital, Institutional Investor or other industry event, make sure you are up-to-date on conference etiquette, or risk being judged in attendee purgatory.

Music is an important part of my daily life. Whether I’m ignoring other passengers on a plane whilst rocking out under my favorite Beats by Dr. Dre headphones, dancing out a bad day in my kitchen, or scaring little kids at the ice skating rink with my early morning musical selections, the music I listen to is a great indicator of my mood and a reasonable barometer for my life at any given time.

In fact, many of my regular readers have noted that there is almost always a song lyric hidden somewhere in my blog postings, and I have even occasionally been challenged to work in specific lyrics - a challenge that is almost always accepted, by the way.

It’s perhaps no surprise then that as I was winging home from yet another conference on Friday afternoon, I began to think about my various fund manager and investor conversations over the prior two days and decided that maybe what the investment industry really needs is a playlist.

That’s right, we all need a break from chasing capital, being chased for capital, due diligence, the low return environment, watch lists and pitch books, so why not get down and get funky?

So without further ado, here are reasonably comprehensive musical stylings for nearly every fund manager and investor mood. The song list and use cases are below, and I’ve even created a Spotifly playlist for those of you who want to break out your best Carlton Banks dance moves.

“Money” - The Flying Lizards – For both investors and fund managers, because isn’t that what this business is all about?

“I Need A Dollar” – Aloe Blacc – For pre-launch fund managers in search of their initial funds.

“Please, Please, Please, Let Me Get What I Want” – The Jealous Girlfriends – For any fund manager about to go into yet another meeting after a string of ‘maybe in 6 months, in 1 year, when you get to XX dollars.’

“Uprising” – Muse – Been blocked out of an opportunity by a gatekeeper or a bigger fund? This song will build your motivation to overcome them and succeed.

“Price Tag” – Jessie J – Been blocked out of an opportunity by a gatekeeper or a bigger fund? This song may help you keep that loss in perspective and your blood pressure in check.

“Patience” – Guns-N-Roses – Investors should have this playing in the background as fund managers wait in the conference room…

“How Soon Is Now” – The Smiths – …while fund managers who are on their third, fourth or fifth meeting in months hum this under their breath.

“What Have You Done For Me Lately” – Sharon Jones & The Dap Kings – Question that should be asked by every investor to their long-time funds.

“Shake It Off” – Us The Duo – Get a bad due diligence rating from a consultant? Fix the problems and shake it off.

“Every Breath You Take” – The Police – How every investor I know feels at the end of a conference.

“Just Got Paid” - *NSYNC – You got an allocation! Woot!

“Mo Money, Mo Problems” - The Notorious B.I.G. – Sure it’s great to gather more assets under management, but as you do, you’ll have to spend more time thinking about your business, operations, compliance, staffing, etc. And it may be harder to generate returns. Being bigger isn’t always glamorous. (Explicit Lyrics)

“Money For Nothing” – Dire Straights – What anyone outside of the investment industry probably thinks about your job.

“Billionaire” - Travie McCoy & Bruno Mars – The morning prayer of every emerging fund manager. (Explicit Lyrics)

“Did I Shave My Legs For This” – Deena Carter - For any investor who’s walked out of a meeting with a fund manager that was ridiculously off the mark based on size, performance, fund age, experience, drawdowns, strategy, etc. That was an hour of your life you’ll never get back.

“Fighter” – Christina Aguilera – When an investment you thought was great, isn’t.

“I’m Still Standing” – Elton John – When you are coming back from a drawdown.

“Everybody Knows” – Concrete Blonde – When you’ve been trying to gather assets for months and keep seeing bigger funds get bigger, even if your performance is better. This one may require a stiff drink.

“Somebody’s Watchin’ Me” – Rockwell – Oh the joy of being on an investor’s or consultant’s watch list.

“Extraordinary” – Liz Phair – You know that if investors ever got to know you, they’d want to give you money!

“Holding Out For A Hero” – Bonnie Tyler – Investors see hundreds of funds a year – this should be playing as they walk down the hall into yet another meeting.

“We Are The Champions” – Queen – When you get your first institutional allocation.

"Don't You Want Me" - Human League - When an investor or gatekeeper won't take your calls or schedule a meeting with you. ('You know I can't believe it when I hear that you won't see me...')

“Have You Met Miss Jones” – Tony Bennett – When you read my blog postings.

Got suggestions for songs I didn’t include? Sound off in the comments below. And happy listening!

I love this time of year. The airport delays. The wonky weather. The smell of burning dust in the heating vents. Snow panic that empties grocery store shelves of white bread and whole milk, even if the temperature is stubbornly in the 40s.

Oh, and the look of shiny hope on the faces of fund managers everywhere.

Ahhhh.....

