A new holiday fad for fund managers of all ages and denominations! LP On A Shelf (or ELP on a Shelf, as I call him) knows when you've been spending too much time at conferences, when you're creating pitch books that are too long, or when you're not hiring critical personnel (or skill sets) and will tell Santa not to offer you an allocation in the New Year.

Many of the fund managers I speak to remain conflicted about how best to position their diverse asset management firm. While I don’t have all the answers, perhaps I can help shed a little light on the topic for folks. Read this while you’re thinking about your capital raising battle plans for 2019. And may it help you separate who’s been naughty and nice, whose chimney you should visit and whose you should skip in the New Year.

Have you been thinking about joining Twitter to expand your investor and investment professional network? Have you been lamenting your lack of Financial Twitter (“FinTwit”) savvy? Are you hoping to take a break from reading incendiary political Tweets to actually put Twitter to use for brand building and marketing purposes?

Well, here’s your chance to learn all you need to know to get started and make the most of Twitter. Take my tour of the FinTwit campus and come on in…the water’s fine.

This past Saturday was not unlike most of my recent Saturdays. I woke up around 7:30, fed my seemingly perpetually starving Siamese cats, and contemplated the end of what was yet another *fabulous* infrastructure week here in the good ole U.S. of A, all before heading out to stress shop.

I’ve always said that shopping is my main form of cardio, but you may not know it’s also one of my favorite methods of stress management, too. There’s something about a perfectly climate-controlled dressing room, a commission-based sales rep at my beck and call, and an impeccable frock (or purse, pair of shoes or new iPhone for that matter) that makes everything bad in one’s life feel more like a distant land war in Asia, rather than like a bar fight in your living room.

This weekend, as I was trying on my potential retail spoils, I happened to overhear a conversation in the dressing room adjacent to mine. A mom and a daughter were discussing a sweater, and whether it could be purchased for less money at another store. The objectionable price of said sweater? $30.

Yep you heard me (read me?) – thirty whole American dollars.

My first thought was “You can buy a sweater for 30 bucks?!?”

I mean, I was at the Nordstrom Rack (I may be seriously into retail therapy, but most of the time I see no reason to pay full price for it), but I can’t recall the last time my hands have alighted on a $30 anything, much less knitted goods.

My second thought was “Would you really want to wear a sweater that could be purchased new for $30? What would said sweater be made of? What would this sweater look like? Would this sweater hold up to normal use without starting to resemble Rachel McAdams’s shirts in “Mean Girls?”

(C) Morguefile.com

I was really struck by two things in the aftermath of the sweater discussion: First, what a privilege it is not to have to worry about spending $30 on a sweater. But second, and more important, how a lot of us have pretty much started to expect everything to be cheap.

Especially when it comes to the investment world.

It’s true that there has been a colossal amount of fee pressure and compression in the investing world over, say, the last 10 to 20 years. For example, active equity mutual funds charged an average of 1.08 percent in 1996, but a mere 0.82 percent by 2016, and equity index funds saw fees plunge from 0.27 percent to 0.09 percent over the same period.[1]And of course, Fidelity upped the low-cost ante even further this year when they announced two no-fee index funds (Tickers: FZROX and FZILX), attracting more than $1 billion in their first month.[2]

One of the investing groups to get the biggest full-court (fullest court?) fee press is hedge funds. In fact, a mid-September Institutional Investor article touted that hedge fund fees had fallen to record levels, with management fees near 1.43% and incentive fees hovering around 17%.(3) Of course, this massive “decline” assumes that hedge fund fees peaked, as often advertised, at 2% and 20%, which I have loudly and repeatedly asserted for years that they didn’t, based in no small part to research that I did in 2010.

This research showed that, at the height of hedge funds’ popularity, and based on a sample of more than 8,000 funds, management fees for funds that launched in 2009 averaged 1.65%, up from 1.35% for 2000 vintage year funds. Likewise, incentive fees during the period were largely stable. They clocked in at 18.7% for vintage year 2000 funds and dropped to 18.5% for hedge funds launched in 2009. So, while there has been a decline in average headline fees (the fees charged per Offering Documents, not negotiated for large investors, longer-lockups or founders’ shares), it hasn’t been a dramatic as one may think.

