As I was trapped in my Nashville home awaiting rescue after Snowpocalypse 2015 from one of Tennessee’s (not kidding) FIVE mid-state snowplows, I watched a lot of television, ate a lot of carbs and tried to fight off scurvy with gin and tonics and a splash of precious lime juice. But at some point, in between re-runs of Shawshank Redemption, Aliens and The Matrix, I was struck by the increasing mainstreaming of behavioral finance.

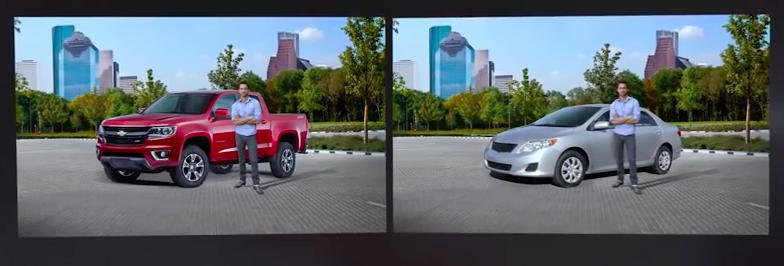

An advertisement for the Chevrolet Colorado, what is known in the Deep South as a “Big ‘Ol Truck,” highlighted a series of focus groups weighing in on the characteristics of two men, Truck Guy and Sedan Guy.

Truck Guy and Sedan Guy from Chevy Colorado Commercial

Now, of course Truck Guy and Sedan Guy are, in fact, the same person, but groups of children, adults, single women, bearded men and old folks were asked to describe the characteristics of each man. The result? Truck Guy was rated as 85% more handsome, 76% more resourceful and 100% more likely to have an “awesome pet” than Sedan Guy.

While it may seem like a silly commercial, and obviously one geared towards my fellow Southern brethren, the reactions of the Chevy focus groups were not unlike the biases displayed in other walks of life. Like it or not, pattern recognition and its resultant behavioral biases are active in every decision you make. Unfortunately, in investing, it may be making you poorer.

Pattern recognition, in particular template matching, is the process by which our brains save time. The brain, which consumes more energy than any other organ in the human body, tries to expend the least energy possible to process data and make decisions by taking incoming sensory data and comparing it to what has already been stored in our memory. Hence why a simple picture of Truck Guy elicited judgments about his character and choice of dog when he was otherwise wholly unknown to the focus groups.

It's true pattern recognition can be beneficial – after all, it would be time consuming and exhausting to start over fresh with each new data set all the time a la 50 First Dates – it can also stand in the way of innovative and profitable thinking. In investing, for example, pattern recognition may impact where you direct your capital.

Let’s consider capital flows of assets into hedge funds, venture capital and private equity.

Hedge Funds – In 2014, 86.9% of asset flows went to funds with more than $1 billion under management per HFR. The “Billion Dollar Club” is approximately 500 funds out of an overall universe of roughly 10,000 funds. Per Pensions & Investments, the 25 largest hedge funds control 46% of all hedge fund assets as of the end of the year.

Venture Capital – Per the Wall Street Journal, venture capital firms raised $32.97 billion in 2014, with a mere 8 venture capital firms of $1 billion in AUM or more accounting for just over one-third of that total.

Private Equity – According to industry watcher Preqin – only 7% of the $486 billion raised in 2014 went to first time funds.

Looking at data like this, it’s clear that investors are thinking along the same lines:

· I should only invest with firms that are BIG.

· I should only invest with firms that are old (uh, “established”).

· I should only invest with firms populated by the pale and male.

To many, this seems like a relatively “safe” approach to investing, along the lines of “No one gets fired for buying IBM.” Unfortunately, it doesn’t leave a lot of room for innovation, eye-popping returns, cognitive diversity and true diversification. So by sticking with these established patterns, what are investors potentially leaving on the table?

1) Research has consistently shown that smaller funds (particularly on the hedged side) often perform better due to the ability to invest in niche plays and club-sized deals. In an increasingly volatile market, smaller funds may be able to be more nimble and liquidate positions in a pinch more easily than larger funds.

2) Research has also shown that younger firms may post higher returns as well, due in part to the smaller fund sizes above as well as a smaller safety net provided by management fees.

3) Research has shown that inclusion of women and minorities may increase returns, in some cases substantially. This cognitive and behavioral alpha may not be available, or may be available only in a limited fashion, at the industry’s largest firms. In addition, a lack of diversity at the fund management level may result in less diversification of deals, stocks, ideas and positions, creating additional correlation within a portfolio. In short, investors may not be as diversified as they think they are if all of their managers think alike.

At the end of the day, pattern recognition has created wealth, but it also leaves money (and risk) on the table. It seems to me that we could all be better off, richer and get better gas mileage if we left our prejudices at the door and just rode with Sedan Guy for a while.