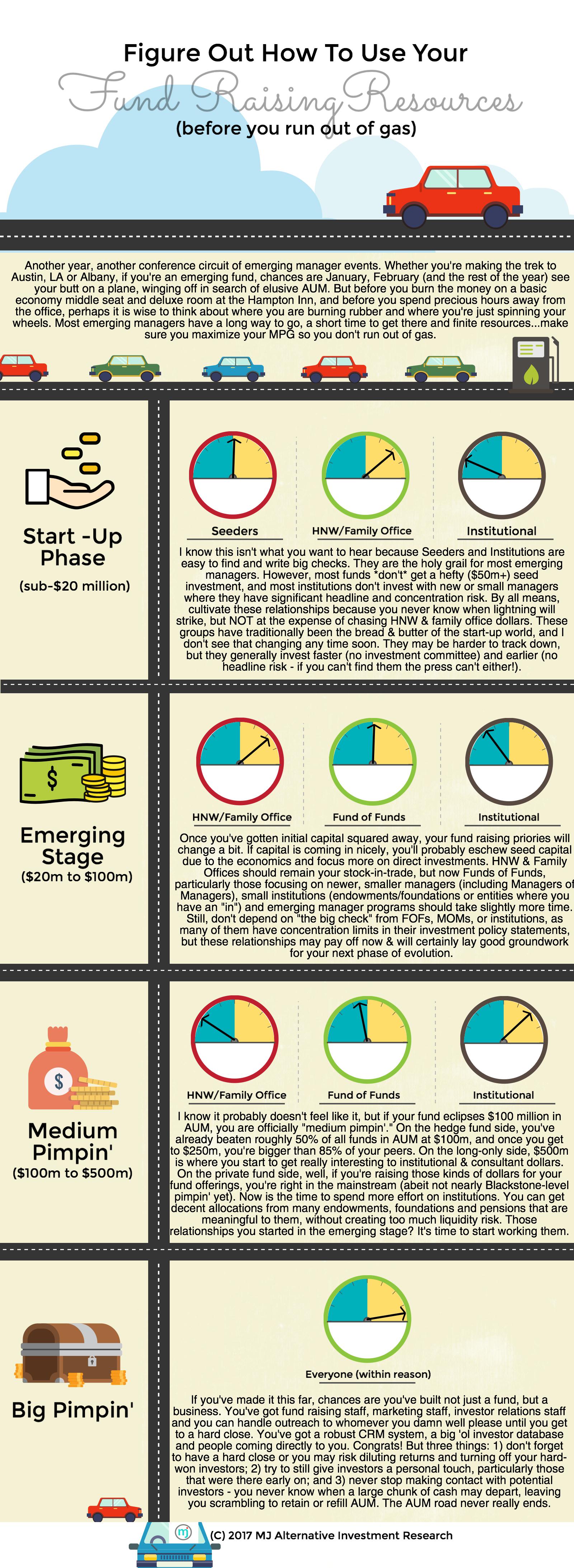

But before conference season road trips get too far underway, it's probably a good idea to think about where managers are spending their (finite) fund raising resources and where they could ease up on the gas.

(c) MJ Alts

As we commence another year of the great capital raising dance, I thought it would be fun to channel all of the back and forth, yes and no, hide and seek frustration into a little game. One that harkens back to a happier and simpler time, and one that anyone who has ever been under 12 or over 60 is familiar with.

So yes, ladies and gentlemen, this year we're gonna play a little Capital Raising BINGO. Simply print out the appropriate investor or fund manager card below and mark off (and date) each time you get a designated response.

The first investor who gets a BINGO can draft me as a single-use meat shield at an event.

The first fund manager who gets a BINGO will also get a prize, custom tailored to the fund in question.

Happy capital hunting! And may the BINGO odds be ever in your favor!

(c) 2017 MJ Alts

(C) 2017 MJ Alts

When I was a young lass in Nineteen Never Mind, I used to spend Christmas Day with my mom and the week after Christmas with my dad. He would come for my sister and me in Tuscaloosa, Alabama and drive us all the way to Ft. Worth, Texas for another week of holiday overeating and unwrapping.

It was about a 12-hour drive, door to door, but we tried to make the best of it. My sister, stepbrother and I would clamber into the “way back” with a cooler full of Cokes,bags brimming with healthy snacks like Pop Rocks, potato chips and Slim Jim’s, nestled securely next to my Dad’s Coors that he snuck over state lines, Smokey & the Bandit-style. There, we’ll loll about (with no seatbelts), stuffing our faces (not dying from the Pop Rock/Coke combo) and alternate singing, sleeping and snarking at one another for the entirety of the 12-hour trip.

At some point, we would inevitably get on my Dad’s nerves. There would be over-the-seat, disjointed swats, strong language and finally a threat to “TURN THIS DAMN CAR AROUND AND TAKE EVERYONE HOME.”

We kids thought that was super funny.

What wasn’t hilarious, however, was 2016 - an epically craptastic annum bad in so many ways that it even made Mariah Carey’s New Year’s Rockin’ Eve performance look apropos.

So, while 2017 is still barely warm, I thought I’d give it a little, tiny warning.

If y’all pull the same stunts this year that you did last year, I’ll turn this year around and take us all home. At the very least, I’ll figure out how to off everyone using nothing but Pop Rocks and warm Coors. You get me?

What am I talking about specifically? Well, here are some of my key investment industry pet peeves from 2016:

Looking in the same tired places for returns, and then pretending shock when they don’t measure up – Investors from Kentucky to New York and a few states in-between reduced or redeemed their hedge fund portfolios in 2016, based in large part on lackluster “average” returns. While many point to “average returns” in the neighborhood of just under 5% though November, perhaps it’s best to look at how the best (and worst) performers are faring. Articles have shown top performing hedge funds gained 20% or more through November 2016. And over the four quarters ending 3Q2016, top HFRI decile funds gained 29.54%. The bottom decile funds lost 15.57%. So there are funds that have performed strongly over the last 12 months IF an investor was willing to look for them and perhaps take risks on lesser known, newer, nicher or funds otherwise “off the beaten path.” It kind of reminds me of the old joke “Doctor, doctor, it hurts when I do this…” How ‘bout in 2017, we stop doing that, lest it continue to hurt.