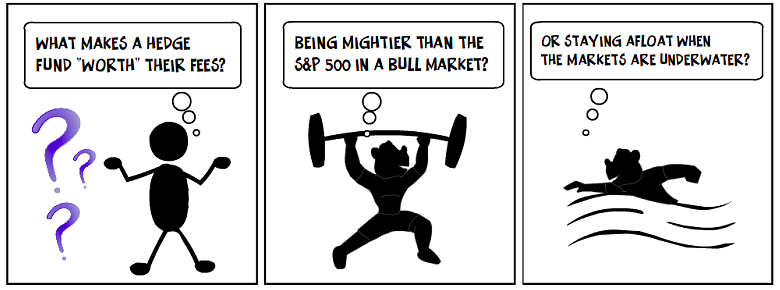

But the bigger question that many have asked is “how low can fees go?” And that, much like my $30 sweater conundrum, is an excellent question.

The rise of index tracking, low-cost ETFs, and the decade of stellar performance of the same, has led some investors to believe all returns should come cheap. But even leaving aside market cyclicality and the active/passive debate, there’s a pretty big difference between mammoth firms like Fidelity or Vanguard offering funds for three basis points and a $100 million hedge fund, private equity / venture fund or even most long-only active managers offering the same.

Why?

The primary issue is economies of scale – Vanguard managed $5.1 trillion (with a “T”) as of January 2018. Blackrock managed $6.317 trillion (again, with a “T”) as of March 2018. Fidelity managed $2.45 capital T trillion as of the end of 2017. If Fidelity charges an average of three bps on its assets under management, it still generates a helluva lot (with an “H”) in fee income.

If Jo Schmoe Fund does the same while managing $100 million, they spit out a paltry $300,000 in revenue. Even if Jo earns a hefty return on investment, triggering the payment of an incentive allocation, that still may not be big enough dollars to run an institutional quality business.

Even if JS Capital Management manages to grow assets to ONE BIIILLEON DOLLARS, they might be able to buy a metric crapton of $30 sweaters charging 3 bps, but running a legit asset management business? I wouldn’t always count on it. Sure, they’d rake in $20 million on a 10% performance year (assuming a 20% incentive allocation), but not every year turns out that way.

There are some years, thought we may not remember them well, where it would be considered outstanding performance to be flat. There are some years when a strategy just isn’t in favor. There are some years when stuff just doesn’t go your way. Do you want to incentivize a manager to use excess leverage, to under hire, to spend all their time trying to raise additional assets so they make a decent buck, or to take undue risks with your capital?

I’m not sure I do. Which is why I didn’t pop my head out of the dressing room to snatch up the mysteriously alluring, though inexpensive $30 sweater on Saturday. The risks of contact dermatitis, catastrophic sweater failure and potential public ridicule were just too great.

[1]https://www.ici.org/pdf/per23-03.pdf

[2]https://www.cnbc.com/2018/09/04/fidelity-offers-first-ever-free-index-funds-and-1-billion-follows.html

Last night, I flew home from San Fran on the redeye after attending not one, but two, conferences in San Fran. Normally, I’m a champion sleeper on planes (as any of you who have ever seen me pre-pushback, comatose, mouth agape, and a tiny glistening pearl of drool perched majestically upon my lips) are well aware, at least based on the post flight mocking I get.

But on this particular flight, I was awake. I couldn’t get comfortable in my (there is a Jesus!) upgraded seat. I moved to the back of the plane and claimed a whole row to myself, but was likewise unable to sleep there after my left hip lost all feeling due to the firmness (I met floors in college with more give) of the seats.

After limping my way Sanford and Son style back to my original seat, I finally accepted my insomniac fate and settled with my ancient iPhone to listen to some tunes. Ironically, the Rolling Stones “You Can’t Always Get What You Want” was one of the first songs to play. I did not, however, appreciate said irony at the time.

Once I was able to grab a little disco nap this morning, it put things into a slightly better perspective. Sure, I couldn’t get what I wanted (a nice, long, mouth-breathing sleep in a tube of recirculated air), but maybe I needed those moments of introspection. I mean, otherwise, I wouldn’t have today’s blog post, right?

Likewise, I meet a ton of managers that are frustrated that they can’t always get what they want, usually $1 BIIILLLION Dollars from institutional investors in six months or less, but maybe, if they noodle on it in the dark of night under a (probably) ebola-encrusted airplane blanket, they may figure out how to get what they need.

