November has been, at least thus far, a month of surprises.

You know that curse on the Chicago Cubs? Surprise! They won the World Series.

Didn’t I just see a Facebook post on a local norovirus (aka the stomach flu) outbreak? Surprise! I temporarily had to rename myself Vomitola Khomeni – and finally found that button I ate when I was three…

Hey! Do you remember all those polls that showed Democrat Hillary Clinton easily winning the White House? Surprise! Donald Trump is the 45th President of the United States.

Oh, and of course you recall all the dire predictions for the stock market should Donald Trump win the presidency? Surprise! The Dow Jones Industrial Average was trading in record-making territory a mere two days later.

To be honest, while I did spend much of the first part of the week “enjoying” my virus-induced weight loss opportunity, I also, if somewhat dimly and feverishly, realized that collectively we have done a terrible job of predicting recent events.

I know many in the financial industry had to have been stunned and dismayed by the election results. According to an October 26, 2016 article in Fortune, Trump raised $239,250 from hedge fund and private equity firms, while Hillary Clinton raised $45.2 million from the same groups. Charles River Ventures, a Silicon Valley venture capital firm even went so far as to entitle a blog posting “F*CK TRUMP.” Even though Republicans in other races enjoyed healthy and widespread financial industry support, it just wasn’t there for Trump.

As a result, for many people, last Wednesday morning must have seemed like the end of the world (as we know it). And while I didn’t notice any birds, there were even “snakes and aeroplanes” for any still doubting the seriousness of the situation. (https://www.theguardian.com/environment/2016/nov/08/snake-on-a-plane-passengers-flight-mexico-city)

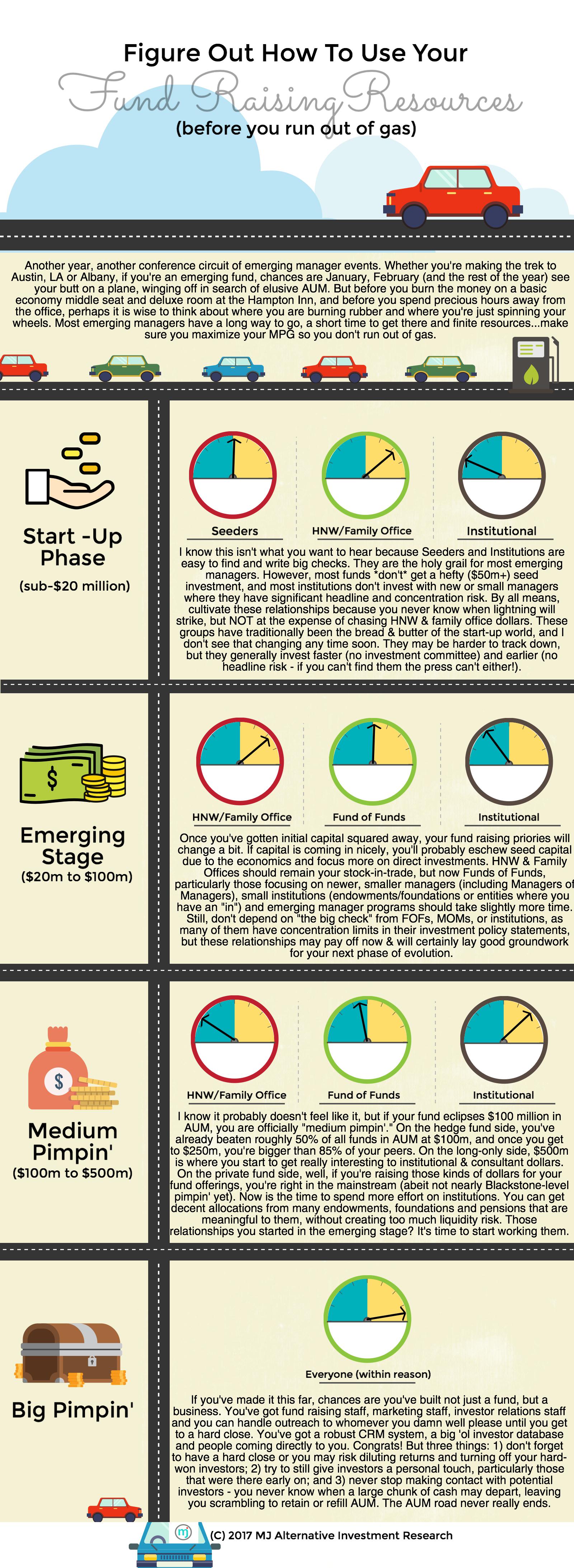

So where do we go from here? How does the investment industry successfully navigate the new normal and survive and thrive in a new world order? Here are a few thoughts I had that may help investors and managers both do good while they do well.

One: Don’t Say Or Write Anything That Endangers Your Current AUM

This was a contentious election. Combative. Testy. Belligerent. Factious. Antagonistic. Insert every single synonym for “unpleasant and argumentative” you can come up with here, because no matter how you slice it, the 2016 political campaign was a dumpster fire, starting with the Republican and Democratic primaries and continuing through the general election. It. Was. Not. Pretty.

As a result, there are a lot of very strong post-election feelings on both sides of the aisle.

And as we extend our personas over Facebook, Twitter, Blogs, Instagram and other platforms, there has simultaneously been a reduction of social restrictions and inhibitions known as the “Online Disinhibition Effect.” It makes us more likely to say, write or post things that we likely wouldn’t have before.