Using “averages” to talk about investment funds, particularly alternative investment funds – Speaking of, with the kind of return dispersion above, why don’t we stop talking about “average returns” full stop. Even when it comes to white-bread mutual funds, getting fixated on “average” returns doesn’t really help. How do I know? One of the top, non-indexed US mutual funds returned 30% in 2016. Yeah, I said 30-freakin’-percent, more than twice the return of the S&P 500. But by fixating on “average return,” no matter what the asset class, investors may in danger of writing off entire investment strategies based on normalized returns that don’t accurately represent reality. In 2017, let’s focus more on the opportunities unveiled by return dispersion and less on pesky averages, shall we? Oh, and the same thing goes for fees discussions, too.

Saying you want to hire diverse talent, but complaining that you “just can’t find any” – So I’ve heard (or read about) more than one asset management firm complain about how they’d “love to hire women and minorities” but they “just can’t find qualified applicants”, and they’re not willing to lower their standards. Come. On.

Women comprise 50.8% of the U.S. population according to the Census Bureau. Minorities make up nearly 23% of the U.S. population. Do some simple math on the number of women and minorities in a population of 323,127,513 and it boggles the mind that there are ZERO qualified diverse applicants.

Indeed, when I read or hear this, one of a few questions generally comes to mind:

- How homogenized is this person’s personal network and how might that impact other investment research and decisions?

- How much effort does this person put into finding diverse candidates? Do they contact recruiters who specialize in the area? Do they go to conferences put on by 100 Women in Hedge Funds, NASP, the NAIC, and others?

- If there is a pipeline problem in this person’s line of work and they genuinely want to fix it, what are THEY doing to fix this issue in the long-term? Do they bring in diverse interns? Diverse entry-level positions? Do they promote these individuals?

Inappropriate benchmarks – Why, oh why, do we benchmark every damn thing to the S&P 500? It’s become so pervasive that I just caught myself doing it above (the top performing mutual fund invests in small caps, not S&P-level stocks) and I know better. Just because it’s well known, and just because it’s been crammed down our throats by everyone from consultants to financial advisors, doesn’t mean it always fits. Small cap fund? Ixnay on the S&P-ay. Hedge funds? Can’t be expected to outperform in bull markets because they are HEDGED. Private equity & venture capital – comparing illiquid investments to a liquid benchmark seems a bit silly, no? So in 2017, let’s either agree to benchmark appropriately so we can make a sober decision about whether an investment has performed well (or not) OR let’s just decide to sell everything and invest only in the S&P 500, since it’s where it’s at, obviously.

Communicating inappropriately – This may be just a “me” thing, but in 2016 I noted an increasing number of asset managers who text investors. What. The. Actual. Hell. Texting is informal. Texting is immediate and insinuates you deserve an instant response. Texting invites typos. Texting doesn’t allow for compliance review or disclaimers. Unless you are meeting someone that day and need to say you’ll be late, early, or identifiable by the rose in your lapel, or unless that investor has given you express permission to text, don’t. The investors I know who put their mobile numbers on their cards are coming to regret it. And if you lose that, you’ll only spend more time waiting on callbacks.

So cheers, all, to a happy, healthy, prosperous, properly benchmarked 2017. May we lose fewer of my 80s idols and more of our investing bad habits.

Sources:

http://www.valuewalk.com/2016/12/new-hedge-fund-launches-fall-total-capital-increases-record/

https://www.census.gov/quickfacts/table/PST045216/00

Photo credit:

Copyright: <a href='http://www.123rf.com/profile_artzzz'>artzzz / 123RF Stock Photo</a>

Me and my Granny, Christmas morning circa 1973/1974-ish

Well, 2016 has been one helluva year. Between the celebrity deaths (Bowie, Rickman, Prince in particular), fake news, election chaos, Zika, creepy clowns, Aleppo, and a host of other miserable events, I know I won’t look back on 2016 with anything remotely regarding fondness. In fact, I may pretend this year didn’t even happen, therefore reducing any future therapy bills and bolstering lies about my real age.

But alas, as much as I wish I could be Queen of de-Nile, I’m afraid 2016 did happen, and I have the blogs to prove it.

So if you need a good year-end chuckle to survive the holidays, the Electoral College vote, or your boozy office fete, or if you’re just craving random info and snarky rants about the investment industry, I’ve got just what the doctor ordered.

Here’s a complete wrap up of all my blog postings, by topic, for 2016. Enjoy them while you rock around the Christmas tree, drink your Gin and Tonica, or however you plan to celebrate the season.

See y’all next year!

Hedge Funds (Don’t) Suck

http://www.aboutmjones.com/mjblog/2016/11/1/killer-kittens-the-decline-of-hedge-fund-returns (Why you’re more likely to be injured by your toilet than get busted by the SEC)

http://www.aboutmjones.com/mjblog/2016/9/6/you-cant-handle-this-hedge-fund-truth (Perception versus reality in the world of hedge funds, told with pictures)

http://www.aboutmjones.com/mjblog/2016/5/17/hedge-fund-truth-dont-believe-everything-you-read (Animated blog about hedge fund fees, returns and the so-called talent shortage)

http://www.aboutmjones.com/mjblog/2016/2/29/the-hedge-fund-headline-predictorator (Using hedge fund headlines (13-Fs, Rich List, etc.) to tell time and seasons)

http://www.aboutmjones.com/mjblog/2016/2/22/person-or-people (Why we tar the investment industry with a big brush, and how that can hurt performance in the long run)

http://www.aboutmjones.com/mjblog/2016/9/20/can-this-hedge-fund-relationship-be-saved (The hedge funds people fell in love with 2000 to 2002…well, they’ve changed…)

Behavioral Finance

http://www.aboutmjones.com/mjblog/2016/8/16/thank-god-what-you-see-isnt-all-there-is (The bias of “what you see is all there is” and why that makes us think returns are lower than they are)

http://www.aboutmjones.com/mjblog/2016/7/19/great-expectations (Matching investor expectations to reality. Matching money manager expectations to reality)

http://www.aboutmjones.com/mjblog/2016/8/2/a-picture-is-almost-worth-1000-words (Truly terrible drawings that illustrate the “streetlight effect” and how we end up looking in the wrong place for strong performance)