To help investment managers on this journey, I put together a handy dandy decision tree to help determine whether now is the right time to market to endowments, foundations and pensions, or whether they should take other steps to get the AUM they require.

Should You Be Marketing To Institutional Investors?

(c) 2018 MJ Alternative Investment Research

But investment managers, take heart, preferably before you start creating a voodoo doll with my face on it. There are plenty of things you can do to still get your Mick Jagger on and try spending some time to get what you need.

Try a different demographic - some of the items above are more specific to institutional investor clients and may not apply to high net worth individuals, family offices and even friends and family.

Talk to institutional investors when you DON’T have a fund to raise - I know you’re probably saying, in the words of Dorothy Parker, “What fresh hell is this?”, but investors can often be more accommodating of meeting requests (and provide some darn fine feedback) when you’re NOT looking for an immediate wire transfer. Asking for a half hour of time with an up-front caveat that you’re not “selling” anything can be a beautiful way to start a client relationship.

Get your ducks in a row - Figure out the nature of your game now so that when you do talk to institutions, you’re bulletproof. That takes time and effort as you perfect your elevator pitch, refine your deck, get the right service providers on board, train up IR staff, etc. Get it right on the front end and it will pay off on the back end.

I know it can be hard to wait to jump into the AUM chase, but if you follow at least some of this advice, I swear you’re likely to get a little more Satisfaction.

In January of this year, I was asked to speak at the 2018 TEDx UIUC event "Roots." The theme of the event was pretty straightforward - "The beginning of all things are small" (Cicero). The organizers asked me to talk about both my professional journey and the work I do around diversity in finance/investing.

First, I was very flattered.

Then, I *may* have pooped my pants a little at the thought of giving a TEDx talk.

Ultimately, I of course accepted. And on April 22, 2018 I gave my talk to about 400 students, faculty, members of the Champaign-Urbana community, my mom, and Jill Kimmel (yes, THAT Kimmel).

The talk looks at what I've identified as the three types of good and bad luck that impact all of us on our journey to success, and how we can create more good luck (or micro-opportunities) to open doors for others and effect change, specifically in the investing community.

If you've got just under 20 minutes, I hope you'll take time to watch it. If you like the message, I hope you'll take time to share it. If you utterly hate it, let me know and I'll send you a personal note of apology for the time wasted AND I'll try to prevent my mom from sending you hate mail, too.

I miss Entourage.

To this day, I’m not sure there was much better than watching Ari Gold lose his collective crappola and yell hysterical insults at people. Listening to Ari’s invective was like giving my id a voice. Sure, it was obscene, profane and probably actionable abuse in many cases, but that’s why it was so much better to watchsomeone else spewing that hilarious filth than to let my own inner Ari Goldout to play.

Vulgarity aside, I also enjoyed watching the agent-principal relationship that Ari had with Vincent Chase. Sure, Vinnie ultimately called the shots, but Ari brought moola and industry know-how to the table. It was, despite a brief firing at the end of Season 3 (and the entire “Medellin” disaster), an almost perfectly symbiotic relationship.

In many ways, you see that same principal-agent relationships play out in the investment world (minus the copious swearing). In fact, I content that all investors can be classified as either principals or agents, or as some hybrid blend of the two, and that it’s critical to know which one you’re dealing with at any given time.

If you’re a money manager on the prowl for assets under management, knowing whether you’re interacting with a principal or agent can save you time, energy and headaches. If you’re an investor looking for a new role, understanding and explaining whether you’ll be a leading lady/man or Ari Gold can help manage expectations down the line.

Investors who are principals usually have some traits in common:

- They’re often quicker to invest – usually because there’s not layers upon layers of decision makers behind the scenes. There is no (or a limited) investment committee and there’s usually no consultant or operational due diligence outsourced resource.

- “Principal” investors may choose more innovative or niche-y investment strategies, invest in new trends earlier and generally take more risks.

- However, they are often able to do this because they are investing their own capital and may not have fiduciary duty to anyone other than themselves or a small group of constituents, which means they don’t have to make enormous allocations or worry about headline risk.

- Think high net worth individuals, single family offices, small foundations.

Investors who are agents also have traits in common:

- They usually take longer to invest due to multiple layers of sign-off and decision making.