When you combine those things – deep disappointment, hurt feelings and increased disinhibition – you end up with an improved likelihood of offending someone, inadvertently or otherwise. And when you seriously offend a client or prospect in this industry, your AUM suffers.

So lock down your Facebook account if you post politically on it. Don’t assume you know what someone’s views may be unless they’ve actually told you what their views are. In fact, to the extent that politics and social issues don’t impact your investment strategy or portfolio, don’t talk about them in professional settings. At all. Better safe than sorry because it’s easier to keep a client/investor than to acquire a new one.

Don’t believe me on this one? Ask Matt Maloney, who’s firm, GrubHub, suffered share price losses of 9.4% in the two days after the election over a leaked internal communiqué. Shut. It.

Two: Consider Diversity In Hiring and Investing

This election cycle has been, at least in part, about disenfranchisement. Trump likely won the election due to the disenfranchisement of the white, working class rural voter, while those who fear pending disenfranchisement (minorities, women, immigrants, LBGTQ) have fueled protests post-election.

The good news for investors and money managers is that inclusion will ease disenfranchisement, and it can also make everyone richer, too. Here’s how:

- Deszo & Ross studied the effect of gender diversity in the S&P 1500 and found that “female representation in top management leads to an increase of $42 million in firm value.”

- Orlando Richard found in his study that for “innovation-focused banks, increases in racial diversity were clearly related to enhanced financial performance.”

- Catalyst found that Fortune 500 companies with the highest representation of women board directors had significantly higher financial performance than those that don’t.

- Morningstar found that mixed-gender mutual fund teams outperformed single gender teams.

- The HFRI Diversity Index (+4.21%) has outperformed both the HFRI Fund Weighted (+3.59%) and HFRI Asset Weighted (1.31%) indices for the year to date through October.

- In a paper by Stanford professor Margaret Neale, diversity and intellectual conflict proved good for organizations. “When…newcomers were socially similar to the team, old team members reported the highest level of subjective satisfaction with the group’s productivity. However, when objective standards were measured, they performed the worst on a group problem-solving task. When newcomers were different, the reverse was true. Old members thought the team performed badly, but in fact it accomplished its task much better than the homogenous group.”

- Diversity includes “Functional Diversity” or “the extent to which individuals frame problems and go about solving them.” As a result, age, background and life experience should also be considered aspects of the diversity equation.

Certainly, in a rapidly changing world, having better problem solving skills and potentially better returns has to be a good thing, right? So cast a wide net when hiring staff or money managers going forward to maximize your cognitive alpha.

Three: It’s Still A Great Time To Focus On ESG Factors

So, early reports have the newly-elected administration throwing out both the Environmental Protection Agency and the CFPB, as well as doing away with Dodd-Frank, among other regulatory changes. While it’s too early to know whether and when that can or will happen, there are a few things we do know:

- 49% of high net worth (HNW) millennials (yes, they exist!) say that social responsibility is a consideration in investing. 53% of all millennials agreed. 43% of HNW GenX also consider social responsibility in investing. Due to demographic shifts in the workplace (these groups of workers are now larger than Boomers) and the looming generational wealth transfer, it probably makes sense to develop products that cater to these interests sooner rather than later.

- Bauer, Frijins, Otten and Tourani-Rad found “well-governed firms significantly outperform poorly governed firms by up to 15% a year” in their paper “The impact of corporate governance on corporate performance: Evidence from Japan.”

- A Wharton paper from 2012 shows a “positive association between corporate governance and performance…and evidence that higher corporate governance leads to an increase in cash dividends.”

- Exxon spent $2.1 billion cleaning up the spill from the Exxon Valdez, which, while recoverable, ain’t great for a company’s bottom line.

- Wells Fargo’s recent governance gaffe could cost the company up to $4 billion in revenue.

- GrubHub’s “hostile workplace” internal email has led to a boycott and a drop in share price.

It seems reasonable that ignoring ESG factors can cost you both potential returns and clients, and possibly increase portfolio risks. And even if there aren’t dedicated regulations or government bodies watchdogging, it also seems reasonable to assume that many investors (and the markets) WILL still care.

Four: Don’t Make Any Sudden Investment Moves

The Sunday before the election, I had a sudden Han Solo moment (“I’ve got a bad feeling about this…”) and decided that I needed to think about buying an inverse S&P ETF. I gave myself 24 hours to ponder and ultimately decided to stay my current course and not change anything in my investment portfolio. Lucky me, right? That single choice would have cost me. Bigly.

Humans want certainty. In a study published in Nature Communications, knowing there is a small chance of getting an electrical shock causes more stress than knowing you’ll be shocked.

Shocking!

But seriously, when you’re feeling uncertain about your investment strategy, take a moment. Take a walk. Take a breath. Take a sip. Take whatever step back you need before making any sudden investment decisions. Whether you’re an investor or a money manager or just a Star Wars fan with a retirement account, it’s important to remember that we generally invest for the long-term. Don’t risk your long-term goals chasing short-term “certainty.”

As for me, I’m taking my own advice. Right after I get back to my 80s roots, dig out my mismatched Converse high-tops from the very back of the closet, and have a 3-minute R.E.M.-party to dance it out. I invite you all to do the same.