Diversity And Investing

http://www.aboutmjones.com/mjblog/2016/11/15/lenny-bruce-is-not-afraid (A post election blog that covers the importance of diversity, ESG, thinking before you talk to investors and a long-term investment strategy)

http://www.aboutmjones.com/mjblog/2016/7/5/and-now-for-something-completely-different (How cognitive, behavioral, structural and network diversity can benefit investors in hedge funds, private equity and venture capital)

http://www.aboutmjones.com/mjblog/2016/6/7/the-five-ps-of-gender-parity (Solutions for getting more women into the investment industry)

http://www.aboutmjones.com/mjblog/2016/1/25/no-quick-fix (The many unconscious biases men AND women have to overcome to achieve gender parity in investing)

http://www.aboutmjones.com/mjblog/2016/1/4/nostradamnus (Why the low return environment heading into 2016 may require some creativity on the part of investors re: active management, diversity, and emerging managers)

Emerging Managers and/or Capital Raising

http://www.aboutmjones.com/mjblog/2016/12/6/the-five-stages-of-emerging-manager-grief (Denial, anger, bargaining, depression and acceptance all figure into your capital raising experience)

http://www.aboutmjones.com/mjblog/2016/10/4/seed-me-seymour (The truth and consequences of seed capital)

http://www.aboutmjones.com/mjblog/2016/7/5/and-now-for-something-completely-different (How cognitive, behavioral, structural and network diversity can benefit investors in hedge funds, private equity and venture capital)

http://www.aboutmjones.com/mjblog/2016/6/21/capital-raising-crimes-punishment (Don’t be guilty of these capital raising crimes or pay the price of low AUM).

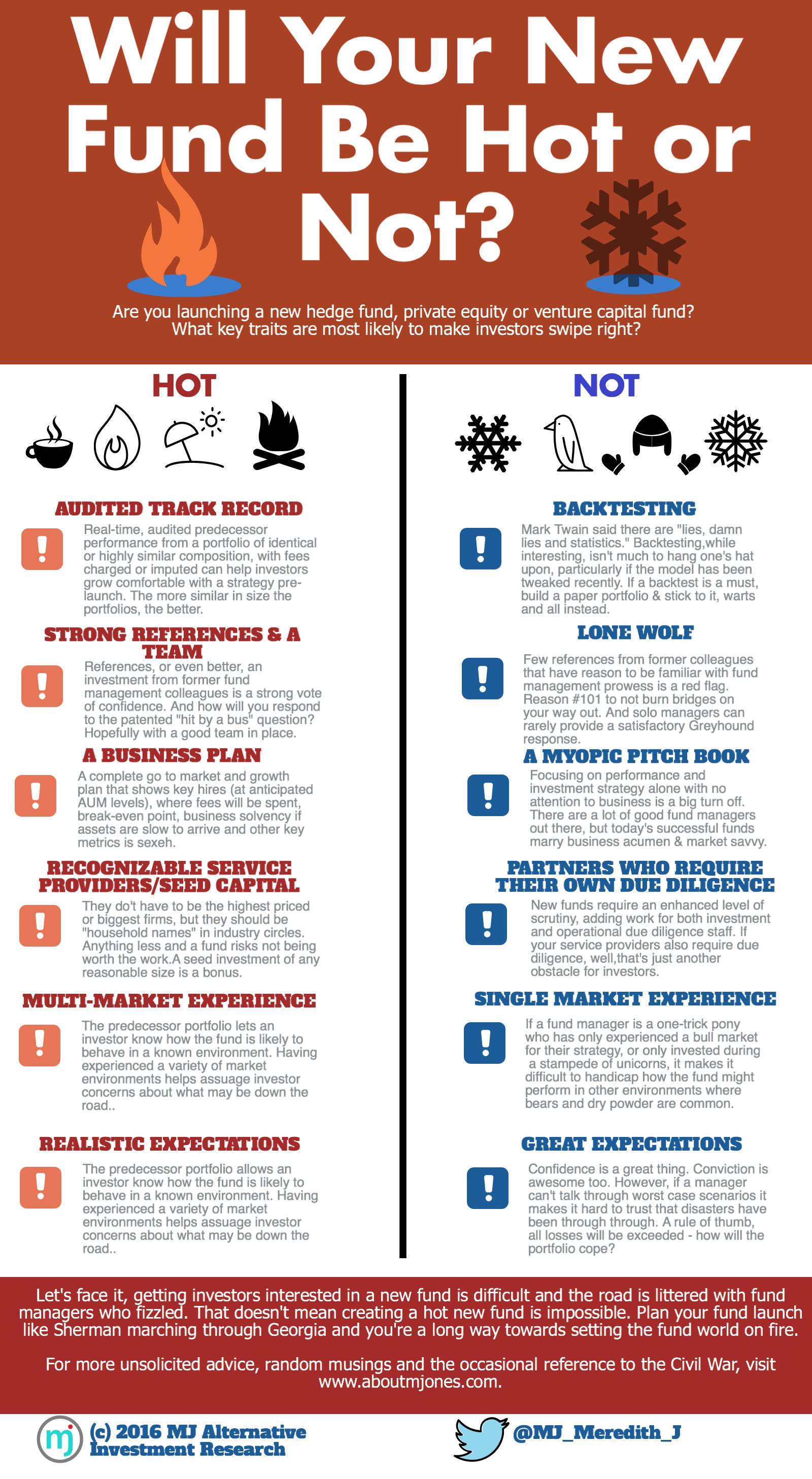

http://www.aboutmjones.com/mjblog/2016/4/5/are-you-hot-or-not (Evaluating a new fund launch – what makes some sizzle and others fizzle?)