- You can be pretty sure that every nook and cranny of your fund, firm and investment strategy will be gone over with a fine-toothed comb, because these investors have more headline and client risk. If an agent investor recommends a fund that blows up or fails you’re almost certain to hear about it because they are investing large, either for themselves or on behalf of their external clients.

- Because “agent” investors often move as a herd, you can rest assured that where one goes, there will likely be a sequel. Making it past the gate with one agent can pave the way for others.

- Think institutional investors (whose minutes and meetings are often matters of public record) and investment consultants. FOFs (who generally have to think about attracting clients to ensure their existence) can fall anywhere on the agent-principal spectrum, depending on the organization.

(c) MJ Alts

Obviously, there are benefits and drawbacks to working with both agents and principals when it comes to investing. The only real drama comes from not knowing with whom you are dealing and therefore not effectively managing expectations (and resources).

For example, if you’ve got a truly niche-y and innovative strategy that perhaps is a bit untested, presenting it only to agents may pay off, but it will likely be a long slog and you may be stopped out entirely if your strategy can’t handle large allocations. Or if you have a strategy that is more of a new twist on an old tale, Aquaman 2for example, you may find that high net worth individuals aren’t sufficiently wowed by your offering. If you need to get to a quick close, or if you only have limited capacity left before your final close, landing a prime role with an agent may not be possible. But if you’re looking for a large anchor, or if you have enormous capacity and the time to run the agent gauntlet, these investors can provide the bulk of your capital.

And to make matters worse, some agents present as if they were principals, and principals can suddenly bring an agent to what you thought was your fund’s premier. It would be so much easier if there was just a script the industry could stick to, but unfortunately, you just have to try to learn everyone’s role and trust that if there’s some confusion, you can just hug it out in the end.

It’s August. It’s slow. It’s what the Hitchhiker’s Guide to the Galaxy might have referred to as the “long dark teatime of the soul” when it comes to investment industry activity. The conference circuit is dead. Everyone is on vacation. There are practically tumbleweeds rolling through your office.

(c) 2018 MJ Alternative Investment Research - I spent my OOO time this year in Middle Earth.

Yep, it’s about this time of year when you believe that everyone but you sold in May and went away.

And you’ve got the Out of Office emails to prove it.

Sure, you’re still sitting in your office, or you’re on a nice beach trying to be productive while your family cavorts and relaxes, dutifully sending out email requests for meetings, performance updates, introductory information, requests for proposals, whatever. And all you’re getting back from Darryl, John, Hall and Oates is “I am currently traveling with no/limited/sporadic access to emails/phone. If you need immediate assistance, please eff off/contact this random person. I will respond to/continue ignoring your email upon my return.”

So what’s an investment professional to do?

If you’re getting the Out of Office (OOO) treatment these days, try these handy tips for coping:

1) Assume the email you just sent is going into the virtual circular file. It ain’t never gonna be read, answered or otherwise acted upon. Even if the autoreply doesn’t go as far as this particular OOO did to spell things out for you, your chances of getting a timely response are pretty slim. So look at the date the out of office email expires and mark your calendar for one week after that date. On that day, send your email again. Do not forward, do not refer to your prior email. Send a virgin email, to be touched for the very first time, without the guilt and recrimination of a forward. Start fresh. Just like you hope the recipient is doing after a nice, relaxing holiday.

2) In investing, time is money, but it isn’t life. We’re not carrying hearts around in beer coolers, y’all. Whatever you are emailing about, chances are it can probably wait a week (or two) for a response. Even if it doesn’t feel like it to you in a particular moment. If you get an out of office response, DO NOT attempt to hunt the person down like you’re the Terminator of the email world. On a recent vacation, I had more than one recipient of my OOO decide to text me since they couldn’t reach me via email. Needless to say, given the 17-hour time difference, I was none too happy to receive communication from those individuals in the wee hours of my morning respite from work and responsibility. So, before you go to extreme lengths to contact someone who is out of the office, ask yourself how you would feel if you reached them and they were, I don’t know, at a funeral. Would your call or text be worth disturbing that particular occasion? If the answer is “no” then put down your phone and back slowly away. Otherwise the only funeral you may be going to is yours.

3) Try a little patience. Most people I know start going through their missed emails from the top down (most recent dates first), in the off chance something has resolved itself in the intervening days or moments and they can blissfully ignore all related messages. If you emailed early on in someone’s OOO timeline, give the person a few days to get back to you. See also, OOO tip one.