http://www.aboutmjones.com/mjblog/2016/2/14/at-your-service (Choosing your service providers)

http://www.aboutmjones.com/mjblog/2016/1/31/making-the-first-move (How to make and keep contact with investors without making them hate you)

http://www.aboutmjones.com/mjblog/2016/1/4/nostradamnus (Why the low return environment heading into 2016 may require some creativity on the part of investors re: active management, diversity, and emerging managers)

Random Musings

http://www.aboutmjones.com/mjblog/2016/11/15/lenny-bruce-is-not-afraid (A post election blog that covers the importance of diversity, ESG, thinking before you talk to investors and a long-term investment strategy)

http://www.aboutmjones.com/mjblog/2016/1/18/money-manager-advice-dont-panic-but-do-bring-a-towel (What 2016 may bring - fee pressure, market volatility, few changes to the regulatory regime until after the election)

http://www.aboutmjones.com/mjblog/2016/5/3/kicking-the-buckets (Do strategy and style buckets help or hurt us? Getting past a checkbox mentality)

http://www.aboutmjones.com/mjblog/2016/4/18/you-are-so-money (Money manager horoscopes - don’t ask!)

http://www.aboutmjones.com/mjblog/2016/3/14/money-manager-report (How to effectively evaluate money manager performance without getting caught up in your benchmark underpants.

http://www.aboutmjones.com/mjblog/2016/10/18/sleepless-in-nashville (The things about the investment industry - hedge funds, private equity, venture capital, real estate, investment advisors, etc. - that keep me up at night)

http://www.aboutmjones.com/mjblog/2016/1/4/nostradamnus (Why the low return environment heading into 2016 may require some creativity on the part of investors re: active management, diversity, and emerging managers)

ESG/Socially Responsible Investing

http://www.aboutmjones.com/mjblog/2016/11/15/lenny-bruce-is-not-afraid (A post election blog that covers the importance of diversity, ESG, thinking before you talk to investors and a long-term investment strategy)

http://www.aboutmjones.com/mjblog/2016/2/7/ucee2gr6omdig0e5vtpsbx8qra738m (Predicting more interest in socially responsible/ESG investing, different pathways to fund management jobs, and a break from paper and PDFs)

Even if the songs tell us it's the most wonderful time of the year, when bells will be ringing and children are singing, for many emerging fund managers, the holidays may simply be the end of another difficult year of fundraising. To help you navigate any holiday season depression and just maybe put things in perspective a bit, I've put together a guide to managing the 5 Stages of Emerging Manager Grief. I hope it (combined with a lovely hot buttered rum) eases you through the holiday season.

(C) 2016 MJ Alts

November has been, at least thus far, a month of surprises.

You know that curse on the Chicago Cubs? Surprise! They won the World Series.

Didn’t I just see a Facebook post on a local norovirus (aka the stomach flu) outbreak? Surprise! I temporarily had to rename myself Vomitola Khomeni – and finally found that button I ate when I was three…

Hey! Do you remember all those polls that showed Democrat Hillary Clinton easily winning the White House? Surprise! Donald Trump is the 45th President of the United States.

Oh, and of course you recall all the dire predictions for the stock market should Donald Trump win the presidency? Surprise! The Dow Jones Industrial Average was trading in record-making territory a mere two days later.

To be honest, while I did spend much of the first part of the week “enjoying” my virus-induced weight loss opportunity, I also, if somewhat dimly and feverishly, realized that collectively we have done a terrible job of predicting recent events.

I know many in the financial industry had to have been stunned and dismayed by the election results. According to an October 26, 2016 article in Fortune, Trump raised $239,250 from hedge fund and private equity firms, while Hillary Clinton raised $45.2 million from the same groups. Charles River Ventures, a Silicon Valley venture capital firm even went so far as to entitle a blog posting “F*CK TRUMP.” Even though Republicans in other races enjoyed healthy and widespread financial industry support, it just wasn’t there for Trump.

As a result, for many people, last Wednesday morning must have seemed like the end of the world (as we know it). And while I didn’t notice any birds, there were even “snakes and aeroplanes” for any still doubting the seriousness of the situation. (https://www.theguardian.com/environment/2016/nov/08/snake-on-a-plane-passengers-flight-mexico-city)

So where do we go from here? How does the investment industry successfully navigate the new normal and survive and thrive in a new world order? Here are a few thoughts I had that may help investors and managers both do good while they do well.

One: Don’t Say Or Write Anything That Endangers Your Current AUM

This was a contentious election. Combative. Testy. Belligerent. Factious. Antagonistic. Insert every single synonym for “unpleasant and argumentative” you can come up with here, because no matter how you slice it, the 2016 political campaign was a dumpster fire, starting with the Republican and Democratic primaries and continuing through the general election. It. Was. Not. Pretty.

As a result, there are a lot of very strong post-election feelings on both sides of the aisle.

And as we extend our personas over Facebook, Twitter, Blogs, Instagram and other platforms, there has simultaneously been a reduction of social restrictions and inhibitions known as the “Online Disinhibition Effect.” It makes us more likely to say, write or post things that we likely wouldn’t have before.

When you combine those things – deep disappointment, hurt feelings and increased disinhibition – you end up with an improved likelihood of offending someone, inadvertently or otherwise. And when you seriously offend a client or prospect in this industry, your AUM suffers.

So lock down your Facebook account if you post politically on it. Don’t assume you know what someone’s views may be unless they’ve actually told you what their views are. In fact, to the extent that politics and social issues don’t impact your investment strategy or portfolio, don’t talk about them in professional settings. At all. Better safe than sorry because it’s easier to keep a client/investor than to acquire a new one.

Don’t believe me on this one? Ask Matt Maloney, who’s firm, GrubHub, suffered share price losses of 9.4% in the two days after the election over a leaked internal communiqué. Shut. It.

Two: Consider Diversity In Hiring and Investing

This election cycle has been, at least in part, about disenfranchisement. Trump likely won the election due to the disenfranchisement of the white, working class rural voter, while those who fear pending disenfranchisement (minorities, women, immigrants, LBGTQ) have fueled protests post-election.

The good news for investors and money managers is that inclusion will ease disenfranchisement, and it can also make everyone richer, too. Here’s how:

- Deszo & Ross studied the effect of gender diversity in the S&P 1500 and found that “female representation in top management leads to an increase of $42 million in firm value.”

- Orlando Richard found in his study that for “innovation-focused banks, increases in racial diversity were clearly related to enhanced financial performance.”

- Catalyst found that Fortune 500 companies with the highest representation of women board directors had significantly higher financial performance than those that don’t.

- Morningstar found that mixed-gender mutual fund teams outperformed single gender teams.

- The HFRI Diversity Index (+4.21%) has outperformed both the HFRI Fund Weighted (+3.59%) and HFRI Asset Weighted (1.31%) indices for the year to date through October.

- In a paper by Stanford professor Margaret Neale, diversity and intellectual conflict proved good for organizations. “When…newcomers were socially similar to the team, old team members reported the highest level of subjective satisfaction with the group’s productivity. However, when objective standards were measured, they performed the worst on a group problem-solving task. When newcomers were different, the reverse was true. Old members thought the team performed badly, but in fact it accomplished its task much better than the homogenous group.”

- Diversity includes “Functional Diversity” or “the extent to which individuals frame problems and go about solving them.” As a result, age, background and life experience should also be considered aspects of the diversity equation.

Certainly, in a rapidly changing world, having better problem solving skills and potentially better returns has to be a good thing, right? So cast a wide net when hiring staff or money managers going forward to maximize your cognitive alpha.

Three: It’s Still A Great Time To Focus On ESG Factors

So, early reports have the newly-elected administration throwing out both the Environmental Protection Agency and the CFPB, as well as doing away with Dodd-Frank, among other regulatory changes. While it’s too early to know whether and when that can or will happen, there are a few things we do know:

- 49% of high net worth (HNW) millennials (yes, they exist!) say that social responsibility is a consideration in investing. 53% of all millennials agreed. 43% of HNW GenX also consider social responsibility in investing. Due to demographic shifts in the workplace (these groups of workers are now larger than Boomers) and the looming generational wealth transfer, it probably makes sense to develop products that cater to these interests sooner rather than later.

- Bauer, Frijins, Otten and Tourani-Rad found “well-governed firms significantly outperform poorly governed firms by up to 15% a year” in their paper “The impact of corporate governance on corporate performance: Evidence from Japan.”

- A Wharton paper from 2012 shows a “positive association between corporate governance and performance…and evidence that higher corporate governance leads to an increase in cash dividends.”

- Exxon spent $2.1 billion cleaning up the spill from the Exxon Valdez, which, while recoverable, ain’t great for a company’s bottom line.

- Wells Fargo’s recent governance gaffe could cost the company up to $4 billion in revenue.

- GrubHub’s “hostile workplace” internal email has led to a boycott and a drop in share price.

It seems reasonable that ignoring ESG factors can cost you both potential returns and clients, and possibly increase portfolio risks. And even if there aren’t dedicated regulations or government bodies watchdogging, it also seems reasonable to assume that many investors (and the markets) WILL still care.

Four: Don’t Make Any Sudden Investment Moves

The Sunday before the election, I had a sudden Han Solo moment (“I’ve got a bad feeling about this…”) and decided that I needed to think about buying an inverse S&P ETF. I gave myself 24 hours to ponder and ultimately decided to stay my current course and not change anything in my investment portfolio. Lucky me, right? That single choice would have cost me. Bigly.

Humans want certainty. In a study published in Nature Communications, knowing there is a small chance of getting an electrical shock causes more stress than knowing you’ll be shocked.

Shocking!

But seriously, when you’re feeling uncertain about your investment strategy, take a moment. Take a walk. Take a breath. Take a sip. Take whatever step back you need before making any sudden investment decisions. Whether you’re an investor or a money manager or just a Star Wars fan with a retirement account, it’s important to remember that we generally invest for the long-term. Don’t risk your long-term goals chasing short-term “certainty.”

As for me, I’m taking my own advice. Right after I get back to my 80s roots, dig out my mismatched Converse high-tops from the very back of the closet, and have a 3-minute R.E.M.-party to dance it out. I invite you all to do the same.

Sources: http://fortune.com/2016/10/26/trump-hillary-clinton-hedge-fund-campaign-finance/

http://seekingalpha.com/news/3223875-grubhub-minus-5_8-percent-following-ceos-anti-trump-commentary

https://www.scientificamerican.com/article/how-diversity-makes-us-smarter/

http://corporate.morningstar.com/US/documents/ResearchPapers/Fund-Managers-by-Gender.pdf

https://www.hedgefundresearch.com/family-indices/hfri#

https://www.gsb.stanford.edu/insights/diverse-backgrounds-personalities-can-strengthen-groups

http://fic.wharton.upenn.edu/fic/papers/12/12-14.pdf

http://www.evostc.state.ak.us/%3FFA=facts.QA

https://www.ucl.ac.uk/news/news-articles/0316/290316-uncertainty-stress

Every time I turn around, I find a manager looking for seed capital. Many are frustrated with what I like to call "second dollar syndrome" - the fact that everyone seems happy to be the second dollar in your fund, but few want to commit the first dollar - and dream of a seed investment as a way out of the fund raising drudgery.