4) For those composing an OOO, go ahead and say you’re not checking emails. Even if you are, there’s bound to be a few you can’t or won’t deal with. Telling people you’re checking emails sporadically or that there’s a “delayed response” gives those receiving your OOO false expectations, and gives them a little more leeway to harass you while you’re grabbing some R&R (or attending a conference, or staycationing…).

5) Even if you don’t get an OOO response, if you don’t get response from someone after a week during this most humid time of the year, give folks the benefit of the doubt. There’s nothing worse than coming back to the office to find a bunch of pissy emails (“I tried you last week but didn’t hear back”) to make someone NOT want to prioritize you.

If you find you’re just too impatient to follow my Out of Office Etiquette, perhaps you need a little OOO time yourself. Economist Juliet Shor found that Americans take less vacation than the average medieval peasant, who worked around 150 days a year. So make a break from your feudal ways and chillax. You can always start stalking folks again after Labor Day.

During this holiday week, declare your independence from investment industry stress and worries. Let your cares float away as you enjoy this guided meditation designed for busy investment professionals. Namast-CFA.

(C) 2018 MJ Alternative Investment Research. All Rights Reserved.

(c) Animal House 1978

Thank You Sir May I Have Another?!?

The first time I ever saw Kevin Bacon in a movie was the infamous and hilarious flick “Animal House.” Although he didn’t yet have the appeal of, oh say, Ren McCormick (me-ow!), he did make an impression on me in his fraternity brother days. Perhaps it was his tight-assed, ROTC-inspired declaration of “All Is Well!” during the movie’s climax that got my attention. But, more likely, it was his tighty-whities in the infamous fraternity initiation paddling scene that caught my eye. I couldn’t imagine, even at the ripe old age of 8, that a grown man would allow another man to paddle him. IN HIS UNDERWEAR. And would cheerfully, though admittedly through gritted teeth, ask for another. And another. And another.

But then again, there are a lot of things I don’t understand, even today at the ripe old age of, well, not 8 years old. For example, I don’t understand why another study showing that smaller and younger funds outperform is necessary or the results touted as surprising.

Haven’t large funds been spanked with this data enough by now for us all to cheerfully conclude that smaller, younger funds outperform their older, larger peers?

I guess not, because just two weeks ago yet another entry in the small/young fund cannon made its appearance. On April 26th, Chao Gao and Chengdong Yin (Purdue University) and Tim Haight (Loyola Marymount University), used data from the Lipper TASS and the HFR databases to prove YET AGAIN that good returns come in small and new packages.

Now, as someone who actively supports emerging and diverse (who are often also emerging) managers, I should be happy to see yet another entrant into the verifiable tsunami of studies proving that small and young funds outperform. But really, isn’t it a little bit embarrassing at this point? I mean, it’s not like we don’t have a metric crapton of research that shows small and young funds outperform already, right? But just in case there was ANY doubt left in anyone’s mind at this point, allow me to point you to the studies that may help you reach the well-documented conclusion that, when it comes to emerging managers, all is, in fact, well.

Small & Young Funds Are Killing It – A Non-Exhaustive, But Pretty Damn Complete List of Research

PerTrac studies on emerging managers, 2007-2011

eVestment studies on emerging managers 2012-2014

Mayer & Hoffman paper on emerging managers. May 2006. Also appears in the book “An Investor’s Guide to Hedge Funds”

“An Examination of Fund Age and Size and Its Impact on Hedge Fund Performance” Derivatives, Use, Trading and Regulation, February 2007

“An Examination of Fund Age and Size and Its Impact on Hedge Fund Performance,”Journal of Investing, vol. 18, no. 1, spring 2009.

“Emerging Managers: Good Buy or Good Bye?” Barclays Capital, 2011.

“Smaller Hedge Fund Managers Outperform: A Study of Nearly 3,000 Equity Long/Short Hedge Funds” AllAboutAlpha.com, February 18, 2013

“Are Investors Better Off with Small Hedge Funds in Times of Crisis?” City University London, July 14, 2015.

“Emerging Hedge Funds Outperform Established Peers” Preqin, July 2017 (multiple other years of studies also available)

“Size, Age and The Performance Life Cycle of Hedge Funds” Gao, Yin, Haight, April 26, 2018.