If you're on the early-stage capital trail, it can be helpful to understand the nuance of seeding and acceleration capital so you know better when to hold 'em and when to fold 'em, know who's 'bout to walk away and who's there to fund. So here are a few pointers that apply to seed and accelerator capital (even if it just says seed in some spots for brevity's sake) that I hope lead you to your own vat of miracle grow.

(c) 2016 MJ Alts

This week, I decided to spare everyone my usual delivery of salty commentary on the investment arena and instead, use two pictures to say my 1,000 words.

So here's this week's blog in cartoon format. Of course, as badly as I draw and with the economic outlook uncertain, these may actually only be worth 500 (or even 5) words. But hopefully you'll get my general drift that:

- Asset managers can limit themselves by pursuing the biggest, splashiest and easiest to find investors, and

- Investors can limit themselves by not casting a wide enough net when looking for investments.

Oh, and apologies to Raiders of the Lost Ark...although maybe this attempt at spoofing humor will inspire you to watch it again.

(c) 2016 MJ Alts

(c) 2016 MJ Alts

For the last several weeks, I've been watching what I eat. After months of travel and often substituting the contents of my minibar for dinner, I had grown concerned that my bloodstream was permanently clogged with Pringle fragments. So I bought some actual fruits and vegetables (goodbye, scurvy!) and sat down to eat something that didn’t start its life behind a Chipotle counter.

Now, me being me, of course I did my research first, only to discover that I seem to have cognitive dissonance when it comes to portion sizes. I expected that a portion of beef is the literal half-cow that I receive on a plate at Del Frisco’s, when instead it is 3 ounces, smaller than a deck of cards. What. The. Actual. Hell? I felt gypped. I felt bitter. I felt hungry, no make that HANGRY.

But a week later, after sticking to my original plan, I realized I felt full, energetic and, well, maybe even kind of skinny. Maybe the problem wasn't with the reality of eating, but with my perception of what it should be. Hmmmm.

And then I started thinking about investing, and how investors and fund managers seem to be facing similar issues. No, I don’t mean that those pants make y’alls butts look fat. I mean that there seems to be some serious mismatches between what fund managers and investors expect from one another, almost guaranteeing that one (or both sides) will end up disappointed.

So in the spirit of the newly converted (quick, ask me how many calories a banana has!), here are a few ways that investment industry participants can better get along.

Investor Expectation #1: My fund managers should never lose money.

Reality: I’ve said it before and I’ll say it again – Continuous outperformance is a myth. No fund manager walks on water, is always right at the right time, or is even always right. No money manager can control for the unknown unknowns, and occasionally even the known unknowns can bite them in the tushie. The key is not to look for managers who never experience a drawdown (um, let’s remember money manager Bernie Madoff only posted one loss in his career) but for fund managers who can mitigate, manage and learn from losses, as well as be candid and proactive about addressing them.

Money Manager Expectation #1: My fund is AWESOME and yet no one gives me money. Jerks.

Reality: Your fund may be awesome, but if you aren’t getting assets, there has to be a reason. Maybe you don’t have the right network. Maybe you’re not targeting the right investors. Maybe your strategy isn’t in vogue right now. Maybe the investors you’re targeting are fully committed at the moment. Maybe you don’t mind a fair amount of volatility but other folks do. Maybe you have more faith in your simulated track record than others. Maybe you’re just too small/don’t have the right infrastructure at the moment and therefore folks can’t commit meaningful capital. The list of reasons why you’re not getting capital can be endless. Rather than dwelling on how shortsighted investors must be to overlook your fund, perhaps the best use of time would be figuring out why assets aren’t flowing in your direction and developing a plan to address those issues.

Investor Expectation #2: Money managers shouldn’t make money from the management fees.

Reality: While it’s generally accepted these days that a fund’s management fee shouldn’t be a bonanza annuity for any manager, it is also generally accepted (though sometimes forgotten) that running an investment fund takes moola. You have to be able to attract and pay talent a base salary in good times and bad. You need ample staff for your particular investment strategy. You may need research, IT, and other services. You’ve got to keep the lights on, the firewalls up and disaster recovery plans in place. How much this costs depends on strategy, location, number of investors, staffing requirements and a host of other factors. It’s up to the fund managers and investors (during due diligence) to determine a fund’s true “bottom line” and pay fees accordingly. Rarely will they be “zero.”

Money Manager Expectation #2: Investors should have infinite time to talk to me about my fund.

Reality: There are generally eight to 10 hours in an investor’s working day. The investors that I speak to often get 20 to 100 emails and calls a day from fund managers. You start doing the math. Oh, and make sure you factor in committee meetings, travel, PowerPoint presentations, conference calls, HR, compliance tutorials, and bathroom breaks. Now do you understand why it took Issac Investor a few days (or a few emails) to get back to you? Or why they only want to chat for minutes, rather than hours, about your fund? To quote The Karate Kid, “Patience, Daniel-San.”

Investor Expectation #3: There’s only one way to be “institutional.”

Reality: As much as we want a “check the box” solution for fund evaluation, it will never exist. Just because a fund manager has a full time Chief Compliance Officer, Chief Operations Officer, Chief Financial Officer, and Chief Information Officer doesn’t necessarily make that fund better than one that has combined or even outsourced some of those functions. Different levels of staffing and infrastructure will be appropriate at different stages of fund evolution and for different strategies. The key is to determine if key functions are covered adequately, not to count C-Suite professionals in the org chart.

Money Manager Expectation #3: Anyone can be a fund marketer.

Reality: Some folks are great at initiating contact with investors, making a concise and compelling case for a fund, pushing gently for follow up and asking for (and getting) a commitment. Some people aren’t. If you aren’t one of those people (see also, Money Manager Expectation Number 1), even if it is your fund and you know it better than anyone else ever could, you should consider delegating those tasks.

What are your “favorite” expectation/reality gaps between investors and fund managers? Sound off in the comments below while I go eat some celery.

With hot weather upon us, more folks out of the office, and a truncated conference schedule, it's easy to get frustrated with the capital raising process. Before you start hating the players *and* the game, make sure you're not committing any capital (raising) crimes and putting your own asset raising efforts in the pokey.

(c) 2016 MJ Alts

(c) MJ Alts

Please note the MJ Alts blog is now posted on the 1st and 3rd Tuesday of each month.

A few years ago, I went to Vienna to give a pre-conference workshop at a hedge fund conference. Because I had more than one connection, I checked my luggage, which I almost never do. When I arrived at the Vienna airport and retrieved my luggage, I discovered that it was soaked with a mysterious pink liquid. Everything in my bag was moist, a little fragrant and a lovely shade of rose.

I rushed out into the Vienna evening to purchase something to wear to the event the next day and was at least able to score some skivvies and something to sleep in before the shops closed. I sent those and a suit out to the hotel cleaning service immediately upon my return to the Vienna Hilton.

After two hours, there was a knock on the door.

“Fraulein Jones! We have your laundry!”

I opened the door and was greeted by a white-gloved hotel staffer holding a few coat hangers in one hand, and a silver tray above his head in the other. As I stood slack-jawed and jet-lagged in the doorway, the tray was lowered to my eye level.

On it were my neatly folded and laundered undies. Which had been paraded in all of their unmentionable glory through the entire conference hotel.

The next morning, the “room service undies” story was the talk of the event. I, or at least my underclothes, was the highlight of the conference.

Now, don’t get me wrong, I appreciated the professional Austrian laundry service. The prompt delivery to my door before I collapsed into bed was lovely, too. But much like Goldilocks, there was a desired level of service that was too much, one that was too little, and one that was just right. I’m not sure I quite needed the white gloves. And the silver panty platter? Well, let’s just say that was straight-up overkill.

It’s not much different in hedge fund land either. At another conference last week, I had the pleasure of sitting next to two gentlemen who were running a small hedge fund. They gave me their elevator pitch (interesting) and then peppered me with some questions about how to take their fund to the next level. It wasn’t long before the question of service providers came up.

“Just how important are our service providers anyway?” they wanted to know. “We’re a small fund and we really need to be cost conscious, so can we get by with what we have?” they asked.

Unfortunately for them, the answer was a fairly unequivocal “no.” They were using individuals, not firms, for the most part. And while inexpensive, these individuals were almost certain to cause problems in one of three areas eventually.

- Scalability – When a fund is small, the number of LPs may also be quite low. This means fewer K-1s, usually no tax-exempt or offshore investors, few requirements to register with a regulatory body or file ongoing forms, no separate accounts, etc. If you are dealing primarily with your own money and that of your friends and family, then your uncle’s friend’s cousin’s accountant son-in-law may be sufficient for your needs. But as a fund grows, the demands on fund infrastructure and service providers evolve. An administrator who can handle money-laundering regulations becomes mandatory as you accept offshore dollars. Audited financials, not just a performance review, are essential. Late or incorrect K-1s become a kiss of death. It is essential to pick service providers that can grow with your fund.

- Due diligence – And speaking of growth, it is also vital that your service providers aid the expansion of assets under management, rather than impede capital raising. The last thing a fund manager should want in an already extensive and extended due diligence process is to force an investor to have to investigate a service provider, too. If you don’t select service providers with at least a basic level of “street cred,” then investors must evaluate not just your skills and organization, but the skill and organization of the groups that support you. And this flies in the face of one of the best pieces of advice a fund manager can hear: “Make it EASY for investors to allocate. The more impediments you put on the road to an investment, the less likely someone will actually send you a wire.“

- Level of service – Finally, while I’m sure Aunt Sally’s friend’s neighbor’s daughter is great at creating account statements each month, she probably isn’t going to invite you to industry events, hold webinars on topics that are pertinent to your business or have value-add service like cap intro or strategic consulting. Just like it’s important to make it easy on investors to invest, it is equally important to make it easy on yourself to grow. The straight money-for-service trade is only part of the equation – you have to evaluate whether there is additional “bang for your buck” that you may miss by being penny wise and pound foolish.

Having said all this, I do believe there is a Goldilocks principle at work with fund service providers too. To use my Vienna analogy, you do want to make sure you can get dressed in the morning, but many managers probably don’t need their drawers delivered on a silver tray.

For those looking to play exclusively in institutional investor markets, the biggest names may be essential, but for many hedge funds, there are a range of players (and price points) available. Several publications, like Hedge Fund Alert for example, provide rankings of service providers based on their total number of SEC filings. This can be great starting point for managers looking for firms with experience (and name recognition) in the industry. Ask around and see who other fund managers use as well. At the end of the day, pick a competent, reputable, scalable provider with value-added services at a price point that seems like a good trade for those services.

Now clearly, I don’t have a dog in this hunt, so all y’all fund managers should ultimately do what you want. But since so many of you might have already seen my undies, I felt we were close enough for me to offer this unsolicited advice.