Want some long-only fund action? I got that, too. How about:

“Does Fund Size Erode Mutual Fund Performance? The Role of Liquidity and Organization” Chen, Hong, Huang, Kubik, December 2004

“Liquidity, Investment Style and the Relation Between Fund Size and Fund Performance” Yan, 2008.

“New Evidence on Mutual Fund Performance: A Comparison of Alternative Bootstrap Methods” Blake, Caufield, Ioannidis, Tonks, October 2015.

“On Size Effects in Separate Accounts” Evans, Rohleder, Tenesch, Wilkens, August 2017.

And how about some Private Equity findings?

“Making the Case for First Time Funds” Preqin, November 2016

“Feels Like the First Time” PitchBook, 4Q2017

As I mentioned, this is a decent representative list of studies of small and new funds across the asset management spectrum. It is not exhaustive, mostly because I’m not sure it needs to be. I mean, you can’t really be standing there decked out in your undies asking me to hit you with even more data, right? So, let’s put the kibosh on proving something we should already know and just work to bring home the Bacon by investing in funds of all shapes, sizes, ages and types, not just tried and true established managers.

I’d like to think I’m not big into snap judgements, but a recent trip to the left coast in super-glamorous coach showed me that I’m completely full of it on that front. As I sat in my window seat waiting for my fellow fliers to board, I quickly sized up each and every passenger as they came down the aisle to determine whether they were someone I wanted to share air (and an armrest) with for the next four hours.

I mentally begged for the tiny old ladies. Anyone the size of a professional athlete (save maybe a jockey) I tried to psychically hurry past my row. I mean, seriously, those coach seats aren’t wide enough for a five-foot three figure skater, let alone a member of the NFL.

In fact, I still sometimes have flashbacks to a flight a couple years back when I was marooned next to a professional bowler for five hours. He was completely lovely, for what it’s worth. He even offered me a piece of gum mid-flight. Sadly, when he pulled said gum out of his pocket, it had liquified. I guess the heat that had built up to Dante’s Inferno level between our inexorably connected hips was just too much for a pack of Juicy Fruit to take.

Yeah, just thinking about that again kind of made me throw up in my own mouth.

Anyway, after the tall but sinewy gentleman took the middle seat on my recent flight, I had plenty of time to think about investment industry stereotypes as I tried not make arm or thigh contact midflight. And since I’m often picking on managers in this blog, I decided to fixate on investors for once.

So here you go!

It’s a completely unscientific, grossly generalized profile of the five investors most money managers meet.

The Tomato Seed– As a Southern girl, I know a thing or two about tomatoes. I know that any tomato eaten before the month of July (or after the month of September) is likely to taste like a whole lot of nothing. I know that, after a certain age, I’ll be required to grow tomatoes if I want to continue living in the South. And I know that tomato seeds are slippery little buggers. Seriously, try cutting a good beefsteak tomato on a cutting board. Now try to pick up one seed on your finger. I bet it squished away from you, didn’t it? Tomato Seed Investors are the exact same way. You can try to pin them down on something (a phone call, a visit to their offices, a due diligence trip, a date for subscription docs to arrive) and you just can’t quite to get them to stick. Tomato Seeds may employ a variety of tactics to slide away… “I’m sorry I didn’t see your email.” “I’m in another city that day, try again next trip.” “Contact my assistant (she’s out for maternity leave)…” but the result is always the same.

The T-Rex- You’ve seen a T-Rex right? Not a real one, obviously, but a rendition or skeleton of one, I’m betting. You know how they have really short arms? Picture those arms trying to reach into their pockets to grab a wallet. There’s no freakin’ way, right? T-Rex Investors similarly have very short arms and very deep pockets. They may say all the right things about how great your strategy is or how they love your team and your energy. They may even go through the full due diligence dance before all is said and done. But they never actually hand you any money. T-Rex Investors are one of the trickiest to deal with in the wilds as you don’t actually know who they are until you’re at least two years in. Up until that point, you kind of have to keep being nice and going through the motions, but once you’ve met a T-Rex, you’ll always be a bit scarred by the experience and perhaps even prone to pushiness with future investors.

The Ghost– For anyone who has ever dated on Tinder, Bumble, Match or, hell, just dated period, The Ghost is a familiar figure. You meet The Ghost Investor at a conference or event. You have a great conversation. There’s terrific follow up. You have another meeting or talk shop over a lovely Merlot. And then The Ghost, well, ghosts. You send emails that fly into cyberspace, never to been seen or heard of again. You leave messages on every available phone the investor has but get no return call. You contemplate hiring a medium to see if you can raise The Ghost Investor from the dead, all to no avail. The Ghost has disappeared, likely never to be seen in more than passing again. They may appear as a brief apparition at a conference but are usually viewed in passing (as they spirit away from all the managers they’ve ghosted before) or from a distance.

The Doorknob– One of my ex-boyfriends was a doctor. He liked to tell me how his day was over dinner and more than a few gin and tonics. Some of the stories were sad, some had delightfully happy endings, and some were SSDD. The most common refrain was complaints about patients who waited until Doctor Dude’s hand was literally on the doorknob, walking out of the exam room, to tell him that something else was wrong. It could be small, like an ingrown toenail, or utterly ridiculous in a “Hey-doc-did-I-tell-you-I-faint-every-time-I-walk-up-the-stairs?” kind of way. Whatever it was, it always stopped Doctor Dude cold. He’d thought he’d reached escape velocity and then WHAMMO! There are investors who excel at The Doorknob, too. You jump through every hoop and are told, explicitly or implicitly, that a wire is imminent. Then, The Doorknob strikes. “Oh, hey…we were just wondering about the trader you fired three years ago…can you provide his contact details to us?” “Gee, we’re really close but we are actually going to need to chat with your compliance person again to get her perspective on your ERISA AUM.” “So, it’s probably nothing, but in our background check we discovered that your chief information officer has a criminal record and we’re gonna need to clear that up.” Whatever it is, it hits you in the face like a glass of ice water and it has to be dealt with before you get any moola. Makes you want a gin and tonic too, right?

The WOW– The WOW Investor (Walk On Water) is the rarest of all investors. They return calls and emails within a reasonable amount of time. Their due diligence process, however lengthy, goes exactly according to plan. They clear up issues quickly and efficiently. They understand that, in order to run a successful business, you actually need cashflow to pay talent and build infrastructure AND they don’t begrudge you making a little coin, too. They call when they have questions and potentially provide insight into how best to communicate with other investors. The WOW investor is the Holy Grail of Limited Partners. They can be confused with the T-Rex and the Ghost, at least for a period of time, but will distinguish themselves in relatively short order by, oh, writing a check or returning a call. If you are lucky enough to find a WOW Investor, you should do everything in your power to keep them happy, up to and potentially including offering them your first-born child. Your wife or husband may grumble, but then again, they’ve never had to deal with the less desirable types of investors.

As you go about your capital raising business, be on the lookout for each of these types of investors. You may not be able to ID them as quickly as I could a potential seatmate on my flight, but you’ll get better at it over time.

(c) 2009 DreamWorks "Up In The Air"

Last week, I almost peed in my hotel room closet.

Yeah, you read that right.

It was the middle of the night. I’d been in different hotels (interspersed with brief sojourns at home) for part of every week since the beginning of the year. And for one brief and almost disastrous moment, I simply forgot where I was. Luckily, I came to my sleep-addled senses when I tripped over one of my own shoes, placed strategically outside the closet door. But still, it was a sobering moment.

Many of us that work in the asset management industry spend a tremendous portion of our lives on the road. Money managers must travel to drum up investments, to keep current investors happy and informed, present at investment committee meetings and otherwise support their assets under management. Investors trek for diligence visits, periodic onsites, and other gatherings (trustee meetings/retreats, investment committees, etc.). And of course, there’s the ever-expanding conference circuit to keep both groups, plus a hoard of service providers, racking up craploads of frequent flyer miles. Many of which we’ll never use because we’re pretty darn happy when we actually get to spend an extended period of time at home.

Over the past ten+ years of extensive travel, I’ve developed a few coping mechanisms to manage the rigors of being almost constantly on the go. And after sharing my closet story with a few folks last week who seemed to identify with my temporary travel amnesia a little too much, I came to realize that we could all use a few hacks to make it through 2018 as productively, and sanitarily, as possible.

So here goes: Meredith’s Top Five Travel Hacks for the Investment Industry

1) File business cards in your conference name badges. After a conference is complete, I always put the cards I’ve collected into the back of my used name badge. That way, I can remember where I met someone and/or pull contact information for a specific person or company quickly.

2) Carry a spare lanyard. If you work for, well, just about anyone, chances are you’ve at one point had a company-branded lanyard. Put it in your computer bag and take it on the road. That way, when you arrive at a lanyard-free conference, or, horror of horrors, at a conference where they expect you to use safety pins to secure your nametags, you’ll be able to spare your look and your clothes while still letting people know who you are. Don’t have a company-branded lanyard laying around? Choose a key service provider and proudly rock their lanyard.

3) Put one of your business cards in the back of your namebadge while at the conference. So, lanyards are great (see above) but sometimes (nearly all the time if you’re me) those contrary contraptions spend more time making your nametag face your belly button than the person you’re talking to. To ensure that folks can always tell who you are and who you’re with, put one of your own business cards in the back of your nametag while you’re at the event. Frontward or backward, you’ll be good to go.

4) Get a good business card with a white, non-slick back. Take out your business card right now and grab a pen. Not a good pen, but a crappy conference giveaway pen with a somewhat bajiggety rollerball. Write your name on the back of your card. Can you see it? Does it smear if you rub your thumb across it? Is there room to write your entire name? If you answered “no” to any of these questions, your business card is the bane of people’s existence. How do you expect us to write notes on the back of a card that doesn’t have ample real estate, is too dark, or where the ink rubs off on our clothes or hands? Make it easy for the people at an event to connect with you later with light colored cards on decent card stock.

5) Know how to sneak in breaks. If you’re a money manager at a conference, you’re there to network. That means anything that says “break” on it in the conference program is showtime for you and your fund. If you’re an investor, your breaks are a little more sacred…if you can get out of the event for a few minutes unmolested. In other words, if you want to get a few minutes to yourself in either case, you’re going to have to plan for it. Money managers, scope out the sessions in advance and figure out one or two you can skip. Note: Do not skip sessions with anyone who has an investment in your fund, who works for your fund, or who could invest in your fund. Investors, you may have to make a break for the break a couple of minutes before a session ends to get to a “safe zone” (bathroom, hotel room, Starbucks). Obviously, you shouldn’t avoid breaks altogether (the best way to find talent is to meet talent!), but skipping out on one out of four in a day may help your sanity level a bit.

Of course, there’s always more where those came from, such as:

- Don’t ever, ever touch your face during a conference or event…with all the hand shaking, that’s the single best way to get sick.

- When going to the airport or train station after a big event, don’t talk business on your phone or with friends until you know you’re not surrounded by conference goers that you don’t recognize because they are now attired in “real people clothes.”

- And of course, always put your shoes outside the closet door.

I’m sure you have a few tips and tricks of your own, so feel free to leave them in the comments below, but if you follow these simple guidelines, you’ll likely save yourself some headaches and may make even better use of your time on the road again.

Happy Traveling!

You know what I miss? David Letterman’s old Top Ten Lists. Hands down, those were my favorite part of late night TV. I know that others have stepped in to try to fill the void. Bill Maher has his “New Rules” and Jimmy Kimmel has the often-entertaining “Mean Tweets” but, to me, David Letterman will always be the original king of the recurring hilarious late night bit.

I mean, who can forget the Top Ten Things That Sound Cool When Said By Snoop Dogg? And the Top Ten Reasons Homer Simpson Should Be President. Or my all-time personal fave: Top Ten California Names.

So in honor of Letterman and out of a wealth of nostalgia that popped up unexpectedly over the weekend, I hereby offer you my own top 10 list…

Top Ten Ways To Alienate A Potential Investor

10. Spend the first 35 minutes of a call or meeting talking about your bio.

9. “I assume you’ve reviewed our pitch book in advance of this call…”

8. Inability to make polite small talk in lieu of laser-like need to focus on your investment product.

7. Interrupting conversations at conferences and/or staring from two feet away until said investor is so uncomfortable they interrupt their own conversation to acknowledge you.

6. Literally not knowing anything about the investor before you approach them.

5. Two words: Wardrobe malfunction (true stories, but better told over adult beverages than in a blog).

4. Ignoring time zones/weekends/holidays when calling.

3. Mansplaining why an investor’s reasoned conclusion is wrong.

2. Lying, and yes, this includes “gilding the lily.”

1. Saying “I’m not going to go through each slide.” And then going through each slide.

(C) 2018 MJ Alternative Investment Research